Open Enrollment & Medicare Part D

Medicare Open Enrollment

Fall has officially arrived! This means crisp air, leaves turning and Medicare Open Enrollment. The Medicare Open Enrollment period began on October 15th and lasts until December 15th. During this period, you may make certain changes, although most are not necessary or recommended. One option that I always recommend reviewing is Part D, or your Medicare drug plan.

If your prescriptions or preferred pharmacy has changed in the past year, chances are there is a better, more affordable, Part D plan available to you in 2025.

What is Part D

Medicare Part D helps cover the cost of prescription drugs along with many recommended vaccines. Part D is in addition to original Medicare which includes Part A & Part B. For those on a Medicare Advantage Plan (bundled Parts A, B & D), this Open Enrollment period for Part D will not apply.

How it Works

Part D plan providers negotiate with pharmacies and have different contracts with each of them. These contracts dictate whether a pharmacy is in-network or out-of-network. If a pharmacy falls within a plans network, Part D plan members will receive lower cost for their prescriptions. There are multiple status tiers that affect how a pharmacies prescriptions are priced with any given plan:

- Preferred in-network – usually offers the lowest cost.

- In-network – usually offers lower cost than out-of-network pharmacies, but higher than preferred-in-network pharmacies.

- Out-of-network – usually you must pay the full cost which tends to be much higher than an in-network or preferred pharmacy.

- Mail-order – cost can vary depending on mail-order pharmacy.

Prescription drugs fall into pricing tiers under each plan. Each plan also contains their own list of covered drugs (formularies). These formularies include both name brand and generic versions of drugs and tend to be the lowest cost.

Make a List

As you begin to shop and research the Part D plans available to you in 2025, start by making a list. This list should include:

- Drug Name

- Dosage

- Quantity

- Frequency

I also recommend adding your preferred pharmacy and a back-up to compare.

Visit Medicare Website

Once you’ve gathered your list and preferred pharmacies, visit the Medicare website (medicare.gov) to input your prescription list. After adding your prescriptions, you can review the costs associated with each plan that corresponds to your preferred pharmacies. The three costs to note are:

- Premium – the monthly cost of drug coverage. Premiums are subject to surcharges based on previously reported income.

- Total Drug & Premium Cost – the estimated amount you will pay for prescriptions and plan premium for 2025.

- Deductible – the amount you pay for prescriptions before the plan starts to pay.

Total Drug & Premium Cost is the most important to note on this list. A month-by-month cost estimate can be reviewed by selecting View drugs & their costs.

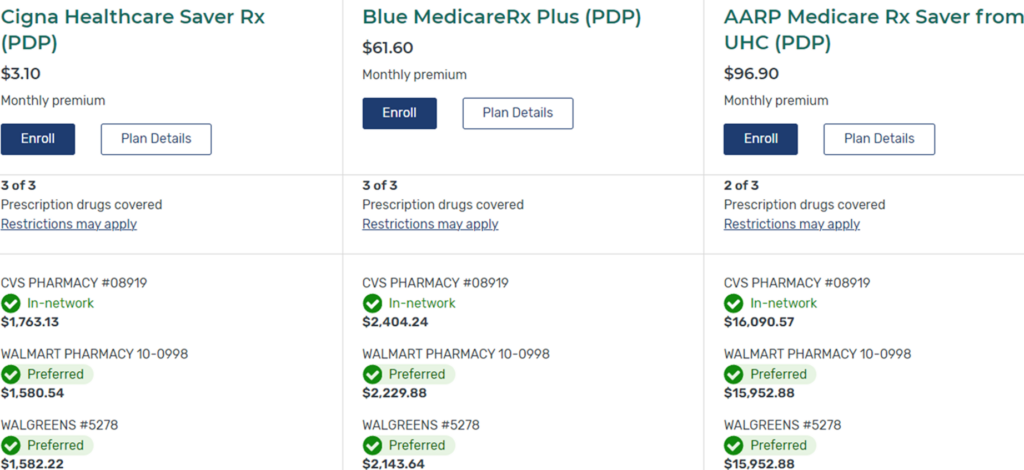

For example, I input several drugs and pharmacies to illustrate the price discrepancies between plans:

As you can see, the price you pay for your prescriptions (Total Drug + Premium) can vary depending on which drugs the plan covers and network status. Note that not all prescriptions will have the same price discrepancy.

Elect to Enroll for Upcoming Year

Finding the best plan for you is what matters most. Your prescriptions could change throughout the year, which may change the estimated costs. Once you have found a plan, you can enroll in the desired plan by inputting your Medicare ID. The plan will become effective in 2025, and your old plan will end. If no action is taken, your coverage will automatically renew for next year.

Shopping your Part D plan can help ensure you pay the lowest price given the information you know today. It could also save you hundreds to thousands of dollars depending on your current plan and prescriptions.

Please feel free to reach out to our team if you have any questions!

Jack Faerber, CFP®

Wealth Advisor

Sources

- Medicare.gov https://www.medicare.gov/

- Centers for Medicare & Medicaid Services https://www.cms.gov/

Important Disclosures:

The views expressed herein are of Jack Faerber on October 17, 2023 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. Kavar Capital Partners is not an insurance broker. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.