Market Update – April 24th, 2022

Written by: Doug Ciocca

Last week started out reasonably strong for US stock markets and reasonably quiet for the bond market. In fact, we saw consecutive triple digits gains on Tuesday and Wednesday and a pop of over 300 points in the Dow Jones Industrial Average on Thursday morning1. The catalysts: strong earnings reports from bellwether consumer staples and healthcare companies as well as speculation from several large money managers that the recent increase in interest rates fully reflected the Fed’s upcoming actions.

However, by noon Thursday, sentiment had turned sour. Investors were fixated on 2 items: 1. Federal Reserve Chairman, Jay Powell, in a roundtable interview with other influential, international monetary policy makers, stated that raising interest rates by ½ of 1% at the next Fed meeting (5/4) would likely be appropriate2; and 2. St. Louis Fed President, James Bullard, who’s never met a microphone he didn’t slobber over, suggested he, “wouldn’t rule out…” a hike of 0.75% in the Fed Funds rate at the same meeting3.

There is no doubt about the Fed raising interest rates this year – the direction has been telegraphed and their communique transparent. And frankly, given the inflationary pressures and the underlying strength of the economy, it is desperately necessary. It is the pace of hiking, not its need, that has been debated by investors.

These statements set off a recalibration of the tightening trajectory of monetary policy, and the ensuing adverse economic consequences thereof. For a market whose sentiment could, at best, be described as delicate, this 1-2 punch hobbled the indices for the last day and ½ of trading.

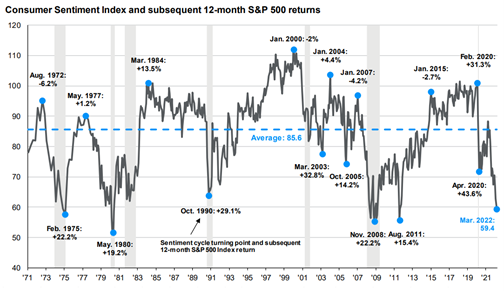

To put this “sentiment” measure into perspective, see the graph below. Quite interestingly, investors’ outlook is more somber now than at the low points of the pandemic in 2020. Going back even further, when the disposition of the investor is this decrepit, it has consistently presaged positive periods for the S&P 500.

So how to best invest in this environment and capitalize on spikes in volatility? We think the following 4 prong-plan is prudent and is what we are endeavoring upon in our clients’ accounts.

- Manage for the short-term & invest for the long-term. This is a theme on which we have harped since the pandemic began. While our confidence is high that the high level of price dislocation will abate, the timing of such is ambiguous and it can stick around well past its point of emotional expiration. Therefore, maintain a healthy amount of reserve capital out of the path of fluctuation. Doing so can unburden your assets that are aligned for longer-term growth and income production and allow them to navigate periods of intense volatility by either staying the course or realigning opportunistically.

- Migrate to High Quality. For years there has been a widely circulated acronym on Wall Street relating to asset allocation decisions: T.I.N.A. (There Is No Alternative) to equities. Due to the persistently anemic yields on fixed income investments, it was challenging to find consistent contributors to a portfolio’s total return in the bond market. This has changed. Quickly. Just last week, the US Treasury bond market offered positive real yields (interest rate minus inflation) for the first time in 3 years4. And this is for “risk-free” collateral. All other fixed income assets price off of comparable-maturity Treasuries and thereby present additional spread/appeal. There is now less need to embrace riskier sources of income generation in pursuit of income and principal protection needs. Shading the bond portion higher along the quality spectrum is critical considering this evolution.

