Market Update – June 10, 2020

Are the markets too positive for the situation?

After crashing -35.4% from its intraday all-time high to the intraday crash low on March 23rd, the S&P 500 has ripped back +46.3% from that level to the close on June 9th, nearly retracing all the way back to all-time highs1. This rally took place while all of this happened:

- approximately 43 million jobless claims were filed in March, April and May,2

- the unemployment rate spiked to 14.7%, the highest since the Great Depression3

- the ISM Manufacturing and Services Indices saw their biggest monthly drops and lowest levels since the Global Financial Crisis in April,4,5

- S&P 500 earnings dropped -13.8% year-over-year and are estimated to drop -20.3% for all of 2020 vs. 2019,6

- US 1st quarter GDP decreased -4.8% according to the advance estimate form the BEA,7

- US 2nd quarter GDP estimates are gasp-inducing. The average of the Atlanta and New York Feds’ forecasting models is -37% as of 6/8/20,8,9

- the NBER officially declared the US has entered a recession,10

Among other historically negative economic data releases and more recently in the middle of major social unrest in every major metro area in the country.

The logical question by many investors is how and why the market has become so disconnected from the main street economy and the turmoil of today. Consider these points:

- Markets are forward looking. The crash that started in February happened while the current economic data was positive, so the market weakness anticipated economic weakness and now market strength is presumably anticipating economic strength.

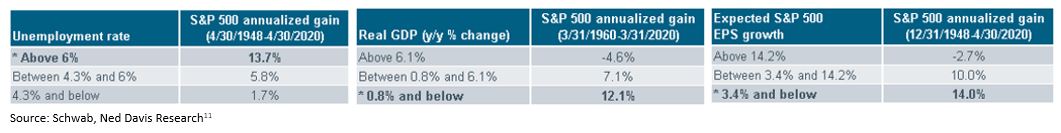

- Market returns from the lowest points in economic data is historically strong:

- The market is a discounting mechanism and it seems to be looking past this crisis to the recovery in profitability and economic growth.

- The low levels of interest rates today and presumably in the future strengthen present values of future cash flows if you are discounting these cash flows in perpetuity using an extremely low cost of capital.

- The market is dominated by mega-cap stocks, mainly Technology companies but also Consumer giants and Healthcare, that have shown the ability to generate profits efficiently regardless of the broader economic environment. Their current values and future cash flows are not impacted much by today’s poor economic environment.

- Unfortunately, or fortunately, in a lot of ways small businesses that are experiencing the most pain do not have much representation in the public stock market. Most public companies with strong balance sheets and durable business models can weather this storm and some are even going to be stronger and better positioned coming out of it.

- S&P 500 is just part of the broader market. Companies that are more “value” oriented and cyclical – for example, Financials and Energy stocks, -12.5% and -21.1% YTD through 6/8/20 respectively, have not fully recovered. Small Cap Value stocks remain down -14.8% YTD through 6/8/20. In these cases, the market is penalizing them because their growth is dependent on positive economic activity.12

- Some of the hardest hit specific areas of the economy remain distressed and some teeter on bankruptcy. These include Department stores, Movie theaters, Rental Cars, Hotels, Cruise lines, Airlines, etc.

- The most recent strength was boosted on May 18th when positive vaccine data was released, and the market has clearly rotated to the small caps, cyclicals and value stocks that were punished the most. This is a signal that the probability of an economic recovery being faster and stronger has increased.

- The recovery received an enormous boost with the latest jobs report surprising to the upside. This, along with the gradual reopening of the country points to continued optimism that the worst of the crisis, both from a public health and economy view, is behind us.

- There is also consideration of the social unrest in the country right now. The market has a history of whistling past social unrest and political turmoil – it is often overestimated how much the nightly news cycle (positively and negatively) affects the stock market –it is very little in most cases.

Does the market reflect a full recovery in 12-18 months?

- We think it is likely that the market is pricing in a complete recovery by the end of 2021.

- The market is certainly giving public companies a pass on 2020 earnings and looking towards the 2021 and beyond numbers.

- The Federal Reserve deserves a lot of praise for calming markets and pulling out all stops to assist during the crisis. Congress eventually got a stimulus package out to individuals and small businesses during the depths of the crises. The policy response was unprecedented but also extremely effective in the moment and established a floor in the markets.

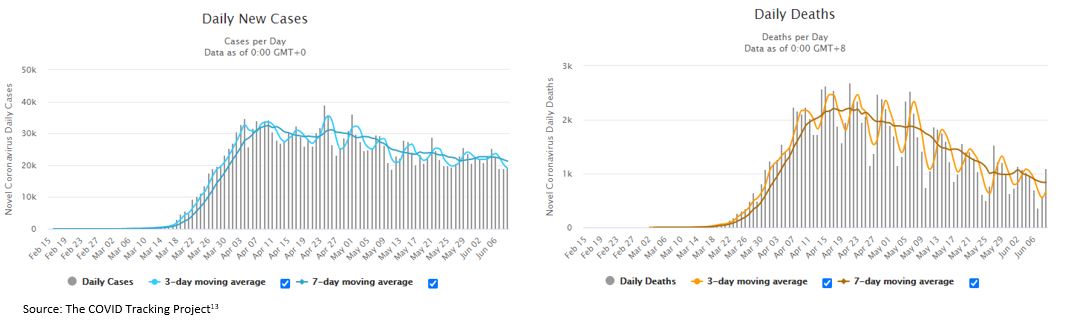

- The data on the COVID-19 pandemic has been incrementally positive since peaking around mid-April. While there are still rising cases in parts of the country, it’s hard to ignore that the initial curve has flattened significantly:

- Vaccine and therapy developments continue to advance at historic speeds, there are 10 candidate vaccines in human trials now, and 126 in pre-clinical stages14 with increasing optimism that by the end of this year, there will be scalable doses of an effective vaccine.15

- There is also anecdotal evidence from medical professionals that the virus is weakening over time.20,21

- The market seems to be pulling forward the scenario that COVID-19 is nearly eradicated during 2021. That would facilitate a swift recovery and then some given pent-up consumer demand.

