Market Update – March 26, 2020

It has been a very wild 4 days in the financial markets!

If you have a thing for understatements, then that one must have made your night!

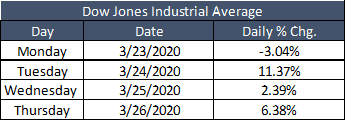

The Dow Jones gyrations persisted into their 5th week, posting these dizzying daily results:

Tuesday and Wednesday represented the first back-to-back up days in the Dow since February 5th and 6th and the last 3 days posted a combined gain of: +21.30%.

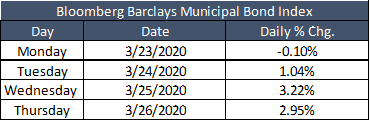

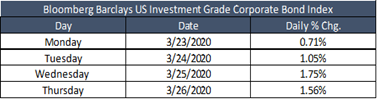

But the excitement was not confined to stocks. Bonds were boosted by some extraordinary and innovative monetary policy initiatives by the Federal Reserve Bank (more on that in a minute) and the whole spectrum of fixed income alternatives responded favorably. Here are two examples:

Total change in Muni Bonds: +7.37%

Total change in IG Corporate Bonds: +7.3

I wanted to bring up the fixed income/credit markets for a couple reasons:

- Without the bond market, the stock market is meaningless. I know that is a strong statement. It needs to be, because it is true. Without access to capital, homes don’t get purchased, inventory isn’t ordered, production plants are not built, municipalities don’t pave your roads, and on and on;

- Whenever there is a suspicion about the proper functioning of the credit markets, it prompts panic. When banks were failing in 2008 and 2009, there was panic in the credit markets.

And this past week, there was panic in the credit markets. Individuals, businesses, foreign governments and others began to simultaneously draw money of out of the credit system, fearing that if they didn’t act fast, they would miss the chance to act at all!

The Covid-19 coronavirus has catalyzed fear in folks that is unique in its compounded constructs – it is equal parts emotional and economic. And preservation of self and sustenance reigns supreme.

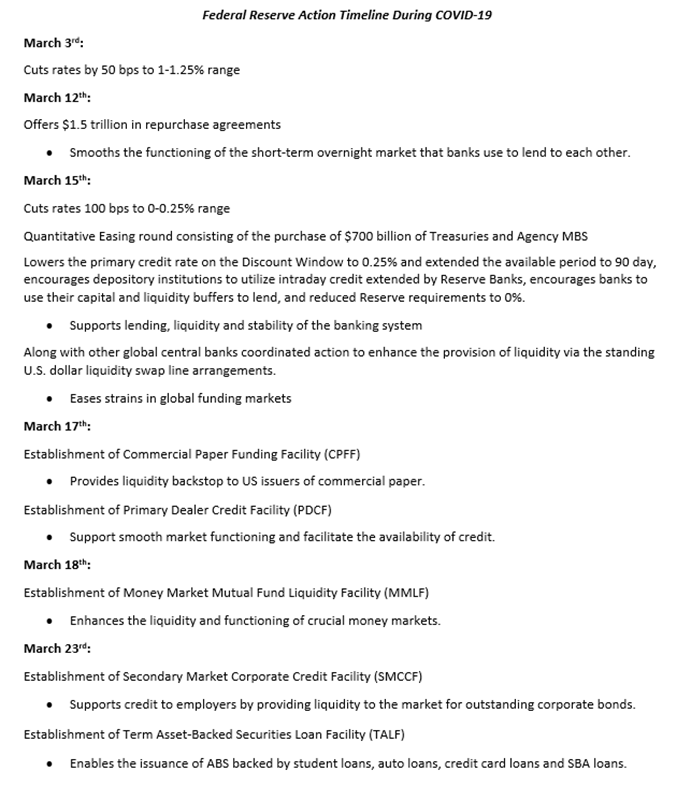

In recognition of this fear and, literal, run on some banks and bond markets (primarily the mortgage, commercial paper and muni bond markets), the Fed came to the rescue, promoting the first of 3 preconditions for creating more market calm: Aggressive Monetary Policy.

In essence, the Fed has showered the credit markets with cash – providing everything from loan guarantees to the actual purchasing of exchange-traded funds (ETFs).

The goal of the Fed is to eliminate any impediments to the normal flow of credit in our economy. Their efforts, in my opinion, have been phenomenal and evidence of such underpins the strength in the bond markets this week.

Here is a quick synopsis of their actions to date in this crisis:

The second of 3 preconditions for creating more market calm is: Aggressive Fiscal Policy.

Now, I had always heard that there are 3 T’s to an effective government intervention:

Timely, Targeted & Temporary! Well, our lovely legislatures have added a 4th: Tardy!

We have all been anxiously awaiting the terms of the 3rd and biggest bill of them all. To recap the first 2:

On February 24, 2020, the Trump administration asked Congress for $2.5 billion in emergency funding to combat the outbreak. Shortly after Trump’s request, Senate Minority Leader Chuck Schumer unveiled a plan providing “$8.5 billion in emergency funding”. By March 4, Congress had reached a bipartisan agreement for $8.3 billion in funding to fight the coronavirus via the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 (HR 6074). The bill passed the House by a 415–2 vote and the Senate with a 96–1 vote. The deal includes “more than $3 billion for the research and development of vaccines, therapeutics and diagnostics, as well as $2.2 billion for the Centers for Disease Control and Prevention, including $950 million to support state and local health agencies.” President Trump signed the bill into law on March 6.

