Market Update #2 – March 9, 2020

I said the same thing when the market closed today that I’ve said after every round of golf I’ve ever played: “Wow, glad that’s over!”

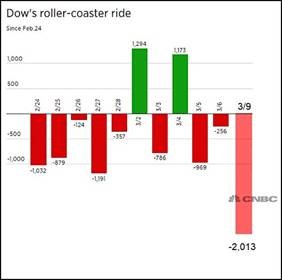

The Dow Jones Industrial Average and the S&P 500 both fell a little more than 7.5% today – record point declines for each. Also like my golf game, this extended the recent streak of wild swings:

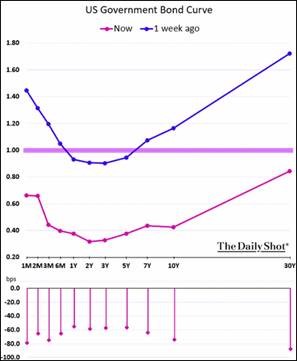

Bonds continued their recent rally, with the yield on the 10yr bond closing at 0.52% and the yield on the 30yr bond closing at 0.97%. All maturities on the US Treasury curve closed below 1%. This is the first day in the history of the bond market that this has taken place.

Source: WSJ Daily Shot (3/9/2020)

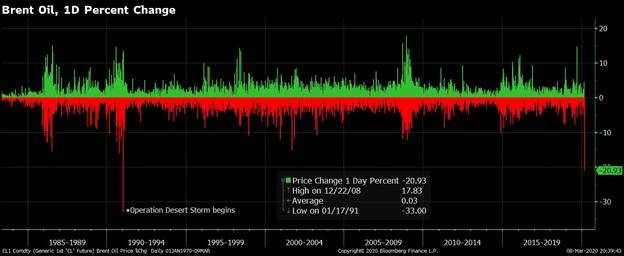

But the big story – yes bigger than those market stats and even bigger, for a day, than the coronavirus – was the drop in the price of a barrel of oil. At one point during the trading day, West Texas Intermediate Crude had fallen more than 30% before stabilizing, as the battle for market share between Russian and Saudi Arabia ranged on. As the chart shows below, this was the largest single-day drop since the 1991 Gulf War.

The timing of this supply shock could not have been worse, occurring amidst a demand decline from the suspension of economic activity surrounding the coronavirus.

And as is done in this day and age, the real-time, second-level, algorithmic dot-connecting didn’t end there……

The drop in the price of oil drove the prices of oil stocks down sharply. As well, because drilling for oil is capital-intensive, the drillers and refiners borrow money to fund their operations. Those loans are in the form of public bonds and their prices were also pressured. For good measure, any industry that borrows money to similarly fund their operations was not spared a fleecing.

Industry-sector bonds are a form of “corporate credit” (not to be confused with government or municipal debt) and there was a quick recalibration of its risk today, further fueling investor anxiety.

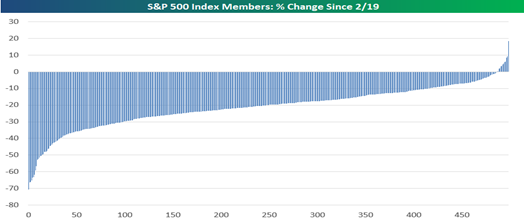

At the close today, the S&P 500 stands 18.9% below its near-term high of 2/19/20…and amazingly exactly ½ of the index member companies are down 20% or more over the last 13 trading days:

Source: bespokepremium.com

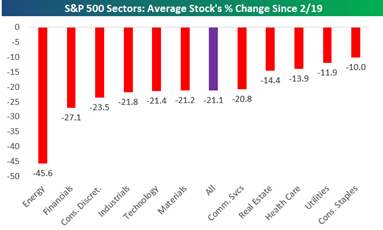

To put the move in the energy sector into a better perspective, consider that the average energy stock in the S&P 500 is down 45.6% from its 2/19 price….a far outlier to the downside compared to the 10 other sectors:

Certainly, the question that we receive a lot these days, understandably, is: “now what?” in relation to your personal portfolios, in light of the recent market dislocation.

While that answer is highly individualized, there are some consistent constructs for consideration.

To that end, I jotted down a great quote from Rick Rieder of Blackrock that he gave on a Bloomberg TV interview the other day. Rick said, “It is important to manage for the near-term and invest for the long-term.”

I love that.

By “manage”, I believe he means the following:

Manage cash flow by setting aside ample liquidity to meet your income needs for the next 12-18 months;

Manage income targets by orienting toward dividend-paying stocks, high quality bonds and sound preferreds and convertibles;

Manage your stress by compartmentalizing your risk and not exposing all of your portfolio to the daily market fluctuations;

Manage your financial well-being by creating and updating a financial plan to support decision-making without emotion and to offer context in the construction of your portfolio.

By “invest,” I believe he means the following:

Invest in great companies, or with great active managers of mutual funds, as quality consistently rises to the top;

Invest with a time-horizon not shorter than a full business-cycle for your equities. This is usually 5-7 years;

Invest w/ balance – finding securities and asset classes w/ “negative correlation’ to traditional classes of assets to reduce volatility and portfolio stress.

As I said, this nomenclature will be applied differently to different client situations but the variation on the theme will resonate.

We look forward to having those conversations w/ you and also, really, for the markets to settle down a bit!

The views expressed herein are those of Doug Ciocca on March 9, 2020 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners, LLC (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.