Market Update – March 4, 2025

US markets have been rattled by renewed volatility centered on tariffs taking effect this week on Canada, Mexico and China and the subsequent economic uncertainty.

The S&P 500 has declined -6% from its February 20th highs in the past two weeks and is now negative for the year; the NASDAQ Composite briefly entered correction territory, down over -10% from its highs.1

Given the proliferation of current headlines, breaking newsfeeds, tweets and blog posts, we think it’s time to address the topic of tariffs.

Tariffs are in essence a tax on imports – in 2024, the US imported over $3 Trillion worth of goods into the country.2 Tariffs are a tax levied on those goods when they cross the border. That tax is typically passed along to the end consumer.

So, why levy tariffs and harm the consumer if you’re the US? Their use and impact are the subject of intense debate among economists, policymakers, and the public and we want to present both sides of the argument in a general framework since their specific deployment is very fluid right now.

Potential Benefits of Tariffs:

While free trade is generally lauded for its efficiency, tariffs can serve specific purposes that warrant consideration:

- Protect Domestic Industries: Tariffs shield emerging or strategic industries from overwhelming foreign competition, allowing them time to grow and innovate.

- Enhance National Security: Reducing dependence on foreign suppliers for critical goods helps safeguard supply chains in defense, energy, and essential resources.

- Generate Government Revenue: Tariffs serve as a source of income for public services and infrastructure.

- Address Unfair Trade Practices: Tariffs can counteract dumping and government-subsidized foreign competition, promoting fair trade.

- Strengthen Trade Negotiations: Countries can use tariffs as leverage to secure better trade deals and address imbalances.

Tariffs serve as a strategic tool for economic policy, but they come with significant trade-offs that can impact consumers, businesses, and global trade dynamics:

Potential Detriments of Tariffs

- Higher Consumer Prices: Import taxes raise costs for goods, reducing purchasing power and increasing expenses on essential items.

- Supply Chain Disruptions: Tariffs make it harder for businesses to source materials, leading to delays, inefficiencies, and potential job losses.

- Retaliation from Trade Partners: Tariffs often provoke countermeasures, escalating trade disputes that hurt multiple industries.

- Protection of Inefficient Industries: Domestic industries shielded from competition may lack incentives to innovate, leading to stagnation.

- Resource Misallocation: Artificial price increases distort market signals, leading to inefficient investment in non-competitive sectors.

- Global Trade & Political Tensions: Tariffs can strain international relations and contribute to broader economic instability.

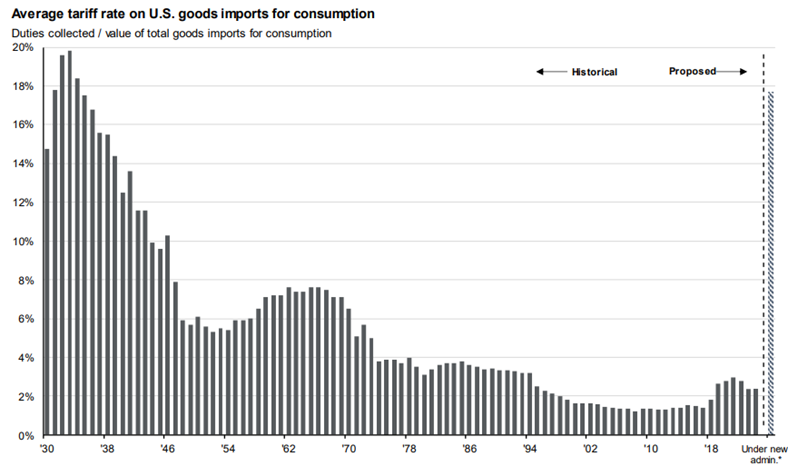

Their use in trade policy has generally declined over the past several decades, driven by trade liberalization efforts, multilateral agreements, and the expansion of global supply chains. Organizations like the World Trade Organization (WTO), regional trade agreements (e.g., NAFTA/USMCA, the European Union, CPTPP, RCEP), and bilateral free trade agreements have significantly reduced tariff barriers, facilitating international commerce.

This has especially been true for the US as our economy has matured and become the dominant consumer globally:

In today’s global, free-trade economy, tariffs are somewhat of a relic for the US, however, the Trump administration views them as a valuable economic tool in leveraging the US consumer against trading partners and citing border security and trade imbalances as key reasons for implementation.

