Quarterly Investment Research Note – October 16th, 2024

3rd Quarter 2024 Summary

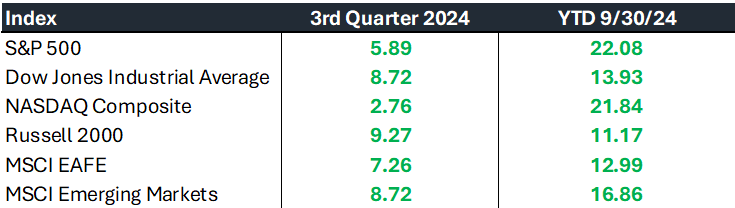

- US market leadership changed hands during the 3rd quarter, as investors broadened exposure beyond the biggest companies, a welcome sign for diversified portfolios. The S&P 500 returned +5.89% for the 3rd quarter while the S&P 400 Mid-cap and S&P 600 Small-cap indices returned +6.94% and +10.13%, respectively during the quarter. The S&P 500 continues to lead on the year and is now up +22.08% through 9/30/24.1

- Internationally, Emerging Markets posted a strong gain of +8.72% for the quarter as measured by the MSCI EM Index and are up +16.86% for the year. Developed Markets, as measured by the MSCI EAFE Index, were up +7.26% for the quarter and are up +12.99% for the year.2

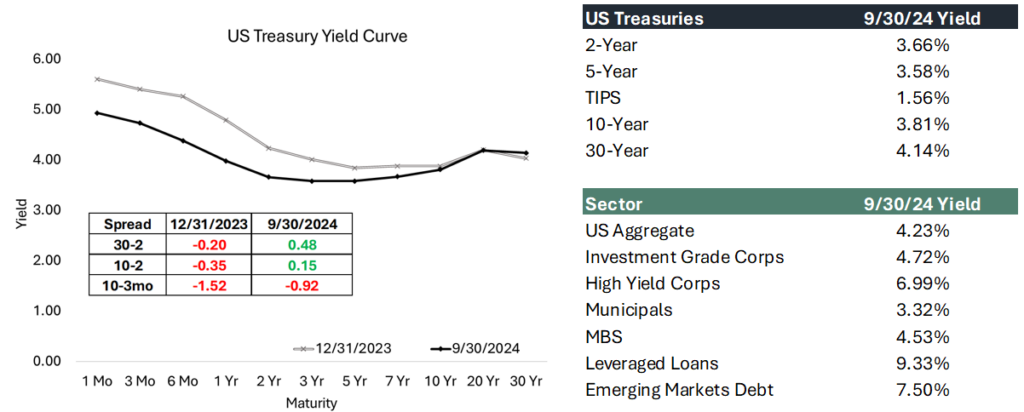

- The bond market gained momentum as Treasury yields declined, driven by disinflation and creeping concerns about lower growth expectations. The Bloomberg US Aggregate Bond Index posted a +5.2% return for the quarter. The 10-year US Treasury yield dropped from 4.48% at the start of the quarter to 3.81% by the end. Short-term rates fell even more sharply, leading to the yield curve’s first positive slope since July 2022, signaling a potential shift toward more normal market conditions.3,4,5

- The market navigated a “growth scare” during the quarter after some surprisingly weak economic data and further signs of cooling in the labor market, including the unemployment rate reaching a cycle high of 4.3%. However, the economy overall continues to persevere, and projections indicate ongoing economic growth in the 3rd quarter. The accommodative policy from the Federal Reserve points to an expanding economy in 2025.6,7

- In September, the Federal Reserve began an easing cycle with a 50 basis points (0.50%) cut to the Federal Funds Rate, the first action by the central bank since its final rate hike to an upper band of 5.50% in July 2023. The rate cut symbolized the shift in the balance of risks for the Fed from bringing inflation down to supporting the cooling labor market. The path of future rate cuts, however, continues to be widely debated.

3rd Quarter 2024 Market Recap and Outlook

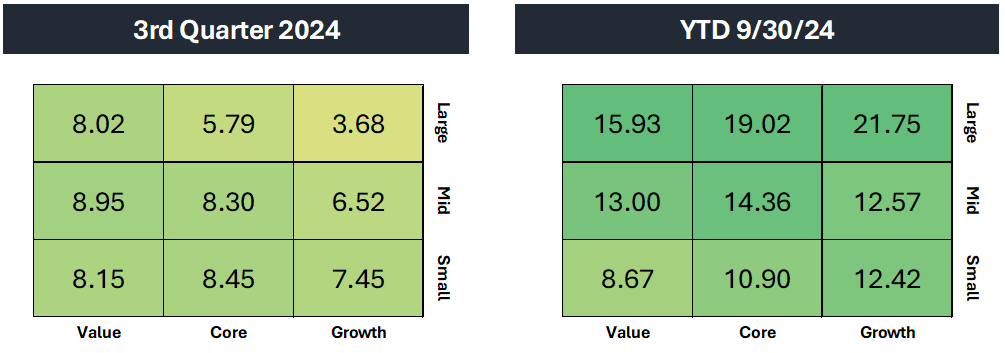

US stocks navigated an August correction and again made multiple new all-time highs, this time led by small-cap and value stocks towards the end of the 3rd quarter. Large-caps also gained although less so and allowed the S&P 500 to surge to a +22.08% return for the first 3 quarters of the year, the best for the 3 quarters of a year since 1997.8

