Market Update – December 8, 2018

Good morning and I hope your weekend is off to a great start! It is off to a frigid one here in KC!

Frigid is a decent way to describe the mood of the markets this past week as well. In only 4 trading sessions the Dow Jones Industrial Average fell 4.5%……and amazingly one of those 4 – Monday’s – saw prices climb almost 300 points.

Coming off one of the best weeks in several years, optimism was high that a thaw in trade war would clear the runway for a Santa Claus rally. Instead, that sleigh resumed an all-too-familiar skidding pattern.

Sources of consternation paving the path of this volatility are nothing new: the aforementioned trade war tension as well as interest rate elevation, geopolitics and the profit cycle position have conspired to preserve a high level of investor anxiety throughout the year.

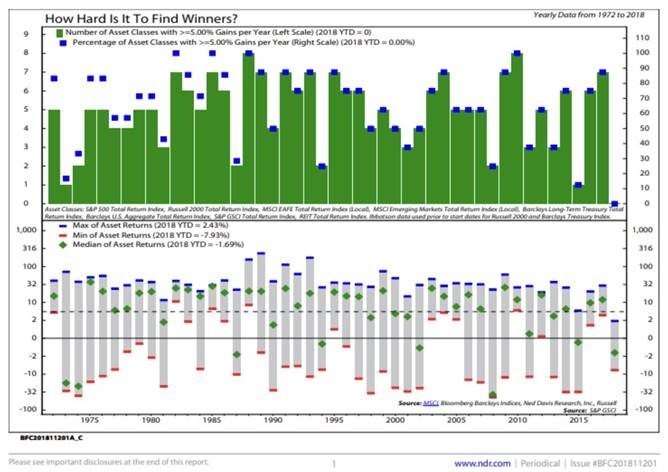

Consistent with a graph that we shot out a couple weeks ago, 2018 has offered few, if any, ports in the storm (see below from Ned Davis research).

Through the end of November, the average class of assets has produced a negative return of almost 2% and there are no classes of assets that are producing returns in excess of 5%.

With that being the case, the most common question we receive from clients is…”so what are we doing about it?”

There is temptation, with precedent, to simply follow the sage words of Vanguard founder, John Bogle. When asked a similar question amidst the turbulent markets of 2011 (does anyone remember those?), he famously responded1:

“My rule — and it’s good only about 99% of the time, so I have to be careful here — when these crises come along, the best rule you can possible follow is NOT “Don’t stand there, do something,” BUT “Don’t do something, stand there!”

“These times of crisis, these times that try investors’ souls, are terrible times to make decisions,” said Bogle. “If you really have to make a decision, just to keep your own sanity, make it a small and incremental one.”

So, in that spirit we are making, or looking to make, only incremental yet opportunistic decisions/alterations to our allocations…not for our sanity per se, but for your portfolio’s stability.

And those decisions/alterations fall under the following categories:

- Dollar-Cost Averaging: putting cash to work progressively as attractive entry points emerge;

- Rebalancing: reinforcing the target weightings between stocks, bonds and alternative assets in a fashion consistent with the best historical risk-adjusted return stream designed to achieve your specific long-term goals;

- Quality-Pairing/Overhauling: taking advantage of indiscriminate selling that does not differentiate between good and bad companies. There is a compression of a “valuation premium” that offers the opportunity to buy good companies that are being priced as bad stocks;

- Tax-Loss Swapping: selling stocks/funds at a loss and simultaneously buying an equivalent position in a similar, but not identical, company or fund. The capital loss that ensues from the sell transaction is tax-deductible, and can be used to offset any capital gains to reduce an investor’s tax liability;

- Incorporating “Core Beta” exposure: complementing an actively managed portfolio with a passive component to better capture a prospective recovery’s breadth;

- Escrowing Cash for Future Distribution Needs: finally, cash/money markets are offering decent yields for investors that want to secure all or a portion of a future income need. They are no longer being punished with punitive yields on these funds;

Certainly not all of these decisions apply to all of our clients as their/your range of objectives are variable and unique. However, as decisions are incrementally made and strategies reinforced, they will be done as a subset of these items.

We look forward to connecting as we head into year-end. We also feel confident that cross-pollinating patience w/ prudence in mild alterations will improve the prospects of long-term success.

As hard as seems in its midst, the current spate volatility and market mayhem will eventually become as distant a memory as that which prompted Jack Bogle’s famous quote above.

The views expressed herein are those of Doug Ciocca on December 8, 2018 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.