Be Curious, Not Judgmental

By: Douglas G. Ciocca

After a fantastic finish to 20211, US stock markets have stumbled to start the new year. As of this writing, all major indices are lower after 2 weeks of trading in ‘22 and the resounding rationale regularly references:

- Covid persistency

- Interest rate elevation/Federal Reserve strategy shifts/Incipient inflation

- Political infighting/instability

Our Investment Committee at Kavar Capital has spent time ruminating on these matters as well as developing some themes for the 2022 trading year.

Below, in Q&A form, I offer some insights as to where we see opportunities, why we espouse optimism and what it is about Ted Lasso that provides perspective.

How does Covid factor into your investment plans/decisions/allocation?

It really doesn’t. It is now so ubiquitous that it is more of a constant and less of a variable. If anything, it confirms our distaste for low margin, highly debt-laden businesses that lack pricing power for our individual stock portfolios. But we were so encouraged by the economic resiliency displayed in the first few rounds of Covid that it gives us confidence in the ability of companies to persevere in the face of significant adversity.

What is catalyzing the high volatility that we’re seeing to start the year?

Certainly, angst about interest rates.

We always think it is interesting when portfolio managers refer to an out of favor asset class or unexplainable selling pressure as being “technical” in nature……but perhaps there is some “window undressing” going on – if that is a thing – where portfolio managers are dumping some winners as opposed to adding them as they were going into the end of the year.

And it also isn’t a bad time for a breather after 3 good market years of returns.

Are we worried about the Fed overdoing the rate hikes?

Do we really think that the Fed will overdue rate hikes? To this point, they have been far too accommodative, and the balance sheet is far too big but are we really concerned about structural demand depression? We’re not.

Competition is way too quick to come to market. Supply lines, once unkinked, are far too disparate to be depleted. Consumer demand is incredibly strong and gainfully employed people, who are the primary consumers, are feeling flush.

Can you give me an example of when the Fed has exhibited proactivity or issued a pre-emptive strike? I can’t. By virtue of being data driven, it takes that off the table, yet for some reason investors expect them to be so, when we think the absolute very best we can hope for is a soft landing.

If the Fed is not buffering the downside….then what/who is?

Doesn’t it always come back to the 4 factors that comprise stock returns?

- Earnings growth

- Dividends

- Inflation

- Multiple expansion/contraction

Dividends as a whole have increased 6.83% annualized from 2017-20212

When the Fed is in a tightening posture, there is likely to be no multiple expansion, so we think in our individual stock portfolios, you should favor better than average earnings growers (which imputes the absence of high debt levels), those that pay dividends and have a moat of competitive protection wide and deep enough to pass along higher input prices to their customers.

Are you surprised by the market’s near-term volatility?

We are referring to this early bout of price dislocation as having an anti-Ted Lasso effect…..

Seeing what’s been happening in the market so far this year reminds me a ton of a scene in the first season of this Apple TV smash hit. It is when Ted is playing darts and suggests that his opponent should heed the famous words of Walt Whitman and: “be curious, not judgmental.”

Well, that is exactly the opposite of what the market seems to do. It has historically been a collection of investors who: fire, ready, aim……and I think that is the worst approach for this market.

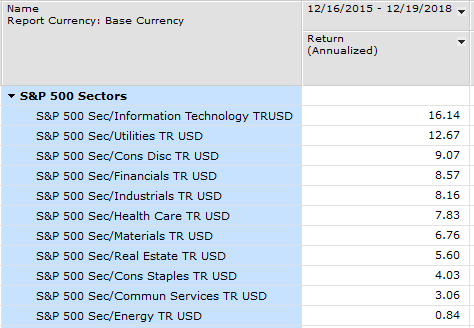

But, if you were a curious investor, you might ask: what was the best performing industry sector in the last tightening cycle?

And, If you were a curious investor…you might ask: what were the best performing assets classes during the last liquidity extraction?