- The risk to this outlook would be the oft-mentioned second wave after summer – would the country be able to lockdown again? That is a huge question for the 2nd half of the year.

Equities — how do we feel about these in the portfolio and at what levels? Are markets overvalued now?

- Equities play a crucial part for growth of a portfolio. This is especially true given the low return expectations in Fixed Income.

- Volatility and drawdowns should be expected going forward, keep in mind the average drawdown for a calendar year is -13.8% since 198016. This volatility is the risk premium associated with stocks’ future returns.

- It is extremely challenging to attempt to exit and re-enter the market at tops and bottoms – this year’s crash and subsequent rally is a prime example of why it is so difficult to do so.

- The valuation question is tricky right now because the outlook for revenues, earnings, cash flows, etc. the metrics of which make up many valuation ratios’ denominator is so muddled.

- According to estimates, the forward P/E ratio is 22.1x as of 6/5/2017, this is over one standard deviation above the 25-year average of 16.4x.18 So, by this measure, the market is overvalued relative to its historical average based on the next 12 months of earnings.

- However, if you assume the market is anticipating a V-shaped recovery in earnings, valuations based on 2021 or even 2022 would not look as overvalued. Again, the market is seemingly giving companies a pass on 2020.

- Also its important to consider valuations in the context of the Fed significantly reducing corporate cost of capital with no signs of increasing it any time soon, low inflation and the low yield environment in fixed income somewhat justify a higher multiple historically.

If the market takes another big hit, which is certainly possible, where do my investments go? Anything we can do to avoid another big hit?

- It is always possible the market takes a big hit at any time and if the portfolio has significant exposure to equities during the next period of equity market weakness, it will logically experience a drawdown representative of that exposure.

- It is always a good time to confirm asset allocation as it pertains to risk tolerance and it is important to maintain a level of equity risk exposure that is within the risk tolerance of the individual. If its uncomfortable it would be prudent to reduce equities as part of the strategic asset allocation.

- However, there is caution needed around attempting to temporarily reduce risk with the idea of increasing it at lower levels. Not many investors felt good about increasing risk on March 23rd – so it is doubtful that feeling would be different if the market really fell hard again.

Is consumer behavior being fully priced in?

- It’s easy to look around today and see how different the world is for consumers and ask if this “new” normal has any impact on the markets, after all its easy to see that consumer behavior is not even close to normal.

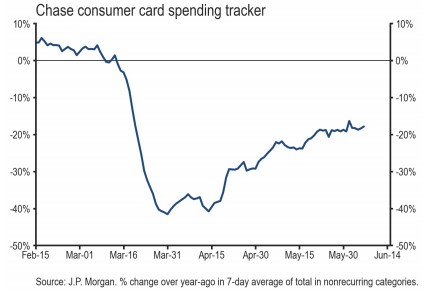

- The chart below is a daily tracker published by JP Morgan looking at Chase consumer card spending19. The data shows a significant increase in spending from the lows of the shutdown but still a way to go to return to normal.

- The market is again projecting a future recovery in this but do not underestimate the consumer, especially in the US. US consumers have historically been durable spenders when they have excess cash.

- But given the market’s composition, it is clear that the full recovery in restaurant, hotel, airline spending does not have to happen for the market to do well – those companies just don’t make up much of the market.

The views expressed herein are those of John Nagle on June 10th, 2020 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.

Footnotes:

- Morningstar Direct Data

- Louis Federal Reserve Economic Database: https://fred.stlouisfed.org/series/ICSA

- Louis Federal Reserve Economic Database: https://fred.stlouisfed.org/series/UNRATE

- https://www.reuters.com/article/us-usa-economy-manufacturing/u-s-manufacturing-skids-to-11-year-low-in-april-as-orders-sink-ism-idUSKBN22D5M0

- https://www.reuters.com/article/usa-economy-services/us-service-sector-activity-contracts-in-april-ism-idUSN9N28N025

- FactSet Earnings Insight: https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_051520.pdf

- Bureau of Economic Analysis: https://www.bea.gov/news/2020/gross-domestic-product-1st-quarter-2020-advance-estimate

- Atlanta Fed: https://www.frbatlanta.org/cqer/research/gdpnow

- NY Fed: https://www.newyorkfed.org/research/policy/nowcast

- National Bureau of Economic Research: https://www.nber.org/cycles/june2020.html

- Charles Schwab: https://www.schwab.com/resource-center/insights/content/every-picture-tells-story-chartbook-look-economymarket

- Morningstar Direct Data

- The COVID Tracking Project: https://covidtracking.com/

- World Health Organization: https://www.who.int/publications/m/item/draft-landscape-of-covid-19-candidate-vaccines

- CNN https://www.cnn.com/2020/06/10/politics/vaccine-trials-funding/index.html

- JPMorgan Guide to the Markets: https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_2Q20-Final.pdf

- FactSet Earnings Insight: https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_051520.pdf

- JPMorgan Guide to the Markets: https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_2Q20-Final.pdf

- JPMorgan Markets https://markets.jpmorgan.com/#home

- Reuters https://www.reuters.com/article/us-health-coronavirus-italy-virus/new-coronavirus-losing-potency-top-italian-doctor-says-idUSKBN2370OQ

- https://www.pennlive.com/news/2020/06/upmc-doctor-says-covid-19-has-become-less-prevalent-and-less-severe.html