The August correction saw the S&P 500 lose -9.7% over the course of 3 weeks. The downturn started with weak jobs and manufacturing data in the US leading to domestic growth concerns and was compounded by a sudden shift in expectations for monetary policy in Japan. This triggered intense currency market volatility and the unwinding of the “Yen carry trade”, a crowded trade favored within the hedge fund industry. With this event, came a significant risk-off flight to safety which meant a dumping of equities. Growth concerns and the ensuing short-lived panic surrounding Japan caused a quick shift in market sentiment and the narrative on US monetary policy, raising questions about whether the Fed acted too late to cut rates.9

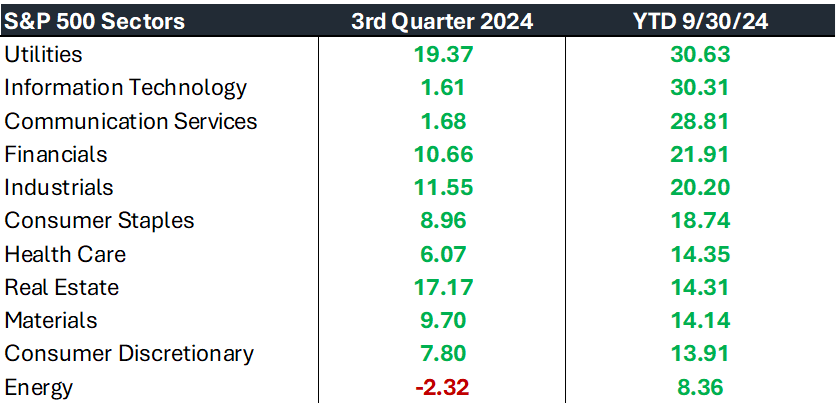

Utilities were the best performing sector for the year through 9/30/24, narrowly better than Technology stocks. Along with the falling rates tailwind, Utilities companies are tangentially benefitting from the Artificial Intelligence (AI) boom that is driving markets due to the massive power demands generated by AI data centers.

The Financials, Real Estate and Industrials sectors were the other leaders during the quarter, adding to the rotation away from Technology and Communication Services stocks which took a breather during the 3 months. Energy stocks were the lone negative performer in the 3rd quarter as commodity prices fell. For the year, 10 out of the 11 economic sectors are producing returns over +13%, with an average return over +20% for those sectors.10

The breadth of the performance was impressive and a positive sign for continuing gains in the market. 78% of S&P 500 constituents gained during the quarter with the average stock outperforming the headline index by 3.7%. Large Value outpaced Large Growth stocks by over 4% during the quarter and narrowed the gap that has persisted throughout 2024 between the two styles.11

International markets were active and ultimately accretive to global equity portfolios during the quarter. In developed markets, the MSCI EAFE was up +7.3%, with broad based strength across Europe and Asia. Japanese stocks lost -17% (in US dollar terms) during the summer correction, with the benchmark Nikkei 225 index diving -12.4% on August 5th, its worst single day since 1987. However, Japanese markets rebounded to finish the quarter positive (in US dollar terms).12

Emerging Markets were up +8.7% on the quarter, spurred by the launch of a substantial Chinese stimulus package which pushed their markets up +23.2% for the quarter. China is now up +28.4% for the year.13

Looking forward, we want to again reiterate our playbook from our outlook at the start of the year; that being that conditions are conducive to equity market strength which has surpassed our optimistic expectations, including these:

- Moderate economic growth buoyed by a strong labor market and consumer.

- A shift to accommodative monetary policy

- Stable interest rates

- Low and falling inflation

- Currency tailwinds

- Tight corporate credit spreads

These conditions have mostly persisted amongst strong earnings growth and markets have likewise followed through with gains. As we begin to craft our outlook for 2025, we are closely watching key events and trends in what should be an eventful last quarter of the year for equity markets, these include:

- Fed policy will continue to shape the macro and market discussion but now with a focus on maintaining strength in the labor market over price stability. Jobs data will be the pivotal signal on the health of the US economy and inflation data will be scrutinized for further evidence that is trending towards its 2% target. The market is currently pricing in 0.25% rate cuts at the 2 remaining meetings this year but the pace and trajectory in 2025 and beyond is a major uncertainty in the market narrative.

