Questions and Quandaries in the New Year

In 1939, Winston Churchill characterized the geopolitical interests of Russia as, “a riddle, wrapped in a mystery, inside an enigma.” Essentially, they were so dense and secretive as to be indecipherable and impossible to foretell.1

Such a colorful, triple-barreled description applies today, almost 80 years later, to a myriad of topics/questions. (Amazingly, the geopolitical interests of Russia are still not ascertainable!)

More pertinent to this penning, however, are the following:

- The persistent strength of the stock market and its complete absence of volatility;

- The outlook for interest rates amid multiple Fed hikes and underlying economic strength, and of course;

- What’s a bitcoin?

It is a great time of year to contemplate such conundrums. Resoluteness is attendant to turning calendar pages and points of inflection are pertinent for planning purposes.

We’ve fielded countless questions from clients embedded in these topics and can offer insights counter to convention on each….except the last.

Given that Bitcoin is a prominent variety of what are known as, “cryptocurrencies,” the root of which is Greek (Kruptos) for: “hidden,” our insight is undoubtedly inadequate. Other than to acknowledge its potential as a medium of exchange should its ubiquity ever possess liquidity, we’re staying away.

Therefore, we’ll focus primarily on the areas of stocks and bonds, denominated in boring old paper dollars.

The persistent strength of the stock market and its complete absence of volatility

2017 was replete with head-scratching courtesy of headlines such as the following:

S&P 500, Dow open at new record highs – Financial Times

S&P 500 Extends Record Run – WSJ

S&P 500 closes at record high, hits 2,600 for the first time – CNBC.com

AND

S&P 500 Volatility Hits 50 Year Low – Forbes

Volatility index posts lowest close ever – CNBC.com

The Year Volatility Died – PensionPartners.com

The term “volatility” possesses alternate definitions, but we think of it terms of both intra-day price fluctuation and intra-year draw down from a previous closing high price. Generally, it is considered a gauge of market risk.

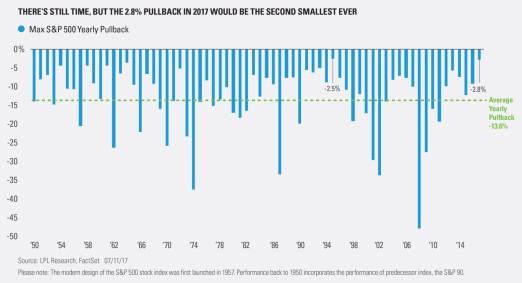

As indicated below, 2017 ended with the second smallest draw down in market history – a measly 2.8% in the S&P 500.

And this near-record quiet in the markets has accompanied actual-record highs in most all major indices. So what gives? Or doesn’t give? Or more commonly crowed, “we don’t get it!?”

You can certainly be forgiven. For time immemorial we’ve been taught this simple saw: reward requires risk. So is this adage outdated? Absolutely not.

