Market Update – April 11th, 2025

We wanted to share a recap of the past few days since our Market Update Webinar this week (follow this link to view replay if interested: https://kavarcapital.com/market-update-webinar-apr-8-2025/), as well as some further perspective on the current environment.

On Wednesday, April 9th, markets saw a historic rally when President Trump announced a 90-day pause with reciprocal tariffs dropping to 10% for all countries (except China):

The announcement instantly calmed markets and sent stocks sky-rocketing – the 3rd best day for the S&P 500 since 1950 (the two better were during 2008), the 2nd best day ever for the NASDAQ (the best was in 2001), the most Dow points gained in a single day – marking a truly historic day. The CBOE Volatility Index (VIX) also settled down, dropping from a high of 57.6 to a closing level of 33.62 the lowest level since April 3rd.

So, Trump “blinked,” signaling an unwillingness to accept at least a certain level of market turmoil. The President commented the market was “getting a bit yippy” in reference to bond yields surging overnight and the US Dollar weakening (see below).

The rise in bond yields explicitly runs counter to an established policy goal to lower yields that is consistently trumpeted by the administration and is unusual during equity market downturns.

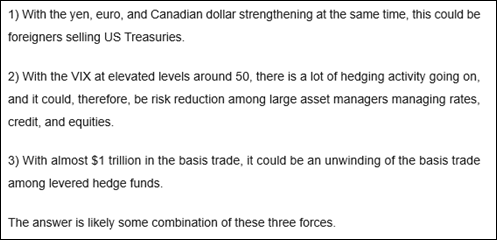

There is debate as to why rates moved like they did, but Apollo’s Torsten Slok provided three potential reasons:

He also specifically mentioned Jamie Dimon, CEO of JPMorgan, expressing fears of a recession in an interview. A positive sign that they are still willing to listen to the country’s business leaders.

As we noted on the call: markets force policy, and this was firm evidence of that. The Wall Street Journal had details on the President’s thinking, and this snippet summarized them well:

On Thursday, April 10th, markets shifted focus from the relief of a pause and hopes of negotiations to the remaining tariffs, including the extraordinary tariffs levied on China – the US imported nearly $600 billion in goods from China in 2024 – and the escalating nature. The administration raised the tariff rate to 145% on China yesterday with no signs of relenting.

The S&P 500 dropped -3.5% on Thursday.

The pause certainly helped to raise the floor of outcomes but in reality now we must negotiate ad-hoc trade deals with 75 countries in a 90-day window as tariffs are still pending on pharmaceuticals, lumber and copper, and the elephant in the room: an all-out trade war with China.

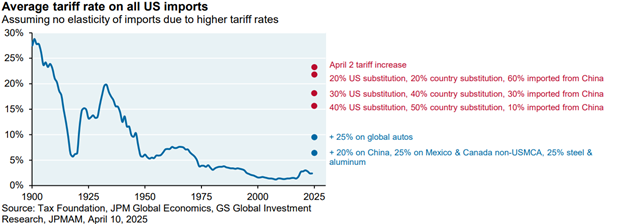

For the time being, the average tariff rate on all US imports remains high, a potential drag on economic growth and potentially inflationary:

US markets performed well today, although it was mostly quiet on the trade war front:

While the market reaction has been dramatic, we continue to monitor the evolving policy landscape with a focus on managing for the short-term and investing for the long-term, upgrading to quality across the board and implementing the planning strategies we discussed earlier in the week.

The volatility underscores the importance of maintaining a disciplined investment approach amid geopolitical and macroeconomic uncertainty. As always, we remain committed to helping you navigate these developments and will keep you informed as the situation evolves.

Please don’t hesitate to reach out to our team with any questions.

The views expressed herein are those of John Nagle on April 11th, 2025 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.