Keeping Politics in Their Place

By: Douglas G. Ciocca

With the last of the debates in the books; with over 50 million votes already cast; and with local legislator’s ad wheels in overdrive, the election is, finally, upon us.

1 week and 2 days from now, we’ll all tune into our favorite coverage team, be sufficiently impressed with their new hi-tech-touch-screens and algorithmic engines of predictive power (gotta be the first to “call” those critical swing states!) as we await the Presidential pronouncement…..

Unless, of course, it is too close to call on the night of the 3rd.

For a society so accustomed to conclusiveness, a deferral of determination would be disappointing.

Although this was the case 20 years ago, as the hanging chads held us hostage, that was before the binary bifurcation of what has become a social-media civilization.

And given that patience has plummeted during the pandemic, we sincerely hope that the will of the people will be rapidly reflected in the results and accepted by all sides.

We have fielded many questions over the last several months about the prospective outcomes (real-time or delayed) of the Presidential and Congressional elections for the financial markets. And while each candidate and campaign are nothing if not unique, we believe that general history can assist in the assessing the impact of the outcome(s).

The information that follows, replete with gorgeous graphics, is not an attempt to project, protect, slander, endorse, influence or editorialize – it is offered purely for perspective.

My name is Doug Ciocca and I approve this message- ha!

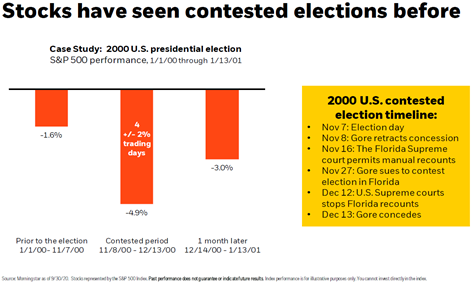

Let’s begin with the least populated data set – an inconclusive end of the evening on November 3rd.

As mentioned above, this took place 20 years ago when George W. Bush ran against Al Gore.

As the chart demonstrates, in the 5 weeks between election night and Gore’s concession, market anxiety was apparent, with the S&P 500 falling roughly 5%. That uneasiness endured right up until the inauguration in 2001.

While an 8% pullback is never nice news, bear in mind that as recently as last month (September 2 – September 24) the S&P 500 declined by 9.25%1. For context, also consider that the 2000 election occurred just a few months after the “dot-com” bubble popped2 and investors were radically repricing risk. The same could be said for post-pandemic positioning today.

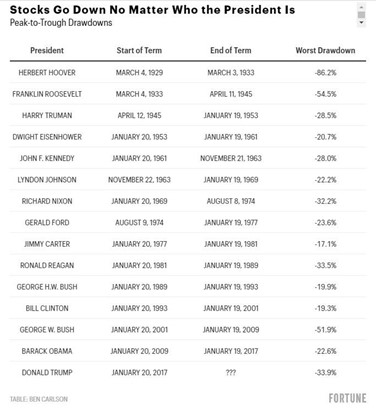

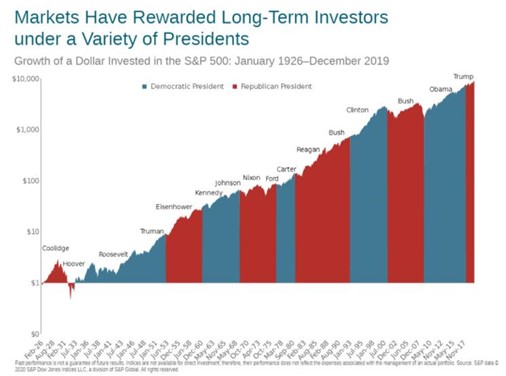

Once the Oval Office occupant is identified, history is fairly firm in its “forecasting”:

….and also, in its “foreboding”:

…..with solid statistical support for speedy stabilization, post-election:

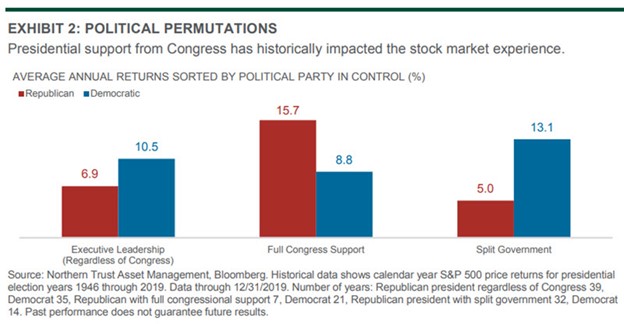

Congressional composition may be modified next week as well. In consideration of its construction, see below:

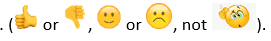

An undeniable take-away from all these graphs and charts, to me, is as follows: given an appropriate time horizon, the impact of politics on markets is inconsequential.

