Investment Research Note – July 12th, 2023

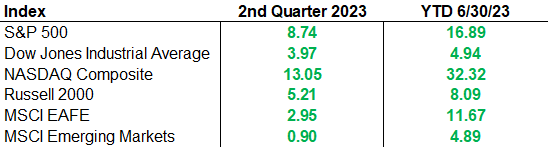

At the halfway point of the year, markets have thus far defied the pervasive bearishness and widely held narrative that the economy was due for a Fed-induced slowdown that characterized the outlook for the year. US markets have rallied strongly, driven by the largest of the large companies, and mainly those in the Technology sector.

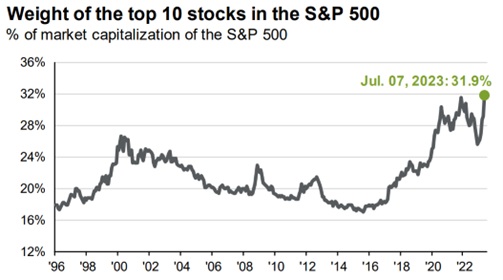

The current top 10 largest companies in the S&P 500 averaged an astronomical return of +63.6% during the first 6 months of the year; and since these companies make up 32% of the total market cap of the S&P 500, they drove the index to a return +16.89% for the same period, its best first half since 2019.1 However, under the surface, the other 490 companies averaged less than half of that, returning +7.14% on average so far this year.2 The concentration of weight in the largest companies is back near all-time highs and the narrow leadership adds another concern for investors to consider – can the market really be this dependent on so few companies in a sustainable way?

The Tech-heavy NASDAQ Composite led the markets, returning +32.32% for the year while the Dow Jones Industrial Average has lagged at +3.97%. US Small-cap stocks have also been modestly positive, returning +5.21% for the year.3

Sentiment has improved, but it remains skewed to the negative if you closely follow the financial media and the parade of pundits that come on air. The market has thus far defied this narrative while the economy has shown signs of accelerating rather than teetering into a recession. Corporate earnings have held up and appear to be in the midst of bottoming out ahead of estimated future growth.

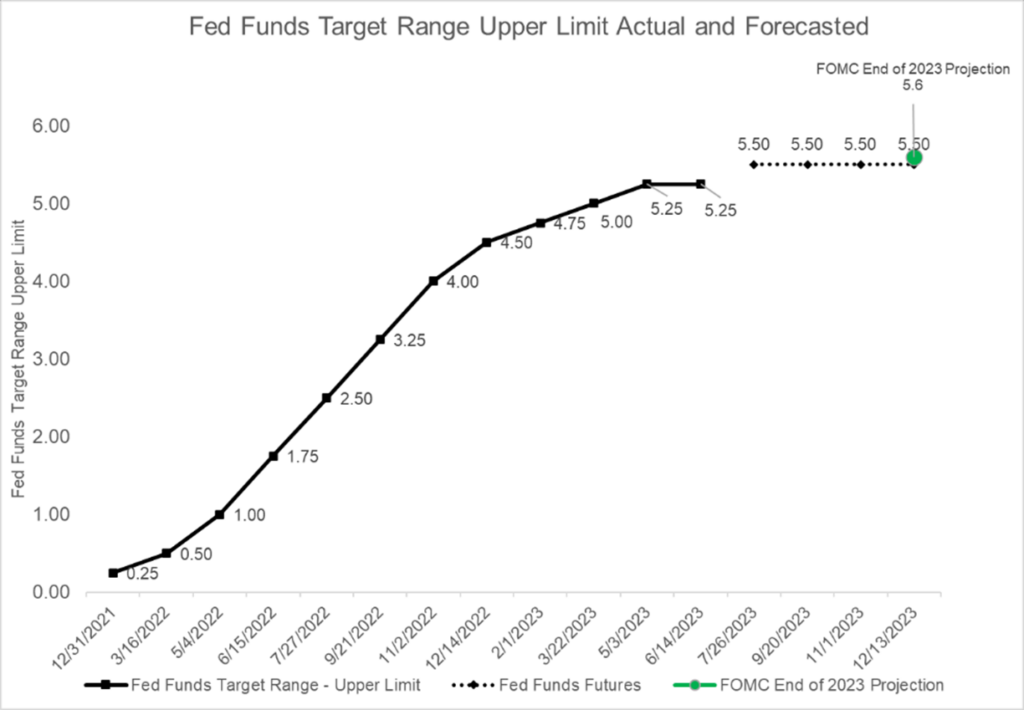

Of course, this poses issues for the main macro input of monetary policy and the Fed’s continued battle against inflation. The Fed has embraced the “higher-for-longer” camp and has finally gotten the market to fall in line and not forecast imminent rate cuts.

