Market Update – November 10, 2024

Turning the Page on Last Week and Focused on the Future

Last week ranked about as high as is measurable on the market’s “News-O-Meter”, with the Presidential/Congressional elections and a Fed Meeting within 2 days of one another.

While there are a still a few House of Representative races to be called, the bulk of the cake has been baked.

Emotion was understandably high going into the week, and the outcome of each catalyzing event was unlikely to be pleasing to many more than most.

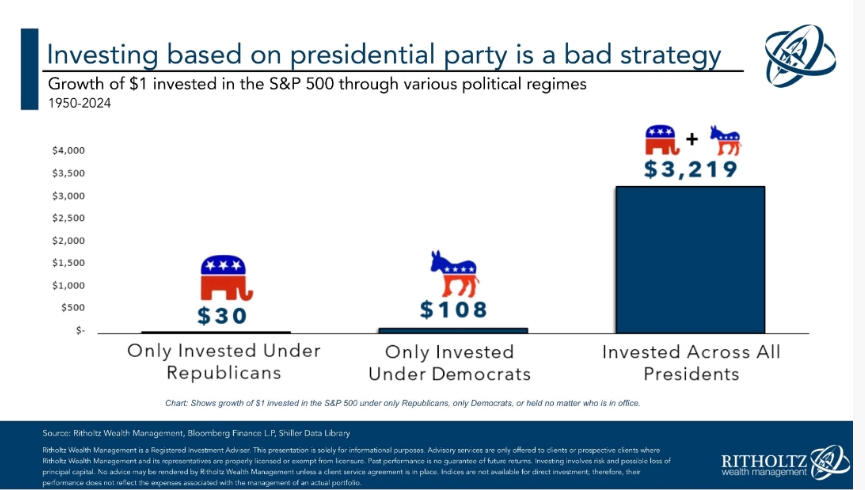

We’ve seen, and presented, lots of points of perspective along this path, knowing that our country and its financial markets can preserve and prosper as they, collectively, reflect information versus speculation.

One more graphical testament to this fact is below:

With only 6 weeks left in the year and the major stock market indices hitting all-time highs, we wanted to offer some quick insights on data points that could impact its direction as we head into 2025.

November 20th: Nvidia reports earnings for its 3rd quarter. Having taken over the top market capitalization spot from Apple this month, NVDA’s influence is immense. As the bellwether for the hugely important semiconductor sector (NVDA’s processing units are the fuel behind AI, quantum computing, the metaverse, autonomous driving technology, etc) its outlook will influence expectations for its collaborators and competitors.

November 27th: PCE (Personal Consumption Expenditures) release. Known as the Fed’s favored gauge of inflation, its trend has been the market’s friend as it tracks toward the 2.0% target:

December 17th – 18th: The Federal Reserve Bank holds its final meeting of 2024. After cutting rates in September (by 0.50%) and last week (by 0.25%), there is still a narrow expectation that the Fed will cut one more time this year.

As the table/chart indicate there is about a 2/3rd’s probability of an additional quarter point of easing.

