Market Update – March 11, 2020

While Tuesday was a day of reprieve, Wednesday faced a resumption of selling on Wall Street.

Yesterday saw the Dow Jones Industrial Average climb 1,167.14 points, only to roll over and drop by 1,464 points today.

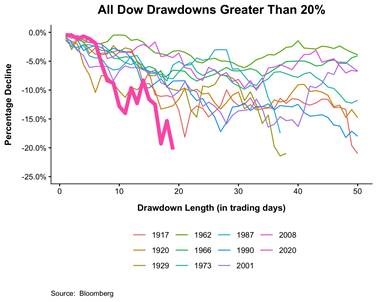

This session’s selling was significant in that it marked a decline of over 20% from the Dow’s Feb 12, 2020 record close.

This effectively ended the “bull market” that began on March 9, 2009, punctuating the longest bull market of all time.

It was also notable for its speed, representing the fastest 20% drop in history….only 19 trading days.

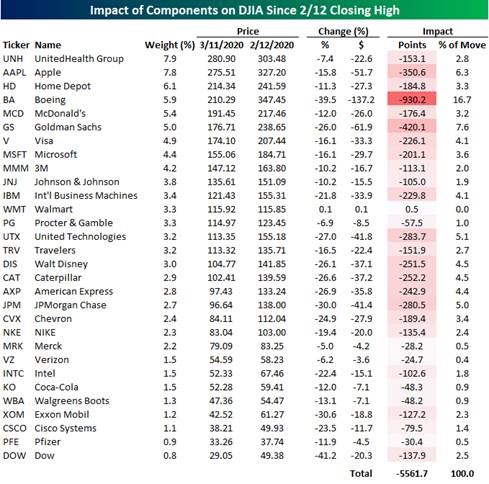

Below are the performances of all 30 stocks in the Dow Jones Industrial Average and their contribution to the 19-day decline:

Source: Bespoke Investment Group

Source: Bespoke Investment Group

While the oil price war played partial protagonist in Monday’s dramatic drop, today the spreading coronavirus was, again, center-stage.

To quote the evening wrap in the Wall Street Journal:

Schools are sending students home. Consumers are canceling vacation plans. And in New York City, the country’s financial center, banks have deployed contingency plans used during crises like the Sept. 11, 2001, terrorist attacks.

Wednesday’s stock-market declines accelerated after the World Health Organization declared the new coronavirus a pandemic and said it is “deeply concerned” by the “spread and severity” of the virus and by “alarming levels of inaction.”

Dr. Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases, who has been a refreshingly pragmatic and professional public presence, testified to Congress today that, “We have got to assume it is going to get worse and worse and worse.” This did nothing to nestle an already fragile investor psyche, despite the necessity of raising such a cautionary tone.

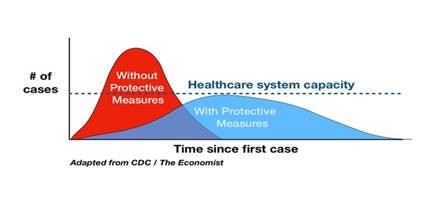

He also spent time with reporters yesterday, promoting the strategy of the Administration to, “flatten the curve.” Better explained:

“If you look at the curves of outbreaks, they go big peaks, and then come down. What we need to do is flatten that down,” Fauci told reporters Tuesday. “That would have less people infected. That would ultimately have less deaths. You do that by trying to interfere with the natural flow of the outbreak.”2

And better envisioned:

It is very certain that the world is undergoing a healthcare crisis, but the world is not undergoing a financial crisis.

It is very certain that the world is undergoing a healthcare crisis, but the world is not undergoing a financial crisis.

There is a risk, however, that the world could tilt into a financial crisis if the healthcare crisis is not contained.

That risk, being calibrated and recalibrated every second of every trading day is what is elevating anxiety, volatility and a daily repricing of assets across the security spectrum.

Here just some examples from today:

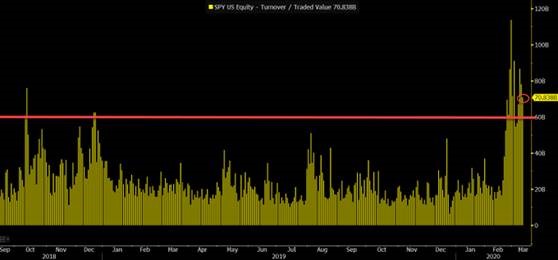

1. Volume on the S&P 500 recorded its 13th straight day above $50b (2.5x its avg) w/ 10 of those days above $60b. The amount and length of the intensity of trading is unprecedented. I went back to Q4 2018 (which seemed really wild at the time) for context.