MARKET REVIEW

The rotation back to Growth stocks caught many investors off guard given the higher interest rate environment, as these long-duration assets are, typically, negatively impacted by higher rates. This was excruciatingly evident in 2022. However, two developments have worked to bring these companies back into favor in spite of macro headwinds:

- Cost-cutting at mega-cap tech companies has revitalized the bottom-line. These companies were always generating massive revenues and growing them, but they spent so much for so long and it largely went unchecked by the market given the low rate environment…until last year. As the environment changed, the market punished this practice and forced companies to rein in spending, which many have, and this has uncovered a renewed outlook for profits.

- The Artificial Intelligence (AI) revolution. It’s still the early innings but breakthroughs in AI technology are undeniable in their potential across industries and their impact thus far in the market. Mega cap technology companies are the clear early winners as customers increase capital expenditure in these areas. This has caused a positive re-rating of companies’ valuations and forward outlook for their profits.

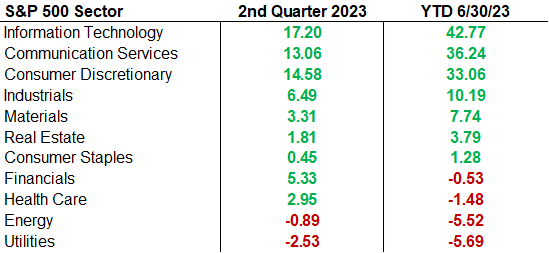

Within market sectors, the areas which were hardest hit last year – Technology, Communication Services and Consumer Discretionary – have rebounded strongly while the relative winners from last year are lagging during 2023. Energy stocks, which were one of the very few positive areas of market performance last year, are down -5.52% through 6/30/23. Financials continue to struggle under the stress of the multiple bank failures during the year; the S&P Regional Bank index is down -24.73% through 6/30/23.4

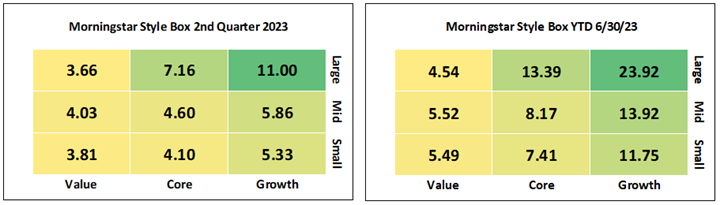

Across the style boxes, the Large Cap Growth outperformance is evident and the returns cascade downwards as you get into Mid and Small-caps and more Value-oriented but are nonetheless positive across the board.5

Globally, the US is outperforming International equities. Developed markets have outperformed Emerging markets: the MSCI EAFE is up +11.67% vs the MSCI Emerging Markets Index returning +4.89% for the year through 6/30/23.6

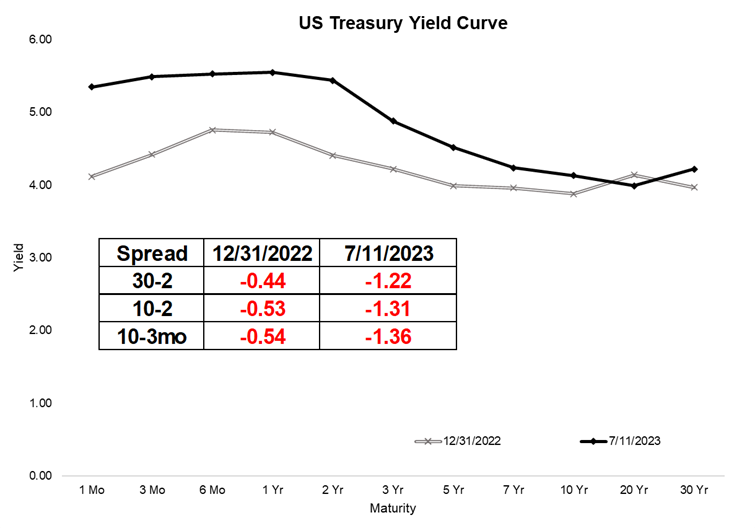

In the fixed income markets, the yield curve has only become more inverted (short-term rates above long- rates) as monetary policy has evolved this year to address the stronger than expected economy and stickier than hoped inflation numbers.7

