Market Update – December 18, 2024

Being a high-profile US government official and, arguably, the most prominent person in the global financial markets, Federal Reserve Chairman, Jerome Powell, is accustomed to criticism. Balancing the impacts of monetary policy across competing constituencies is difficult duty. Pleasing the pack of portfolio managers is a fool’s errand as investment objectives are as varied as their vendors. But all investors seemed to agree that today, on the Fed’s last meeting of 2025 and one week before Christmas, Powell was generally a Grinch.

The Fed fulfilled the embedded expectations of the markets and cut overnight lending rates by 0.25%. This is the 3rd consecutive Fed meeting in which rates have been reduced for a total reduction of 1 full percentage point. The “Fed Funds Rate” now sits @ 4.50%1

So while there was little surprise in the immediate outcome of the meeting, it was the subsequent communique that left investors feeling like Cindy Lou Who….watching the market “gifts” get snatched before their eyes!

Keep in mind that going into today’s Fed meeting, the market was emitting echoes of discord: the Dow Jones Industrial Average had fallen for 9 consecutive days (the longest streak since 1976) while the Nasdaq Composite Index (primary domain for the high-tech, Mag 7 set) hit an all-time high on Monday.

This bifurcation is worrisome, particularly when buttressed by a bond market that hadn’t caught a bid since Thanksgiving.

Such delicacy doesn’t demand gale-force winds for destabilization, just a nudge or 2 by the Fed caused consternation enough. So, what was the message that the market found so meddling? It was multi-fold.

First, not all Fed governors were on the same page about today’s rate cut. There were 4 dissenters, tho only one was a voting member of the Federal Open Market Committee. While seemingly a small point, when the market identifies an absence of unanimity, it begins to question its own conviction.

Second, many in the markets were wondering why the Fed would even need to cut rates at this meeting….think about it: the economy is strong, inflation’s decline has leveled off and the labor market is broadly in balance. And if the direct intent of a rate reduction is an elevation of economic activity, which tends to be inflationary, then would they have been better off waiting until the need was clearer? Posing such a question to Chair Powell resulted in an answer that I would characterize as confusing and without conviction, sewing deeper seeds of doubt as to the efficacy of the approach. His defense did invoke one of my favorite economic acronyms: NAIRU (non-accelerating inflation rate of unemployment) but it was cold comfort, as cool as it sounds.

Third, Powell was equivocating, at best, in his outlook for the future of rate cuts. Keep in mind that 1 year ago today, the market was anticipating 6 or 7 cuts in 2024…and we got 3 (4 if you count the September move as 2 since it was a ½ point instead of the traditional ¼ point). The expectation for 2025, based upon the newly released Summary of Economic Projections, is for 2 more.2 So the recalibration of monetary stimulus has been retrenching for many months, instigating impatience.

Historically, broadly, most asset classes tend to benefit from declining interest rates. Lowering the cost of money brings more of it into circulation and tends to unleash the virtuously circular benefits of capital markets. With all major indices on the verge of completing very strong back-to-back years, it is only natural to question this streak’s longevity if tailwinds become tougher to identify.

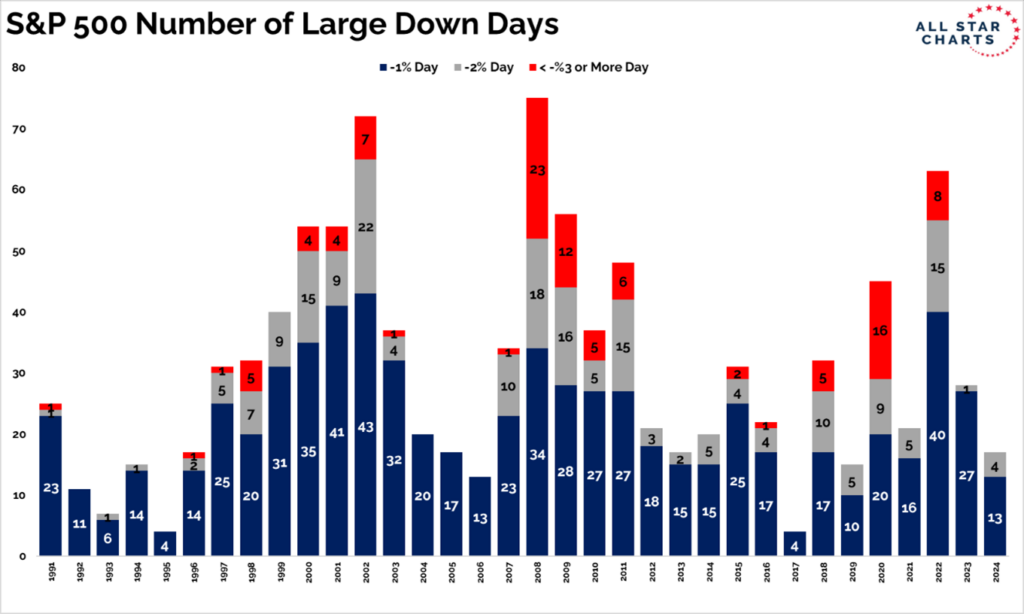

And while today was unpleasant for stock and bond market investors, I think it’s proper to invoke perspective given the strength that’s been present for the better part of the year and the lack of volatility attendant to attaining much of the gain. This chart below does a great job in that regard:

Source: All Star Charts

There are only 8 trading days left in 2024 and I don’t take today’s tape as an predetermination of their outcome. I liken the Wednesday session to that of a Ciocca kid at Christmas – when someone takes his toys away, it can trigger a tantrum! But rest assured, the market/economy qualities that led such gifts to be conveyed have not gone missing: strong earnings growth, healthy consumer, transformational technology cycle and regulatory reductions. These characteristics can combine to overcome the glumness of the Grinch and bring those stolen sacks back down to Who-ville.

We’ll be in touch and Happy Holidays! dc

1 Source: Bloomberg Market Data

2 Source: Bloomberg Market Data

The views expressed herein are those of Doug Ciocca on December 18th, 2024 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.