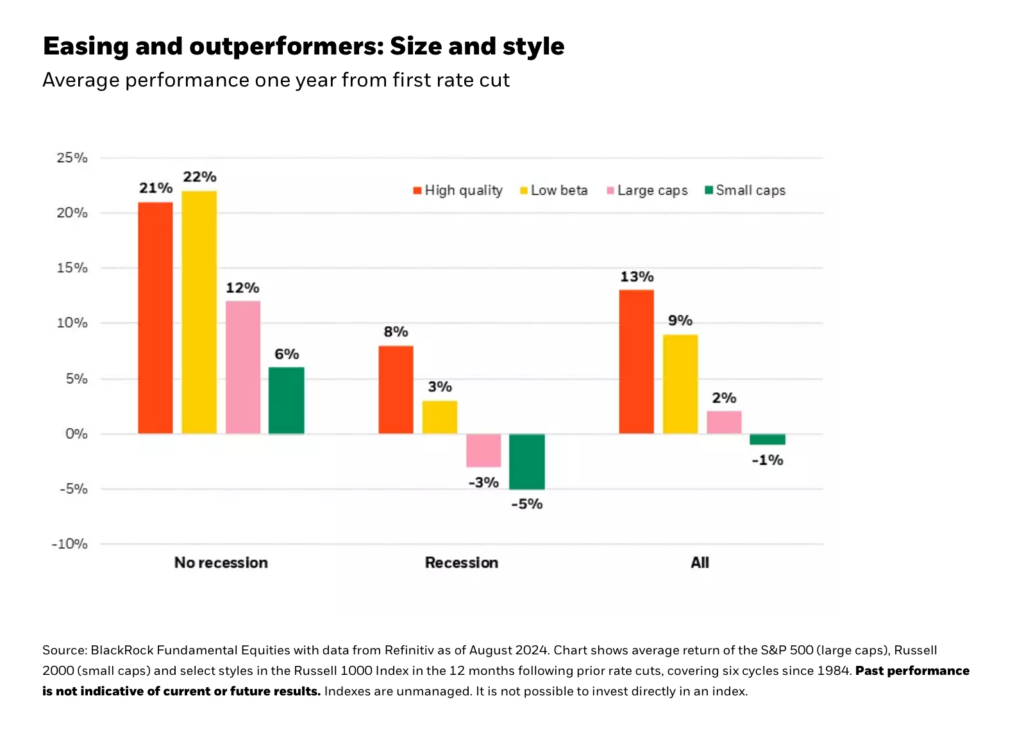

And while the tailwinds of accommodative monetary policy blow strongly across equity categories:

Certain specific sectors tend to be outsized beneficiaries of Fed Benevolence:

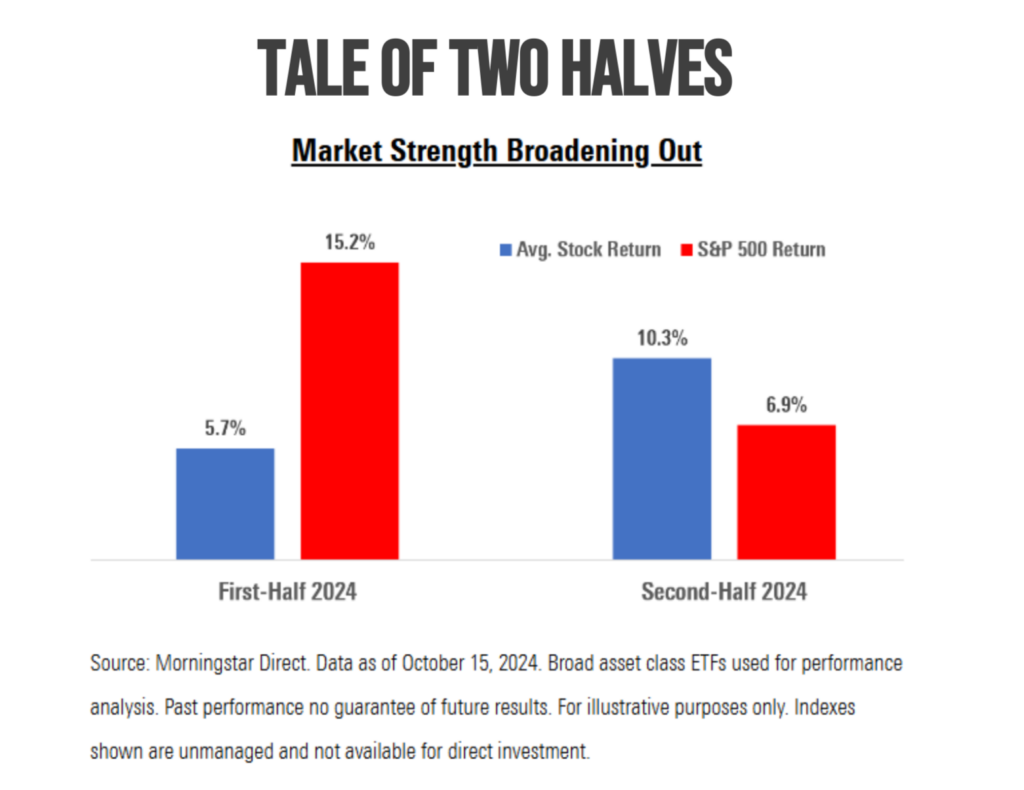

Should these trends persist, the broadening of the market’s leadership, which has taken hold in the second half, would be a welcome way to wind down the year.

We are also keeping a close eye on the bond market and its meandering. We think that the narrative of its steepening normalization based upon Trump’s predisposition to spend and institute high tariffs is just too convenient to be the only catalyst. We would add: strong underlying economic growth, fear of an inflationary reversal courtesy of Fed cuts and the reestablishment of a legitimate term premium this far into the expansion cycle.

So even in the absence of the preeminent headline hogs, we don’t think the year-end will be dull!

The views expressed herein are those of Doug Ciocca on November 10th, 2024 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.