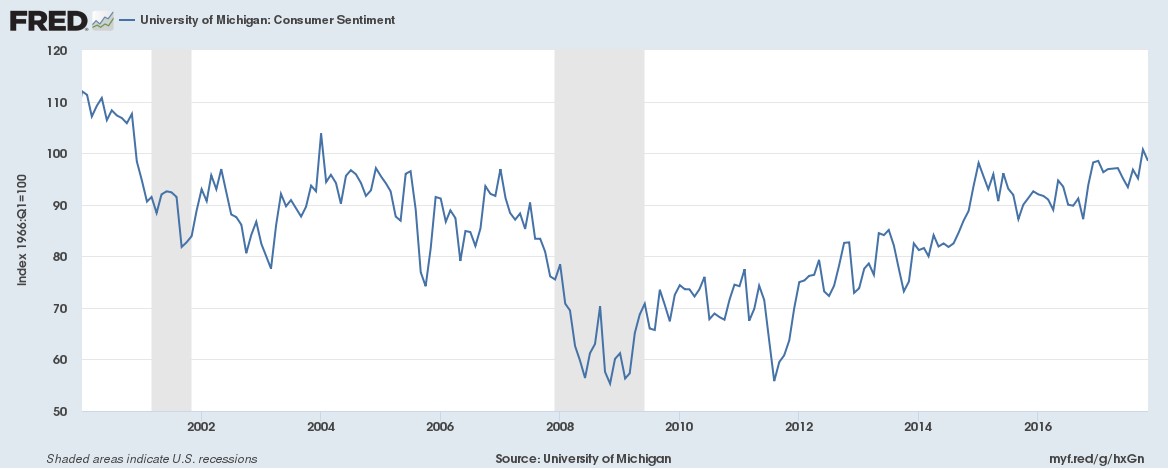

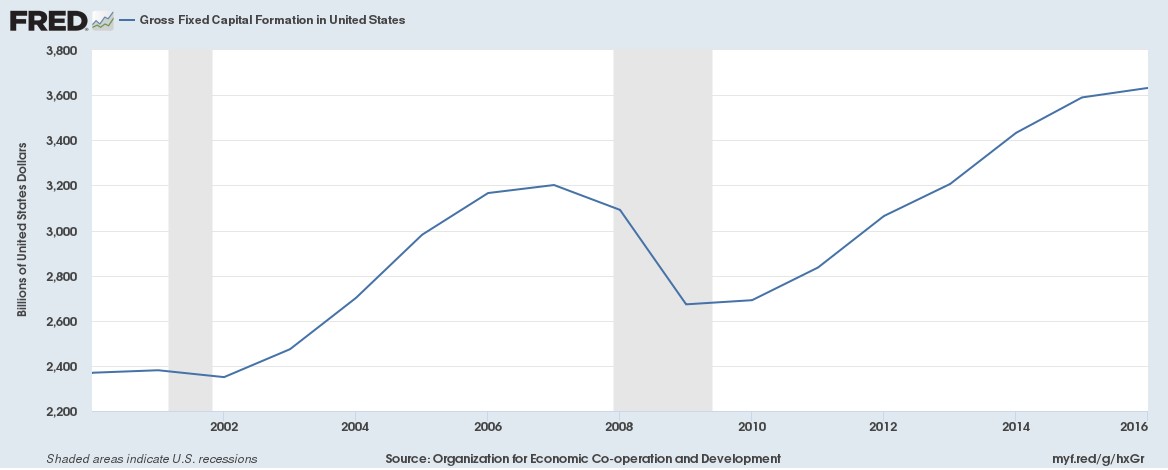

At a high level, stock markets pivot on 2 axes: access to capital and confidence. Recalling 2008’s Great Recession, it was easy to understand the credit seizure that took place in the absence of both. Conversely, today, each is plentiful, and the market is celebrating such. (See 2 charts below for current and recently historical charts on consumer confidence and capital formation in the US).

This backdrop may, in some respects, underwrite risk taking in pursuit of investment returns, but we think that is only part of the story…the macro part.

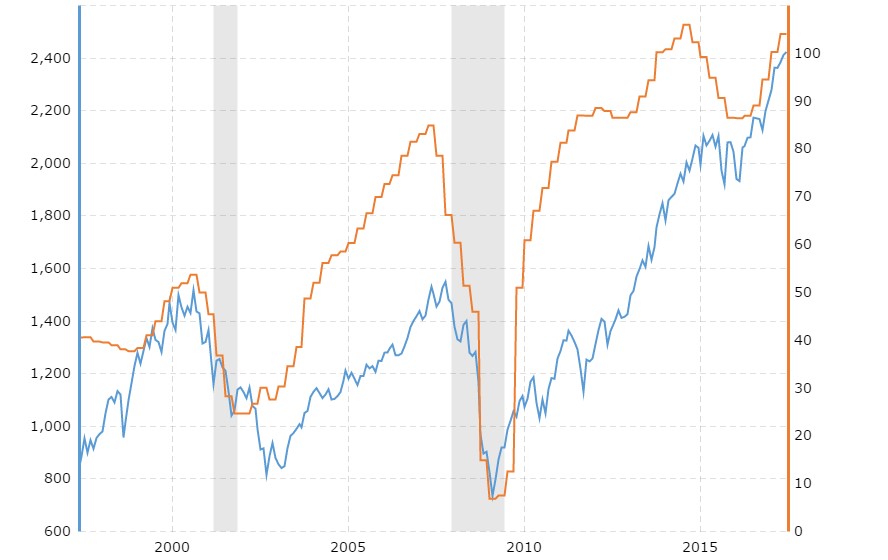

At the micro level, corporations in whom we can purchase shares, are by-and-large making profits right now. Very large profits. The chart below plots the level of the S&P 500 (RHS) against collective index profitability (LHS). The gain in earnings per traded share over the last 8 years is impressive and its perpetuation likely serves to sustain the valuation (dollars of price paid for every dollar of earnings, or P/E ratio) of the index at current levels.

Source: http://www.macrotrends.net/1324/s-p-500-earnings-history

When headlines have not been dealing with the eerily quiet levitation of stock markets this past year, they have been (rightfully) consumed with items like natural disasters on and away from our domestic shores and certainly with the state of domestic politics and foreign policies.

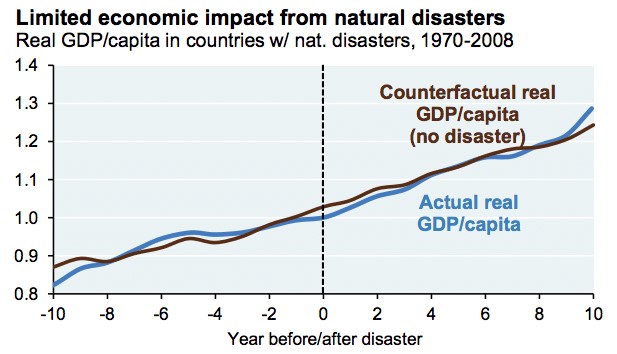

And while the interconnectedness of wealth and well-being is undeniable (which goes back to the area of investor confidence), the capital markets have actually exhibited a consistent capability of bifurcating the two over time.

