Market Update – August 5, 2024

Good afternoon – Checking in given the choppy trading we’ve witnessed in global stock markets over the last few days.

What began last Thursday gathered considerable downside momentum overnight which perpetuated throughout the US market session today.

The S&P is down around 6%1 in just 3 trading days and the Nasdaq is down closer to 8%1. In addition, last night there was a spike in the widely followed volatility index (known as the VIX) to levels last seen during Covid:

Source: Bloomberg Market Data

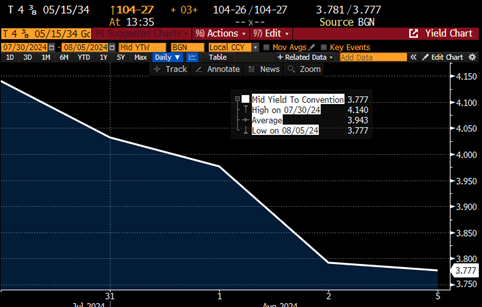

Funds have correspondingly flown into “haven” trades – seeking safety and protecting principal. The foremost beneficiary of this endeavor is the US Treasury market, pushing prices higher and knocking yields down (see 10yr US Treasury yield as a proxy below):

Source: Bloomberg Market Data

Every sell-off has its narrative(s) as it aids in attribution, and this one has a literal grab bag!

- The economy is slowing faster than had been anticipated, heightening the prospects of a recession…

- The big tech companies that have led the market the last 2 years are failing to impress with their latest profit reports…

- The presidential election adds ambiguity to the tax and regulatory environment into 2025…

- The “carry-trade” overseas is unwinding which drains liquidity from the capital markets…

And that is just to name a few……

It’s on days like today that I find comfort in the wit and wisdom of eponymous television personality, Ted Lasso, particularly as he stated:

“There are two buttons I never like to hit: panic and snooze.”

The high reading on the VIX was tantamount to panic. Comparing the underlying preconditions of today vs. a period of internationally sanctioned economic seizure (Covid in March of 2020) is inappropriate. Giving in to such fear and selling securities that are designed for their long-term contributions to your return targets is counterproductive. Engaging in such an endeavor is the epitome of market timing and is close to impossible to perform properly. Please don’t panic. A well-designed asset allocation actually obviates the need to do so.

It is never poor practice to reassess an investment plan and periods of heightened intraday price fluctuations offer insights as to its appropriateness that are otherwise difficult to simulate.

But keep in mind the levels from which this pullback began: thru the first 7 months of this year: the market-cap weighted S&P 500 was higher by 15.7%1, the Nasdaq by 17.2%1 and the average stock in the S&P 500 by 8.7%1. All are still nicely higher on the year and this doesn’t include the strength undertaken by all 3 of those referenced indices in 2023.

Speaking of panicky perspectives, there is a chorus of talking heads and Wall Street strategists clamoring for the Federal Reserve Bank (Fed) to cut interest rates before their next scheduled meeting in September. I think this would be ill-advised. The Fed JUST MET last week and over 2 days of discussions and deliberations decided to stand pat with the current level on the Fed Funds rate of 5.375%. Reversing course so close to that decision, in my opinion, undermines any confidence in their process and drives them to do the EXACT opposite of what Fed Chair Powell indicated in describing their posture as being “…data dependent but not data-point dependent.”2

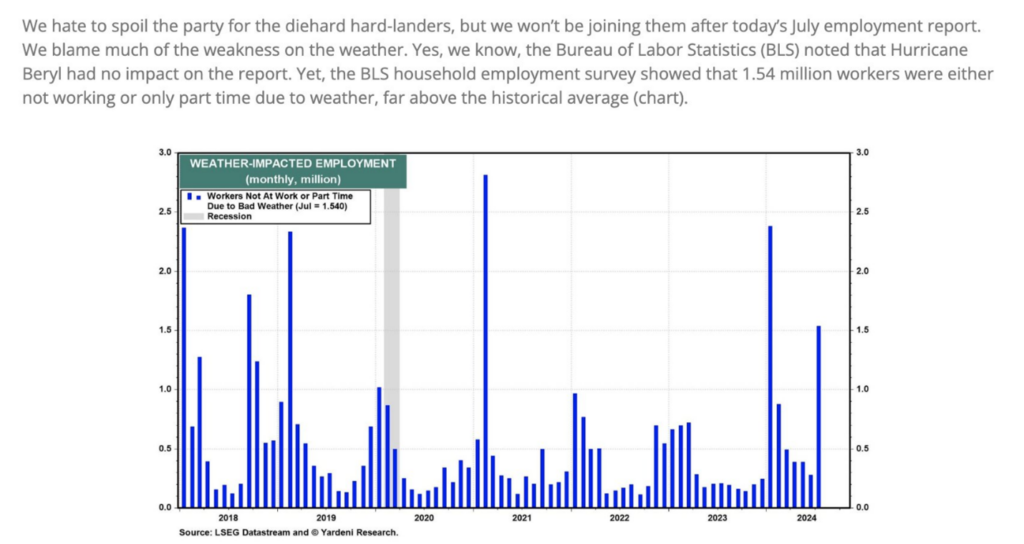

The data-point upon which the market is fixated is the weak non-farm payrolls number that was released on Friday. It indicated that the US added 114k1 new jobs last month, far less than the 175k1 anticipated. There was also a lift in the unemployment rate to 4.3%1, triggering itchy sell-button fingers throughout Friday’s trading hours.

However, there is a plausible explanation of that decline (see below) as well as some offsetting strength in other measures of economic activity (notably this morning’s S&P Global US Services Purchasing Manager’s Index which fell firmly in the economic expansion range.) 1

Look, it is clear to us that the economy is broadly slowing – the propensity of the evidence offers an indication of such – and that has been the catalyst for the softening tone the Fed has stricken since last October. But monetary policy implementation is a prescription, not an inoculation. We don’t want the Fed to panic any more than we want our clients to do so and we are certain they are not snoozing.

I think Rick Reider from BlackRock captured our perspective well in a Twitter/X post this afternoon:

Lastly, a quick word on the final bullet above as it is getting a lot of chatter across mainstream and social media today. A carry-trade is one that occurs when an investor borrows funds in a currency with low interest rates and reinvests the proceeds into higher-yielding assets in other countries. The Japanese Yen has been a common source for funding, but that characteristic has unwound quickly as it, like the Treasury market in the US, has become a surrogate safe haven in the face of very large losses in Japanese stock markets.

Keep in mind that currencies have no absolute value when it comes to foreign exchange. They are only denominated in terms relative to the partner’s currency with whom they are trading. Suffice it say, and as confusing as those last 2 sentences can confirm, this is mostly the lair of the algorithmic program-trader, the likes of whom are very prolific across institutional capital pools. These program trading algorithms tend to be very large, very correlated and very leveraged. When those trades begin to unwind, liquidity gaps evolve (instantaneously) as the programs try to exit positions before they worsen, creating a crowded exit and a lopsided market that requires cross-asset class liquidations to meet redemptions. It can, and likely did last night, create a domino effect that triggers a volatility spike.

That is all for now. We’ll keep in close touch and will stay vigilant in passing along pertinent data as it informs our decision-making in your portfolios. dc

1Source: Bloomberg Market Data

2https://www.cnbc.com/2024/07/31/powell-says-september-rate-cut-on-the-table-if-inflation-data-continues-to-cool.html

The views expressed herein are those of Doug Ciocca on August 5, 2024 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.