Market Update – June 16th, 2022

Good evening,

On May 4th, Federal Reserve Chair Jay Powell stated:

“A 75-basis point increase is not something the committee is actively considering.”

However, enough changed in just 42 days that yesterday, June 15th, the FOMC not only actively considered but put into action a 75-basis point increase, intensifying its attempt to bring down inflation in the most aggressive Fed rate hike since 1994.1

The May inflation report2 surprised the market to the upside and the University of Michigan Consumer Sentiment Survey3 pointed to inflation expectations becoming further embedded into consumers’ psyche. These two data points influenced the Fed to get even more aggressive; even as this aggressiveness works to dampen the broader economic outlook – which the Fed fully acknowledges as they increased their estimates for unemployment and decreased their estimates for economic growth.4

The predicament of the Fed today is that inflation comes from both supply and demand dynamics and the current headline inflationary problems lie mainly on the supply side of the ledger as rising prices have been aggravated by the war in Eastern Europe and sustained supply chain impasses related to the COVID pandemic. In addition, it’s not as if the demand side is easily influenced either, as US consumers continue to burn off the excess stimulus, built-up savings, and pent-up demand from the pandemic.

By raising 75 basis points, the Fed took a step that could either be viewed as ‘prudent’ (they’re getting serious about getting inflation down sooner than later) or ‘panicky’ (they’re getting overaggressive because what they’re doing isn’t working). In the immediate aftermath of the decision and during the Chairman’s press conference markets traded in whipsaw fashion, with stocks ending the day broadly positive.

Nevertheless, the market has seemingly labeled it ‘panicky’, as today, capital markets are further riled by the prospects of an economic slowdown, or even a contraction, heavily caused by tightening central bank policy globally.

Leading up to the meeting this week, as the idea of a 75-basis point hike became the consensus expectation, the yield on the 2-year Treasury continued rising until hitting a near-term high of 3.44% (started the year at 0.73%). The 10-year Treasury hit 3.50% (started the year at 1.51%).5 The shape of the yield curve contorted as well as the 10-year briefly yielded more than the 30-year Treasury for the first time since 2006.6

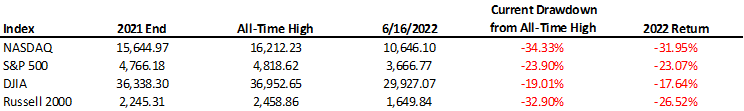

The S&P 500 officially entered a bear market on Monday7 and the major US stock market indices all made new lows for the year today, led again by the Tech-heavy NASDAQ:

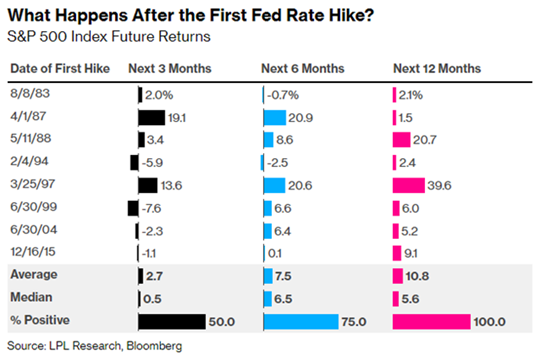

The negativity and uncertainty surrounding the global economy has only intensified throughout the year, throwing fuel on the fire for risk assets. However, it’s important to recall that volatility of this nature is not completely out of the ordinary, and especially so in the times around Fed rate hike cycles. During past Fed rate hike cycles, stocks have taken time to reorient valuations and expectations, often experiencing volatility and weakness before resolving:

In light of this ongoing volatility, we reiterate the plan of action in the challenging market environment below:

- Manage for the short-term and invest for the long-term:

The market is going through a major re-evaluation of valuation (the price investors pay) and fundamentals (the cash flows investors receive). The valuation reset in light of higher rates has mainly taken place, the S&P 500 is currently trading below it’s 25-year average on a forward price-to-earning basis.8

The question now is how much of the fundamentals may be compromised by the second order effects of tighter monetary policy, namely a slower-growing or contracting economy. The market is taking time to sift through this outlook but the sentiment is overwhelmingly negative right now and is furthering weakness.

Therefore, as the market sorts out this uncertainty and prices in some level of economic distress, maintain an adequate amount of reserves for short-term needs (if necessary) while taking advantage of the dislocation and indiscriminate selling with long-term capital.

2. Migrate to High Quality:

In the persisting macro environment with an increasing possibility of a slow-down, quality remains paramount. Migrating to high quality in fixed income means moving into investment-grade credit exposure and into liquidity (out of junk credit and illiquidity). And given the move up in the yield, return expectations for these investments are better now than they have been in years. The need to stretch for yield has diminished somewhat. Migrating to quality in equities means identifying opportunities that provide a margin of safety, through cheaper valuations, durable business models, and strong balance sheets.

3. Tax-Loss Swapping

In taxable accounts, the sell-off provides an opening to harvest tax losses in assets that have declined in value. While it’s never enjoyable to sell something for less than it was purchased for, it’s an unavoidable aspect of investing and the benefit of booking a loss to offset futures gains with the ability to re-invest the dollars, can be incrementally positive to after-tax returns

4. Favor ‘Value’ Equity Allocations but Don’t Give Up on ‘Growth’

Value stocks have continued to outperform relative to Growth stocks this year as rising rates have hammered valuations. In the current market environment, Value stocks would logically outperform, and we believe will continue to do so, thus tactically an emphasis should remain there. But also stay diligent on the Growth side. The decimation of Growth stocks has also logically opened up opportunities for some areas of the market that were too frothy for consideration before this valuation reset. We aim to maintain balance between the two styles to cover the entire market spectrum in order to fully capture the potential recovery.

Please reach out to any member of the Kavar team with questions or concerns, we look forward to connecting with you directly in regard to your personal portfolios and circumstances.

John Nagle

Footnotes:

- CNBC https://www.cnbc.com/2022/06/15/fed-hikes-its-benchmark-interest-rate-by-three-quarters-of-a-point-the-biggest-increase-since-1994.html

- CNBC https://www.cnbc.com/2022/06/10/consumer-price-index-may-2022.html

- CNBC https://www.cnbc.com/2022/06/16/this-inflation-indicator-shook-the-fed-and-caused-it-to-get-more-aggressive.html

- Federal Reserve https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20220615.pdf

- Bloomberg Market Data

- Bloomberg Market Data

- As defined by a 20% drop from closing high to closing low WSJ https://www.wsj.com/articles/global-stocks-markets-dow-update-06-13-2022-11655088638

- JPMorgan Guide to the Markets as of 6/15/2022 https://am.jpmorgan.com/content/dam/jpm-am-aem/americas/us/en/insights/market-insights/guide-to-the-markets/daily/protected/mi-daily-gtm-us.pdf

The views expressed herein are those of John Nagle on June 16, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.