Intermediate and long-term rates have stabilized during the year and credit spreads have marginally tightened during the year, providing a boost to credit sensitive issues.8 For the year, the Bloomberg US Aggregate Bond Index is up +2.09%, likewise bouncing after a historically poor 2022.9

Investment Grade and High Yield Corporate bonds have returned +4.02% and +5.38% through 6/30/23 and globally, Emerging Markets Debt has been a bright spot, returning +8.27% with the tailwind of a weakening US dollar.10

After having its worst year since the Global Financial Crisis, the heavily used balanced mix of the 60/40 portfolio (60% S&P 500/40% Bloomberg US Aggregate) has returned 11% so far during 2023.11

EARNINGS AND VALUATION

One of the fundamental backings for equity strength this year was a “better-than-feared” earnings season. The S&P 500 recorded a year-over-year earnings decline of -2.2% for the quarter, which exceeded expectations and included 78% of companies beating estimates. As often is the case, it is not as important if the data is “good or bad” but whether it is “better or worse” than anticipated.12

For the 2nd quarter, expectations are also for an earnings decline (-7.2%) vs. the prior year. The market is undoubtedly in an “earnings recession” – which is not an unexpected outcome coming out of the hypergrowth post-pandemic. What will matter to markets is twofold: the magnitude of this decline compared to those expectations and the projected recovery into positive growth in 2024 and 2025.13

As of now the market estimates a return to earnings growth in the 2nd half of this year and in 2024, meaning we are projected to be at the low point of the earnings cycle if these estimates were to come to fruition. This is fully encompassed by market prices today and as the market looks forward to future growth partially explains its strength this year.14

Given the market’s returns year, particularly led by higher valuation stocks, valuations remain slightly above their recent historical average. The S&P 500 trades at 18.9x the next 12-months earnings per share, compared to the 10-year average of 17.4x.15

Recall in the commentary above how influential the largest companies have become on the index; those top 10 largest companies combine for a 28.8x P/E vs. 17.5x for the rest of the index – scratching the surface of the valuation opportunity outside of the largest names in the US markets. For example, within the US, Small and Mid-cap Value companies trade at P/E ratios below 15x and globally, the MSCI ACWI Ex-US Index trades at a 12.6x P/E.16

While we maintain that valuation is not a short-term catalyst for market movements, it does inform asset allocation decisions in search of the highest expected long-term returns as diversifying additions to core equity holdings.

THE FED

The Fed remains top of the mind as they have significantly slowed down the pace of rate hikes and by most indications will be ending the hiking cycle during the year. At the last meeting (6/14/23) the committee paused after raising rates by varying degrees over 10 consecutive meetings. The market expects the 0.25% rate hike at the next meeting (7/26/23) to be the final hike of the cycle.17 Although some Fed participants forecasted an additional hike during the year, the data continues to suggest that may not be required. The next few months of inflation and jobs data will be very telling in that regard.

