Market Update – February 23rd, 2022

Good evening,

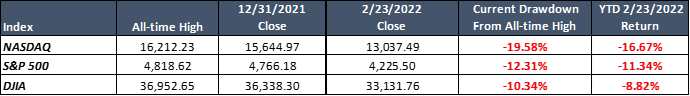

The market retreated further today for the 4th consecutive trading session, re-testing the intraday lows of last month and marking its lowest close of the year. The S&P 500 and the Dow Jones Industrial Average (DJIA) dropped -1.84% and -1.38% respectively while the NASDAQ Composite dropped -2.57% as the outsized weakness continued for the Tech-heavy index1. For the year, these markets now stand as follows, with the major indices firmly in a correction2 and the NASDAQ on the precipice of a bear market3:

The overarching and interconnected issues of rising inflation, rising interest rates and the Fed’s pivot to an aggressive tightening path continue to pressure stocks. “Growth” stocks, particularly those in the Technology sector have borne the brunt of an earnings’ multiple compression…generally speaking, when cash flow projections are less identifiable due to higher costs of capital, investors express less optimism in their outlook.

And just in the course of the last couple weeks, geopolitical worries have percolated into the market, adding a new risk to be discounted.

These worries center on the conflict between Russia and Ukraine. Taking a 30,000-foot view on the conflict, from a capital markets perspective, this is what matters in our opinion:

- The market is heavily discounting the (small) risk that a larger conflict will erupt in the region, potentially pulling in other countries. Under this scenario, global economic activity and corporate profitability would be materially impacted. This consequence seems unlikely.

- A regional conflict between Russia and Ukraine should not significantly impact portfolios past this short-term reaction to the news. Bear in mind that:

- Markets have largely ignored the conflict since this vintage started in earnest in 2014 with the Annexation of Crimea. Importantly:

- Russia and Ukraine are the 11th and 55th largest economies globally by nominal Gross Domestic Product (GDP) representing less than 2% of the total Global GDP.4

- Russian stocks represent less than 0.5% of the MSCI World Index, a conventional benchmark for the Global stock market. Ukraine is not in the Index.5

- US companies have low direct exposure to the countries, Russia makes up roughly 0.6% and Ukraine less than 0.1% of revenues for companies in the Russell 1000 Index.6

- Markets have largely ignored the conflict since this vintage started in earnest in 2014 with the Annexation of Crimea. Importantly:

- The most impactful aftershocks are already being felt in the Energy markets. Russia is one of the largest producers of oil, natural gas and coal so the conflict is provoking a price shock in commodity prices. Energy companies obviously benefit from this (and their stock prices have responded favorably) but users of commodities – consumers and businesses – get squeezed. This leg-up on top of the current inflationary environment has corroborated against valuations for risk-assets.

The fact that this conflict has flared up in the presence of a market already fitful in finding its footing has elevated the uncertainty and angst for investors.

In dealing with markets, the only constant is change. Geopolitical events tend to burst on the scene unexpectedly, disrupting markets and propagating hyperbolic narratives – this is not new. Thankfully, markets have historically processed such risk and focus then returns to economic and company fundamentals as the drivers of asset prices.

When the market does move on from this current geopolitical crisis, it is only a matter of time before the next one surfaces. And in the meantime, the environment characterized by persistent inflation, higher interest rates and transitional monetary policy has not gone away.

The calendar is full of market moving events over the next few weeks that are centered around the Fed’s dual mandate of price stability and full employment – culminating with a March FOMC meeting where the first interest rate hike in 4 years is fully expected.

- February 25th – Personal Consumption Expenditures (PCE)

- March 4th – Non-Farm Payrolls

- March 10th – Consumer Price Index (CPI)

- March 15th-16st – Federal Reserve Meeting and Rate Decision

We will stay in close contact as we work these and other events happening throughout this volatile period for markets and will offer insights and optimism as it relates to identifying opportunities that will emanate from this unrest.

Please reach out to any of the Kavar team members with questions as to any specific implications for your personal portfolios.

Thank you and have a good evening!

John Nagle

Footnotes

- Morningstar Direct Data

- Correction defined as a -10% drop from all-time highs

- Bear Market defined as a -20% drop from all-time highs

- The World Bank https://data.worldbank.org/indicator/NY.GDP.MKTP.CD

- MSCI https://www.msci.com/World

- JPMorgan Research

The views expressed herein are those of John Nagle on February 23rd, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.