Financial markets are merely an abstraction of the companies that exist within an economy. If, over time, said economy grows, then the fortunes of the companies contributing to such growth will elevate along with their share prices.

Should the US continue to embrace practices that catalyze economic expansion, then I would see no reason that, though not unabated, the stock market would perform differently in the future than it has in the past.

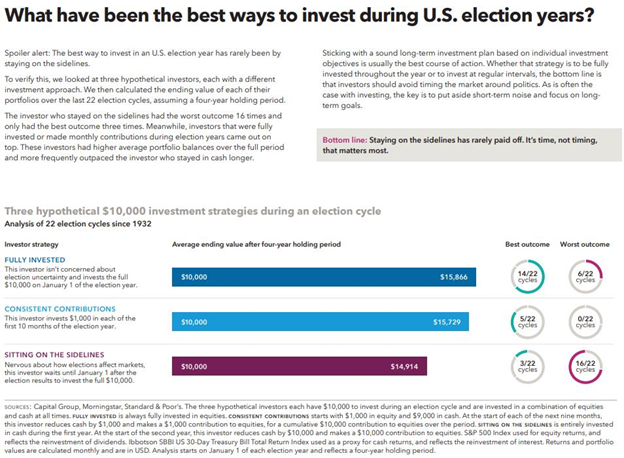

Investors are often tempted to allow a near-term fear of the unknown (in this case the outcome of the election and the policies of the prevailing party) to dictate their long-term investment strategy.

This type of investor behavior is imminently defendable given the human instinct to protect.

And this instinct elevates when the need for protection is deemed to be multi-faceted. The onset of the pandemic was one such case. Ongoing social unrest is another.

In consideration thereof, we reiterate a theory offered earlier this year, which is: manage for the short-term and invest for the long-term.

In practice, be sure to have ample liquidity set aside for operational needs should there be an elongated period of divergence from historical averages BUT retain a stock/bond allocation otherwise consistent with your long-run objectives with the balance.

I thought that the 2 snippets below from the Capital Group captured the essence of this issue and the consequences of conflating, as opposed to compartmentalizing, strategies.

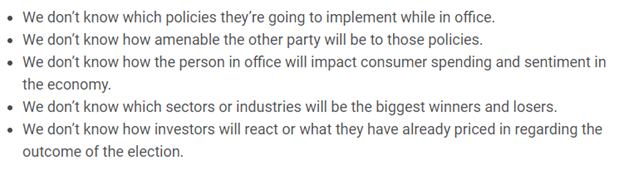

So with just over 1 week until the election, I would caution against abiding by any of the many “rules of thumb” for investing money and for the likely winners and losers (companies, industries, initiatives, etc) based upon the party of the President and the Congressional alignment. There is simply too much noise to ascertain clarity.

To wit, I am excerpting (bullet points below) an awesome column from Ben Carlson3:

Ultimately, what drives financial markets is the following: earnings, interest rates, currency strength and credibility. No single person or party is powerful enough to realign that relationship and history supports such a statement.

And ultimately, what drives your personal investment success is the following: proper asset allocation, discipline, patience and paying attention. History also supports that statement.

So, the day after the election, after the last of the ballots is cast and counted, the markets will open and close as they did the day before. We will confront this challenge as we would any impacting your portfolios and plans – collaboratively and constructively, encouraging you to always consider the consequences of any action.

Until such time, we’ll stay in close touch and please do not hesitate to reach out to any member of the Kavar team at any time.

1 Source: Bloomberg Market Data

2 https://www.investopedia.com/terms/d/dotcom-bubble.asp

3https://awealthofcommonsense.com/2020/10/dont-mix-your-politics-with-your-portfolio/

Important Disclosures:

The views expressed herein are those of Douglas Ciocca on October 25, 2020 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.