A judgmental investor is making an impatient determination that a great unwind must be forthcoming because we are transitioning away from the easiest money environment of all time. We just don’t think the Fed will be so disruptive to corporate prosperity as to warrant some bleak prognostication…..particularly when we anticipate earnings to indicate otherwise.

Should there be a recalibration of valuation? You bet. Is it possible that active management and mean reversion could be beneficial in this type of environment? You bet.

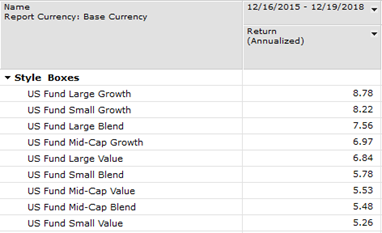

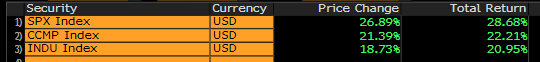

What is instructive is that during the last tightening cycle – when the Fed raised rates 9 times, undertook a balance sheet reduction AND the 10yr went from roughly 2.4% to 3.2%, the leading sector in the S&P 500: Tech…but all 10 sectors were higher3. US Large Growth was the best performer in the 9 style boxes but held an annualized spread over the worst performer, also positive, by only 3.5%. So a pretty tightly correlated ascendency4.

Look, there were certain areas in the market that embodied the speculative fervor that is attendant to later-cycle insanity – SPACs, memes., crypto…..the high multiple (often multiples of sales not EVEN earnings), high growth, platform stocks. They are being re-rated by the market. There is also a re-rating of multiples taking place for certain areas of Technology like cloud, SaaS, EV, some biotech, space, etc. that investors flocked too during 2020 and we think that is justified as well.

What impact do politics play in these markets?

We have always felt that financial markets need access to capital and confidence to function properly…if not prosperously.

What is taking place in DC right now, inspires no confidence whatsoever and, and at the margin, could elevate a contentedness to sit things out. This is, as you’d likely suspect, may be good for markets as it is just another level on the wall of worry that the market needs to climb and that has some contrarian benefits to it.

With Powell’s Congressional testimony last week, the bickering of the Build Back Better bill, the absence of any significant tax law – income, cap gains or estate tax – changes, the gridlocked nature of Washington keeps it largely out of industry and that is more good than bad in our opinion.

What are your Themes for 2022?

- International monetary policy nonconformity.

- Recovery speeds are alternating around the world, necessitating different policy postures. There will be organic opportunities for direct investments into certain countries and also inorganic, or currency motivated moves to be made in others.

- Mean Reversion…finally re: international and value stocks – will they have their day in the sun!?

- After years (well, it’s over a decade for international investments) and almost as long for value stocks, the expected returns may finally be @ levels conducive to elevated portfolio weights.

- Enduring Hunt for Hedges – multiple options for the best defense against inflation.

- This is the high conviction, high ambiguity theme! Commodities, crypto, TIPS, cyclicals, cash…..a combo? This is what is on most on investors’ minds and could be more so after last week’s CPI number. The instinct has seemingly been to sell and sit it out and if you think about it, that is a strategy to preserve principal but not purchasing power. Challenges are persistent in this area.

Therefore, we think that investors should straddle the line between cyclical and defensive areas of the stock market – we feel confident that: rates are going to go up but not by an unwieldy amount, the economy is going to keep growing and inflation will end up being more manageable than the worst-case scenario.

Within fixed income, incorporate complements and extensions from the benchmark to preserve purchasing power – floating rates, foreign fixed income, converts, diversified collateral.

We look forward to keeping in close touch as we move through 2022….if the first 2 weeks are any indication, there will likely be lots to discuss.

The views expressed herein are those of Doug Ciocca on January 17th, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.

Footnotes:

1 Source: Bloomberg Market Data

2 Source: Morningstar Direct

3 Source: Morningstar Direct

4 Source: Morningstar Direct