Market Update – June 23, 2016

What is “Brexit”?

The term “Brexit” is a verbal blend of “British” and “Exit” referring to Britain, aka the United Kingdom, essentially voting to either leave or remain a member of the European Union (EU).

Citizens of the four constituent countries with the sovereign state of United Kingdom – Britain, Scotland, Wales and Northern Ireland – as well as, Gibraltar, will answer a simple question: “Should the United Kingdom remain a member of the European Union or leave the European Union?”

What is the EU?

The European Union (EU) is a political and economic union consisting of 28 member states. Along with the UK, notable members include Germany, France, Italy and Spain. The EU member states relinquish some of their sovereignty, or their authority to govern, to several Institutions which work together to run the EU. These institutions hold legislative, executive, and judiciary powers over the member states. Most important to the financial markets, is the EU’s central banking Institution – the European Central Bank or ECB[1]. The ECB is the central banking authority for the Euro currency – used by 19 of the 28 EU member states as their national currency (but not by the UK, they still use the British Pound).[2]

The EU was essentially born after World War II to foster peace as well as social, political and economic harmony among European nations. Today the EU serves many roles in order to maintain these harmonies, including being the world’s largest trading bloc. The EU negotiates international trade agreements with other partners (like the US) as one entity rather than by individual member states. The EU fosters free trade amongst the member states by reducing and/or eliminating barriers like tariffs on trade and creating efficient flows of goods and services.

Why are they Brexit-ing?

Some British have always been opposed to EU membership and it was not an original member. The UK has opted out of some key EU decisions, like using the Euro and relaxed border controls through the Schengen Treaty. Critics of the UK’s membership believe Britain is being held back by the EU, that it gets little in return for the money it pays in and would be better off (safer) taking back control of its borders. The Pro-Brexit side wants to protect, and restore, the country’s identity, culture and independence – a lot of this has to do with an opposition to immigration. The Pro-Brexit side is anti-EU establishment and one of their rallying cries is “Take Control.”

The Pro-Brexit camp is more likely to be less educated and less wealthy. The debate cuts along the country’s already deep class divide and evokes a sense of abandonment amongst poor and working-class Britons in pursuit of loftier economic goals by the UK elite[3].

The Remain supporters basically only argue that staying in the union is better for the British economy. Better in the sense that leaving would be disastrous, so a lot better. The EU is Britain’s most important export market and greatest source of foreign direct investment. EU membership has been critical in establishing London as a global financial center – an exit would jeopardize that status (and the high-paying jobs that come with it). Remain supporters aren’t so much defending the EU as a great situation but that it’s a necessary situation –they admit reforms are needed.

It’s largely a function of social unrest, economic discontentedness and anti-establishment uprising by a neglected class of citizens. Which should sound similar to the fervor and enthusiasm surrounding candidates like Donald Trump and Bernie Sanders here in the US. In the absence of a vision and its articulation, of a feeling of broad representation and inclusion, there is a heightened susceptibility of fracture in any union. The British and Europe are certainly at a critical cultural inflection point, much like we are in the US. There is a leadership breakdown, whether it be David Cameron, UK Parliament or the EU leadership in Brussels. Sound economic growth has a way of nursing social ills but without sound fiscal policy we are left to focus on the ECB in Europe and the Fed in the US when it comes to economic growth which is difficult for markets to interpret currently.

What would the implications be for the EU and UK?

The UK is one of the strongest members of the EU on paper, it would not be good for them to leave. Brian Klaas, a fellow in comparative politics at the London School of Economics, compared the Brexit to California and Florida being lopped off the US economy for reference.[3]

The UK provided over 12.5% of the EU budget during 2015, about €18.2B, and while the UK gets some of that back to support development and projects, their net contribution was still €8.5B[4]. The UK pays in more than it gets from the EU currently.

The total GDP of the EU in 2015 was €14.635T, of which the UK was responsible for €2.568T, or about 17.5% and second to only Germany among EU member states. The UK has also produced above average GDP growth relative to the EU as a whole[5].

The UK makes up 12.7% of EU population, third behind Germany and France.[6]

Beyond the facts and figures, there is speculation that a Brexit could lead to other disenfranchised member states calling for their own referendums. This is more likely in Eastern Europe where countries like Poland have recently clashed with EU regulators.

The overarching implications are uncertainty and instability which generally isn’t positive economically, politically and socially. Right off the bat there would be a risk that access to the UK for the rest of the EU and vice versa would be cut off for movement of goods, services, capital, enterprise and labor. While the process of leaving would be negotiated and worked out over a couple years, the short term upheaval would most likely be significant.

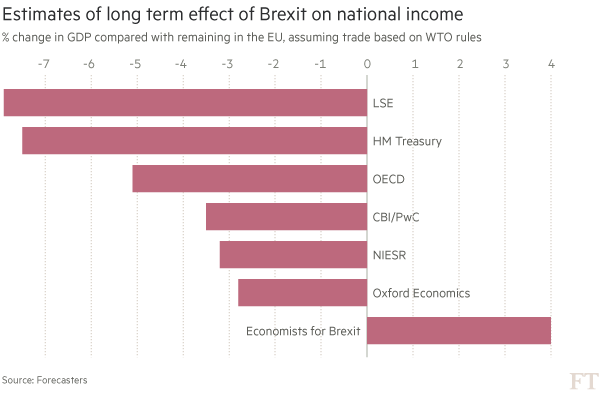

Economists overwhelmingly believe that a Brexit is bad for the UK economy. Erecting trade barriers with the EU would hinder growth, which would no easily be replaced. There is one group, “Economists for Brexit” which believe the UK economy would be stronger after an exit and adoption of unilateral free trade, but they’re pretty much on their own. The majority believe it would be bad news for the British economy[7].

Other implications could include a review or even a downgrade of UK credit by rating agencies and thereafter widening of credit spreads.

What would the implications be for the US?

For the US, the Brexit uncertainty is most important. There is not much consensus on what would happen immediately within markets and what the long-term effects would be for the economies of Europe if the “leave” vote won out. Financial markets do not like uncertainty and we’d probably see weak global stock markets and a flight to quality. We’ve already seen an upward move in volatility as the polls fluctuate and the voting day nears.

Long term, it shouldn’t make a huge difference to fundamentals for US Equities. S&P 500 companies generate just 3% of their revenues from the UK[8]. While instability in all of Europe is a concern, it’s more of a geopolitical issue that is hard to incorporate into an investing framework. The growth of the European and UK economy would be of worry for International investors in the US if it left and has the forecasted effects on its GDP. The UK economy is world’s 5th largest[9] and the effects on this standing are unknown – which ultimately introduces risk.

The British Pound would probably weaken considerable against the US Dollar – this is a negative for any business bringing profits back from the UK or consumer purchasing UK goods with Dollars.

[1] http://www.bbc.co.uk/guides/zgjwtyc

[2] http://www.ecb.europa.eu/euro/intro/html/map.en.html

[3] http://www.nytimes.com/2016/06/21/world/europe/brexit-britain-eu-explained.html?_r=0

[4] http://www.bbc.co.uk/guides/zgjwtyc#zy9tg82

[5] http://ec.europa.eu/eurostat/tgm/refreshTableAction.do?tab=table&plugin=1&pcode=tps00001&language=en

[7] http://www.ft.com/cms/s/2/0260242c-370b-11e6-9a05-82a9b15a8ee7.html#axzz4CFPymqeC

[8] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_6.17.16

[9] https://www.cia.gov/library/publications/the-world-factbook/fields/2195.html

Important Disclosures:

The views expressed herein are those of Douglas Ciocca on June 23, 2016 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.