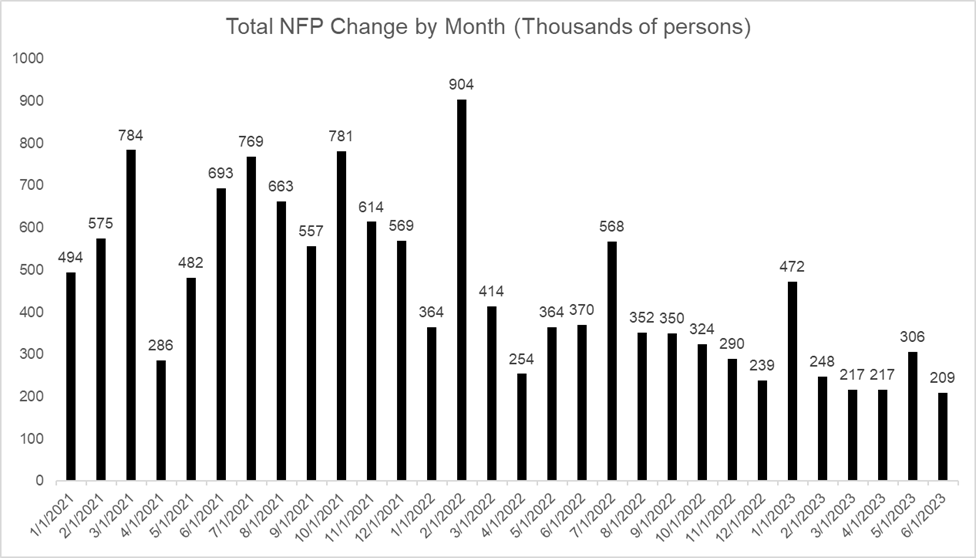

The two mandates of the Fed: full employment and price stability are both showing signs that a “soft landing” remains a distinct possibility. The labor market’s impressive strength has kept the consumer and the economy afloat while inflation data has markedly turned lower. The economy has added 3.8 million jobs over the past 12 months and the current unemployment rate is historically low at 3.6%.18,19

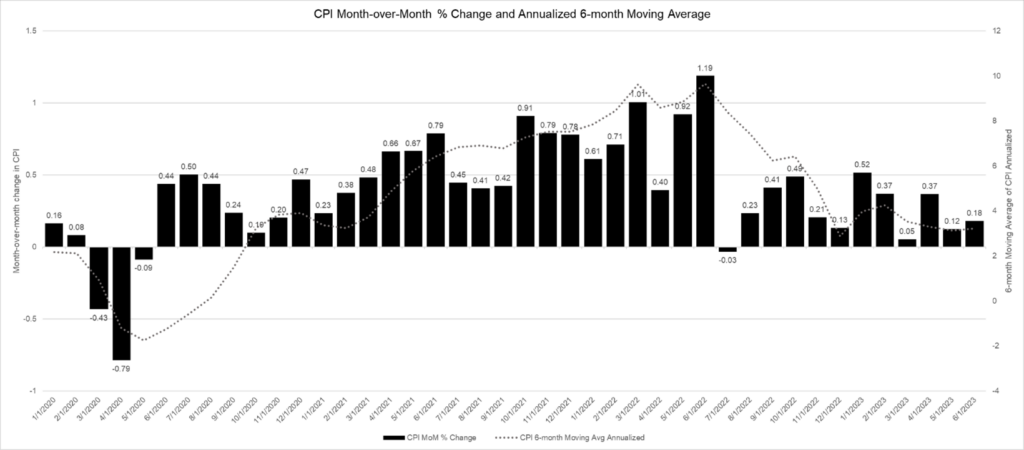

Additionally, the risk of inflation is dissipating. CPI has fallen from the peak of 9% in June 2022 to 3% as of the most recent report for June 2023. Core CPI (Inflation excluding Food and Energy prices) has remained more stubborn but has also continued on the downtrend, from a peak 6.6% in September 2022 to 4.8% as of the most recent report for June 2023.20,21

It looks more like the Fed, while it’s been extremely reluctant to do so, will be forced to acknowledge significant progress that has been made on the inflation front while maintaining a strong job market. The inflation problem is far from over and we expect inflation to remain a volatile and closely watched data set for months and years to come but the 1970’s style stagflation worries of 2022 are clearly fading.

We appreciate the opportunity to provide these market updates on a quarterly basis, please reach out with any questions regarding the content or as it specifically pertains to your personal investments with Kavar Capital Partners.

-John Nagle

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2023

- https://fred.stlouisfed.org/series/BAMLH0A0HYM2

- https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-the-markets/daily/mi-daily-gtm-us.pdf

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_070723.pdf

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_070723.pdf

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_070723.pdf

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_070723.pdf

- https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-the-markets/daily/mi-daily-gtm-us.pdf

- https://fred.stlouisfed.org/series/UNRATE

- https://fred.stlouisfed.org/series/PAYEMS

- https://fred.stlouisfed.org/series/CPIAUCSL

- https://fred.stlouisfed.org/series/CPILFESL

The views expressed herein are those of John Nagle on July 12th, 2023 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.