Senators Chuck Schumer and Nancy Pelosi then requested that all Covid-19 testing be free of cost. They would also ask that paid emergency leave and food assistance be provided to affected employees. In a vote that concluded at 12:30 am on Saturday March 14, 2020, the House passed the Families First Coronavirus Response Act (HR 6201) in a 363–40–1 vote after President Trump had tweeted in support of it. The bill provides for free coronavirus testing, “paid emergency leave and other resources intended to help stem the crisis and stabilize financial markets.” The bill was sent to the Senate on March 16 after undergoing technical corrections,[83] and was approved on March 18 with a vote of 90–8; President Trump signed the bill later that day.

With any luck, this 3rd stimulus bill will pass tomorrow as the Senate has handed it off to the House. All seems to be in order, with the exception of the best way to overcome some logistical social-distancing challenges. I am hopeful that there will not be any last-minute alterations that cause a further delay. Like never before, TIME IS OF THE ESSENCE!

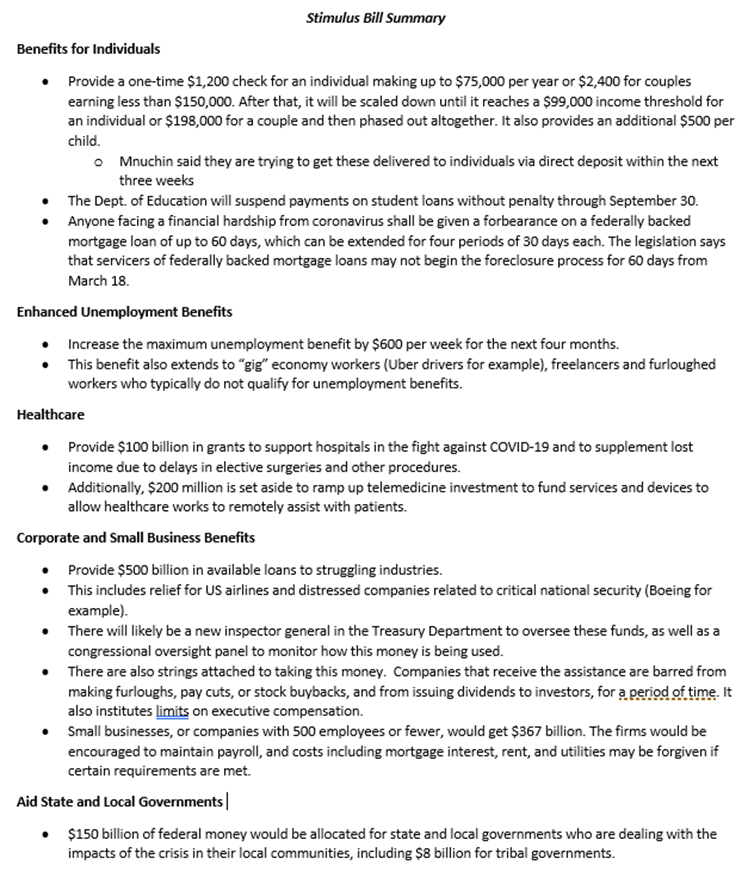

Assuming all goes through the House as passed the Senate, here are the highlights:

This is the proverbial bazooka – very big and comprehensive – though not exhaustive. Work has already begun on a 4th bill, should it be necessary.

There is little doubt that the market found this effort encouraging based upon its performance of the last few days.

The last of 3 preconditions for creating more market calm is: empirical evidence that we are successful fighting the Coronavirus.

This evidence may be in the form of a cresting case count, or a more considerable reduction in the mortality rate, or fewer epicenters of outbreak, or widespread availability of therapeutics. Or even better – all of those things!

The humanitarian efforts put on by the medical professionals and outpouring of state, local and corporate support has been as heartwarming as the stories of the victims has been sad.

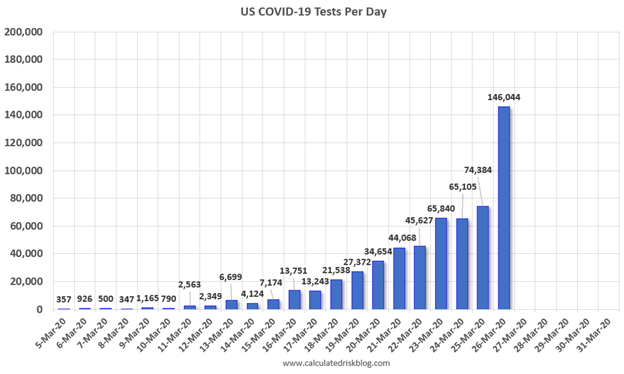

We track the US testing count everyday at our office (well, our remote locations) and the data here is encouraging:

Data, well knowledge, is power in fighting this pandemic. I think we are now getting good data which will optimize resource allocation and, hopefully, shorten the time it takes to defeat the Covid-19.

Until such time, it would seem difficult to achieve elongated periods of market calm.

Stock markets ultimately attempt to discount the future cash flows of their companies. The level of ambiguity in the world right now obscures such an analysis and vagaries lead to volatility.

It has been heartening to see the market respond positively to the efforts of the Fed and Congress. It will be much more so when the tri-fecta is complete.

Until such time, it is not unlikely that the gyrations endure, though hopefully less so now in the credit markets given the pledge of Chairman Powell on The Today Show this am, that he, “has plenty of ammo left!” Keep firin’ Jay!

We’ll keep in close touch and I am wishing you great health! dc

The views expressed herein are those of Doug Ciocca on March 26, 2020 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners, LLC (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.