2. The VIX (a real-time, tradable index representing the market’s expectations for wild swings over the coming 30 days) closed above 40 for the 4th straight day. That hasn’t happened since March-April 2009.

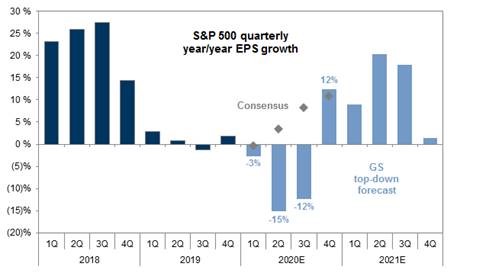

3. Big investment banks are rushing to modify their valuation models, attempting to be the 1st movers in reducing client expectations. Such was the case with Goldman Sachs this am – anticipating 3 consecutive quarters of earnings decline before bouncing back.

This has been a recent resounding theme on Wall Street: a drop in industrial and consumer demand, followed by a robust snap-back. Given the spotty track record of the consensus, I’d take these predictions with a grain of salt.

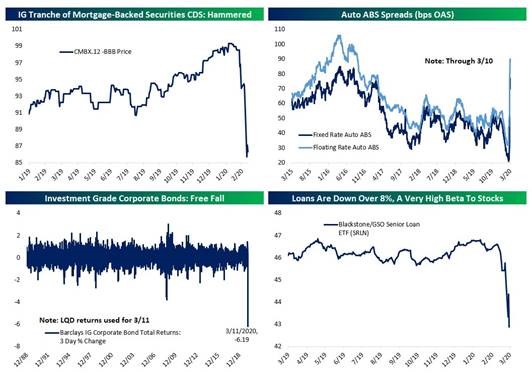

4. Behold the credit quad-box. Credit is a high-finance way of describing different classes of non-government debt. As illustrated, mortgage bonds, asset-backed securities (things like auto loans), high-quality corporate bonds and bank loans all experienced pricing pressure today:

Source: Bespoke Investment Group

Source: Bespoke Investment Group

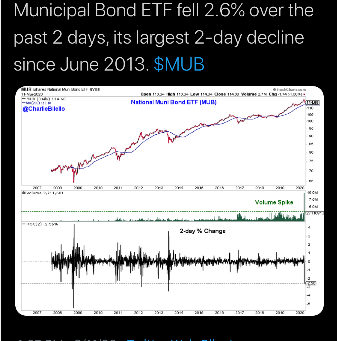

5. Lastly, even municipal debt has seen a decline in price this week. In fact, the primary muni bond ETF, MUB, has fallen 2.6% over the last 2 days….it’s largest 2-day decline since 2013:

So, if we are not in a financial crisis, why are financial products pricing as though we are? Or will be?

Simply put, financial markets are reflexive animals of self-preservation. Think about it, markets are no more than the collective intellect and emotion of their participants.

And “flight” is often easier than “fight” in the presence of ambiguity. The coronavirus is certainly ambiguous. Selling, though, is definitive.

If, indeed, the worst-case scenario plays out and there is a reduction or suspension of certain economic activity in the United States, or any other country for that matter, is it a permanent impairment of prosperity? No.

If, indeed, economic activity as we’ve known it is altered temporarily, is there ready access to capital for corporations and individuals to sustain through a period of difficulty? Yes. Our banks and financial institutions, coming out of the last crisis, are in very sound shape and are ready to express capital to people/companies in greatest need.

I think Dr. Fauci is correct: the outbreak in the US may have to get worse before it gets better. It seems more than anything that we should focus on testing equipment to get a true read on the incidence of infection and the mortality rate.

There is power in knowledge and the steps being taken to offset the spread, draconian as they may seem, offer opportunities to intervene effectively. Once we can quantify such efforts, I think it will provide confidence in our country to conquer the health and economic consequences of this crisis. And confidence is what the markets need to stabilize.

1 https://www.wsj.com/articles/global-markets-calmer-after-two-hectic-days-11583899913

2 https://www.statnews.com/2020/03/11/flattening-curve-coronavirus/

The views expressed herein are those of Doug Ciocca on March 11, 2020 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners, LLC (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.