Source: Cembalest / JP Morgan2

Often, stimulus measures are enacted to assist afflicted areas of the world and those can possess positive economic by-products. When implemented in the context of a growing global economy, those by-products may even instigate a multiplier effect.

If you are still reading this, it is obvious that Twitter’s confining 140 or even 280-character limit is suboptimal for Kavar’s communication tendencies, but it has retained its preferred-venue status for most domestic political disputes.

Suffice it to say, there is division and there is unrest in our country. Expecting much out of D.C. in this climate is likely misplaced. The fact that tax legislation was passed last year was, to us, pretty surprising and we are optimistic on its impact to improve the cash-flow generating capabilities of corporations.

Should there be a fiscally responsible deployment of some of the tax-savings, there is reason to believe that this could promote longer engagement by investors with the stock market.

Onto the bond market perplexity…….

The outlook for interest rates amid multiple Fed hikes and underlying economic strength.

In December 2015, the Federal Reserve Bank did something that hadn’t been done in over 8 years – they raised interest rates. The rates that the Fed raised are the overnight lending rates that banks charge one another as well as the rate at which the Fed lends its money to the banks.

Overnight rates serve as a “base rate” against which other lending rates are set. Since December of 2015, the Fed has raised those overnight lending rates 5 times, taking them from 0.25% to 1.50%. Dependably, prime rate, LIBOR and 2-year Treasury rates have also risen, reasonably in lock-step.

It follows that the longer dated a loan, the more interest should be paid to the lender, all else being equal.

It also follows that the difference, or spread, between rates on shorter and longer-dated bonds would remain stable or expand if the data driving the Fed actions was dependable.

These 2 elemental concepts comprise what is known as the term structure of interest rates and combine to form the shape of the “yield curve.”

Disconcertingly, the market is not experiencing either of the logical progressions of a normalizing, post-recession rate tightening cycle: longer dated bonds (10-30 years) have barely budged in yield and the spreads between short and long-dated bonds has narrowed.

So what gives?

One commonly offered attribution is the lack of inflationary forces present in our economy. That makes sense based on the following observations: 1. The world’s flatness offers instantaneous access to cheap labor and capital and the profit-seeking enterprise will identify every opportunity to streamline costs of production and pass those savings onto their customers. 2. Amazon. Its reach is incredible. Its distribution is formidable. Its innovation in merchandising is transformational. Companies in industries from healthcare to consumer staples know they need to modify their business models or risk relevancy and part of that modification is reducing their prices. (Go on into a Whole Foods since Amazon purchased them if you are skeptical).

Another attribution combines Fed tightening (raising rates) with the global demand for yield. Let me explain. As I mentioned, the Fed has raised rates 5 times in the last 25 months. The Fed felt emboldened to lift rates as the US was several years clear of the 2008 mortgage and credit crisis.

That credit crisis was global and central banks around the world mimicked the actions of our Fed to stimulate their economies by driving their own interest rates lower. Several countries drove their rates well below those of the US and in large part, those countries have sustained their discounts vs. the equivalent maturity US bonds.

When the Fed began raising rates, in addition to the nominal yield moving up a bit, the competitive yield (differential between the US yields and those of other countries) improved as well. Add a positive currency conversion component (foreign borrowers of US debt receive interest payments in stronger dollars that upon repatriation experience a higher value in their home (comparatively devalued) currency) and the spread widens even more.

Not unlike an enigma-wrapped mystery riddle though, the bond market is on a slippery slope of a continuum. As long as demand exists for the supply of bonds that are the offshoot of Fed tightening, the quietness of credit markets can persist. However, threats are now present from the reserve currency accounts of certain US trading partners that signal a reluctance in continuing to buy bonds at current levels.

Ultimately, and perversely, a little inflation may go a long way in providing calm and preserving sponsorship along the path to normalization. The key lies in the job market.

With the unemployment rate at a 17-year low of 4.1%, it seems likely that wage inflation may be the catalyst for product price inflation. Demand for qualified workers in many industries should increase salary requirements. That additional money will need to be made up for in increased productivity for the hiring employer and result in higher disposable income for the employee.

More money in the economy has a clear impact on economic growth and certainly on inflation. The Fed is predicting such with its telegraphing of additional rate hikes this year. The market is not so sure. This disparity of opinion is creating gridlock and flatness in bond land. It is creating confusion and inducing inertia.

We think that the normalization will ensue this year. We think that wage-exported inflation will re-establish a more traditional term premium of yields. And we think that the capital markets will experience more mean-reverting levels of historical volatility without completely dislocating.

Timing markets in any fashion is at best, difficult, and timing market inflection points is nearly impossible. Our goal as your advisers, is to decipher the clues offered periodically and adjust exposure accordingly. We’ll keep in close touch along the path toward demystification.

1 https://idioms.thefreedictionary.com/a+riddle%2C+wrapped+in+a+mystery%2C+inside+an+enigma

2 https://www.theatlantic.com/business/archive/2017/10/why-does-the-stock-market-keep-going-up/543249/

Important Disclosures:

The views expressed herein are those of Douglas Ciocca on January 16, 2018 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.