The market is discounting the prospectively immediate effects of tariffs:

- Slower short-term economic growth, and;

- Consumer goods inflation.

Higher prices are likely coming to the goods in which tariffs are levied that are imported from Canada, Mexico and China. For example, the US receives 90% of its fresh vegetable and avocados imports from Canada and Mexico; 83% of beer imports come from Mexico, including the highest selling beer brand in the US: Modelo Especial; 66% of imported poultry products and eggs come from Canada.3 These items will likely rise in price in the coming weeks as tariffs take affect and will hit the consumer at the grocery store. Other items like wood, vehicles and vehicle parts, furniture, bedding, light fixtures, toys, games and sports equipment will also be impacted.

Higher prices put pressure on the consumer and slow down their spending, thus slowing the economy. Higher labor costs may also be in the cards as US companies prepare to bring manufacturing back home – this is exacerbated by stricter immigration policies. In general, protectionist trade and immigration policies are a short-term negative for US GDP growth.

The Atlanta Fed’s GDPNow estimate is showing -2.8% GDP for the 1st quarter4, although this number is heavily distorted by the massive number of imports front-running the tariffs.

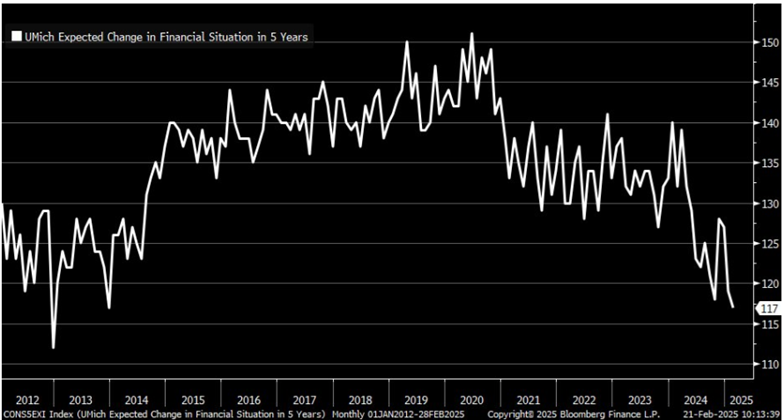

And consumers, as surveyed by the University of Michigan, are as pessimistic in their 5-year financial outlook as they’ve been since 2013:

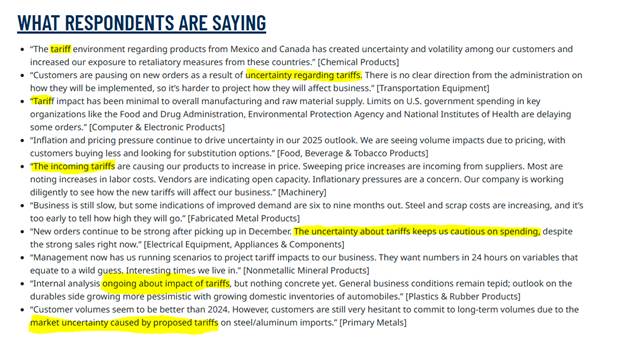

This week the ISM Manufacturing survey highlighted how corporate respondents are hesitant to do business in this environment, largely due to tariffs:

It is important to bear in mind that investors experienced a similarly tenuous trade environment in Trump’s first term, and it was navigable despite the attendant choppiness. Like then, today we view tariffs as unlikely to persist as advertised and consider their deployment primarily as a short-term negotiating tactic that catalyzes long-term beneficial bilateral trade agreements.

While tariffs are the topic of this note, they exist within a hyper-dynamic system that is President Trump’s campaign-promise implementation, making their consideration, in isolation, a challenge for the markets. Broadly, the administration views them as one element to the critical identification of efficiencies for America. We’ll keep in close touch as they ebb and flow and share thoughts on the best way to incorporate their existence, or lack thereof, into our asset allocations.

Footnotes:

- Bloomberg Data

- US Census Bureau https://www.census.gov/foreign-trade/Press-Release/current_press_release/ft900.pdf

- Callie Cox on OptimistiCallie https://www.optimisticallie.com/p/the-trump-trade-war-begins

- Atlanta Fed https://www.atlantafed.org/cqer/research/gdpnow

- ISM https://www.prnewswire.com/news-releases/manufacturing-pmi-at-50-3-february-2025-manufacturing-ism-report-on-business-302388950.html

The views expressed herein are those of Doug Ciocca and John Nagle on March 4th, 2025 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.