- Earnings have been the catalyst for the market’s 2-year rally off the October 2022 lows and Wall Street estimates are calling for growth of +9.4% this year, +14% in 2025 and +13.1% in 2026, which are above average expectations and significant acceleration in corporate productivity. With current valuations also on the high end – the S&P 500 trades at 21.5x the next 12-months earnings – the index is leaving investors with little room for error in the current set up; however, we continue to argue that beneath the headline multiple, which is influenced by a few large companies, the opportunity set is robust.14,15

- US elections in November and other geopolitical risks. While we do not advocate drastic portfolio changes around elections, we expect volatility to pick up this fall as it typically does in election years. Policy uncertainty is a negative for the markets. Globally, armed conflicts continue to present the opportunity for volatility.

As we move into the final stretch of 2024, equity markets are sitting at all-time highs, on the heels of strong breadth in the 3rd quarter and leadership from the underappreciated corners of the markets. Though we continue to view the environment as favorable for risk assets long-term we continue to acknowledge the uncertainty and potential for shifts in sentiment in the coming months.

Fixed Income had a standout quarter as interest rates fell, and the Bloomberg US Aggregate Bond Index posted a +5.2% gain. Outside of the 4th quarter of 2023, this was the best quarter for the broad bond market going back to 1995. The 10-year Treasury yield fell to a low close of 3.63% in mid-September on a variety of factors including continuing disinflation, slower growth expectations and the anticipation of imminent rate cuts by the Federal Reserve and other global central banks.16

In a significant and positive development for bond investors during the quarter, the yield curve normalized on the 10-year Treasury minus 2-year Treasury spread measure, a closely watched indicator of the curve. This normalization means the yield curve is positively sloped (intermediate-term bonds yielding more than short-term bonds) which is a signal of a stabilizing economy and fixed income market.

The drop in short-term yields in anticipation of Fed cuts is largely the catalyst for the steepening but in recent days during the 4th quarter, the intermediate and long-term areas of the curve have continued to move up in yields on better economic data, providing a further steepening yield curve.

Credit spreads briefly ticked up in a flight to quality during the August episode but ultimately corrected and even tightened by the end of the quarter. The Bloomberg US High Yield Bond Index returned +5.28% for the quarter, while higher duration helped Investment Grade Bonds outperform, returning +6.60%. Floating-rate bonds were positive but trailed as current and future rate cuts reduce investor appetite for the structure – the Morningstar LSTA US Leveraged Loan Index returned +2.04% for the quarter.17

Going forward, we expect the Fed to continue to bring monetary policy from restrictive to neutral, but not fully accommodative if the data allows. This would include inflation continuing to trend towards the 2% target; however, keep in mind this will not take place in a straight line down and we expect month-by-month volatility in inflation readings. The Fed’s own forecasts in September did not project that Core PCE inflation will hit 2% until 2026.18 The labor market will also drive the discussion and the magnitude and pace of cuts will depend on the Fed’s confidence in the labor market continuing to balance but not deteriorate to a point of distress.

Rate cut cycles historically bode well for traditional fixed income and we are constructive on deploying capital into the asset class in the new higher interest rate environment. The upcoming decline in the Fed Funds rate encourages investors to move out of the cash and money market holdings that were a safe harbor since the Fed raised rates.

We will continue to engage closely with clients throughout the remainder of 2024, providing these market updates on a quarterly basis is part of our commitment to keeping you informed. Please don’t hesitate to reach out with any questions—whether about the insights shared here or how current market conditions may impact your specific investments with Kavar Capital Partners. We appreciate the trust you place in us and look forward to guiding you through the evolving landscape.

John Nagle, CFA

Footnotes:

- Morningstar Direct Data

- Morningstar Direct Data

- US Treasury https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2024

- Morningstar Direct Data

- Yield curve spread referenced is 10-year minus 2-year Treasury spread

- St. Louis Fed FRED Database https://fred.stlouisfed.org/

- https://www.atlantafed.org/cqer/research/gdpnow

- CME Group FedWatch https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- Morningstar Direct Data

- Morningstar Direct Data

- Morningstar Direct Data

- Morningstar Direct Data

- Morningstar Direct Data

- Yardeni Research https://yardeni.com/charts/yri-earnings-outlook/

- JPMorgan Guide to the Markets as of 9/30/24 https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

- Morningstar Direct Data

- Morningstar Direct Data

- Federal Reserve https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240918.pdf

The views expressed herein are those of John Nagle on October 16th, 2024 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.