Market Volatility and Sequence of Returns Risk

As we close out the 1st quarter and reflect back on the last 8 months, the re-emergence of market volatility has been noticeable. This is an important time for investors to re-acquaint with the prospect of temporary drawdowns while owning risk assets. Depending on your time horizon, you viewed this tumultuous period as either a buying opportunity or a time to re-evaluate your asset allocation. Ultimately, volatility is a constant force in the public markets and ebbs and flows with near-term psychology. For investors that are in the “accumulation” phase, volatility can be your friend and afford you the opportunity to buy more shares at lower prices. However, investors that are approaching the “distribution” phase should view volatility or market drawdowns in a different light. This brings into focus the concept of “Sequence of Returns Risk.”

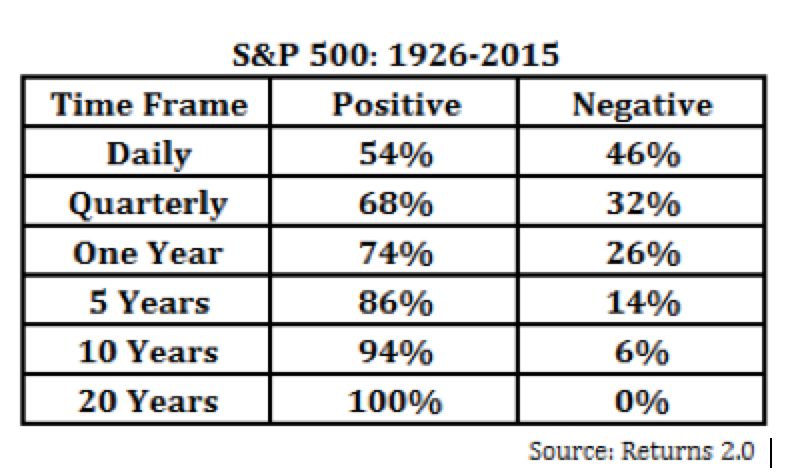

First, let’s look at some historical context. Below is a chart1 displaying the probability of negative returns from the S&P 500 over different time intervals. As you will see, on a daily basis it’s basically a coin flip on whether or not the market will be positive or negative. The probability of negative returns diminishes as your time horizon increases. Intuitively, most investors know this to be true. However, the presence of negative returns in the short-run coupled with the need to liquidate investments to meet obligations can have devastating effects on a retirement plan. In other words, turning paper losses into permanent losses robs you of the opportunity to let time work on your side. Since 1980, it has taken an average of 2.6 years for the S&P 500 index to recover from a bear market contraction2. This underscores the importance of minimizing the impact of market drawdowns during your retirement years.

The retirement landscape today is becoming more and more complex as life expectancies increase. On the investment side of things, I would say the ability to manage Sequence of Returns Risk is near the top in terms of importance. How does an investor maintain purchasing power, account for unforeseen expenses and reduce investment risk all at the same time? This can be a difficult equation to solve. Let’s dive into some solutions.4

Conservative Withdrawal Rates

One of the first steps in retirement planning is to forecast your annual expenses (fixed + discretionary) and to contemplate how those might change over time (inflation & lifestyle). From there you can calculate your initial withdrawal rate by subtracting your guaranteed income sources (Social Security, Pensions, Annuities, etc.) from your annual expenses. What’s left over is the amount your investment portfolio will need to produce to close the gap. This number divided by your liquid net worth will determine your withdrawal rate. One way to lessen the impact of a poor return sequence in retirement is to have a low withdrawal rate which can insulate you from having to sell assets when they are down in price. For example, being able to live off a portfolio’s dividends and interest affords you the flexibility to be more selective when selling certain assets to fund major purchases. Also, if you have low fixed costs you can adjust your discretionary spending based on the returns of your investment portfolio. This is referred to as a “Dynamic Withdrawal Strategy” where you increase discretionary spending during periods of higher returns and decrease during periods of lower returns.

Reduce Volatility in Early Retirement Years

The time when negative returns can be most impactful for a retiree is right after they retire. It’s crucial to develop an appropriate balance within your asset allocation in your early retirement years. We think the concept of Liability Driven Investing can be helpful when determining the right asset mix. This often involves building a bond ladder as part of a bucketed approach where security is emphasized for assets to be consumed in the short term and growth is the focus for assets to be consumed over the long term. It’s also important to introduce the idea of negative correlation through Alternative Assets in order to reduce volatility and act as a “store of value” within the portfolio.

Develop Buffer Assets

At the onset of retirement, the focus should be on optimizing your entire balance sheet to develop your income replacement strategy. Often the focus is on one’s investment portfolio without much consideration to other assets such as real estate, private investments, cash value life insurance, etc. The coordination and contribution of these assets can be crucial to immunize an investor from an adverse return sequence in the public markets. On the real estate front, a lot of research is being developed on how to maximize home equity. Traditionally, the approach has been to pay off your home and transfer that equity to the next generation or use it as a last resort. There are two potential flaws with this approach. First, most heirs who inherit a house have no need for it and end up selling it right away to settle the estate. Second, home equity can provide a nice “buffer” when used correctly against a draw down in the public markets. A study authored by Barry Sacks and Stephen Sacks3 in the Journal of Financial Planning put some teeth behind this approach. They concluded that “using home equity as a last resort” was suboptimal to a reverse mortgage credit line in scenarios where higher withdrawal rates were needed to fund expenses. In other words, the use of home equity can act as a nice buffer during bear markets as opposed to selling assets at depressed prices.

As you can see there are a number of different ways to offset Sequence of Returns Risk and a thoughtful plan should pair the right mix with your goals and objectives.

Here is a graphic put together by BlackRock to illustrate the impact of Sequence of Returns Risk. They used 3 different return streams with the same starting value and constant withdrawals throughout the time period. The annualized return was the same for each scenario but the outcomes varied widely. Without knowing the sequence of returns in the future, careful planning is needed to provide peace of mind that your plan is steadfast in an uncertain environment.

1 http://awealthofcommonsense.com/2015/11/playing-the-probabilities/

2 Morningstar Direct

3 Reversing the Conventional Wisdom: Using Home Equity to Supplement Retirement Income, Sacks and Sacks, Journal of Financial Planning – February 2012

4 Managing Sequence Risk, Wade Pfau, The American College

Important Disclosures:

The views expressed herein are those of Tom Boling on April 6, 2016 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.