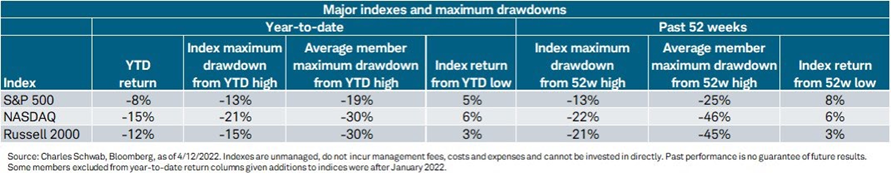

Regarding the stock pieces of your allocation pie, it is undeniable that, broadly, both good companies and poor companies are being treated as bad stocks. There has been, in my opinion, indiscriminate selling this year (see table below for support of this statement: the average stock in the Nasdaq is down almost 50% from its 52-week high and the average stock in the S&P 500 is down 25% from its 52-week high….and this was before last week!). When such a situation exists, it presents the prospect to trade into companies or asset classes that may have seemed expensive or unaffordable beforehand. Think of this as you would the housing market – patience in the pursuit of the ideal home or neighborhood can be rewarded when a cycle turns.

So, in many respects, we may be in the vey best kind of decline – one that offers attractive entry points to better achieve our long-term total return targets and doing so with assets of extremely high quality.

- Tax-Loss Swapping. This is beneficial only for non-retirement accounts and can be a source of optimization in the downstream impacts of portfolio management. As mentioned above, given the high correlation amongst asset classes this year (both stocks and bonds losing value) the implementation of a quality overhaul can produce capital losses that can be useful in offsetting future gains. I completely understand this thought you may be having: “…it is awful to lose money.” Agree. And/or, “…it is not a loss if I don’t sell.” Don’t necessarily agree. If an investment falls below its purchase price, we have the option be patient for it to turnaround and recover, or we can sell it and redeploy the proceeds into an alternative perceived to have equal or better prospects to reach and ultimately exceed its initial value. Put this into the category of a silver-lining strategy, but one from which you can be a beneficiary as markets recover.

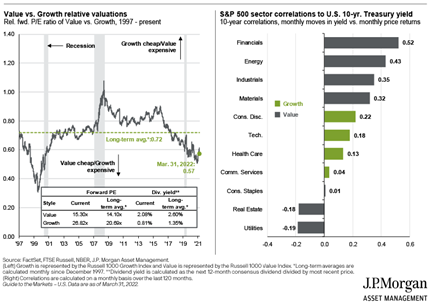

- Favor “Value” Equity Allocations but Don’t Give Up on “Growth”. Much has been written of the tendency for Value stocks to outperform their Growth counterparts in a market environment where rates are rising. Through the first quarter of 2022, only 2 sectors produced positive returns: Energy and Utilities5. Both are prototypical Value sectors. We suspect this may play out for a while – not in those sectors solely, but in sectors that have historically occupied the Value camp – as the will of the Fed and the impact of inflation becomes embedded in valuations.

Below are 2 great illustrations from JP Morgan that consider the valuation and interest rate backdrops that support a tilt toward Value. It is a tilt that we are embracing. Mean reverting trends are powerful in investing and they typically possess a catalyst. The course reversal in monetary policy as well as long-run valuation disparity are strong enough together to be such a catalyst.

This will in no way lead us to eliminate Growth from client accounts as many prototypical Growth sectors, notably Technology & Healthcare, are driving substantial changes in commerce, communication and well-being, and we think exposure to such transformational initiatives will put investors in the path of participation in an elongated profit cycle. The shift this year will be subtle but not inconsequential.

We often communicate with clients in this format when markets exhibit negative behavior, and we feel compelled to offer perspective. This submission, however, is more prescriptive and practical from the standpoint of evoking broader action in light of the circumstances.

We look forward to connecting with you directly with any question you may have relating to your personal portfolios and goals and please do not hesitate to reach out to me or any member of the Kavar team in that regard.

Have a very nice evening! dc

1Source: Bloomberg Market Data

2https://www.cnbc.com/2022/04/21/powell-says-taming-inflation-absolutely-essential-and-50-basis-point-hike-on-the-table-for-may.html

3https://markets.businessinsider.com/news/stocks/fed-james-bullard-rate-hike-inflation-too-high-economic-outlook-2022-4

4https://www.barrons.com/articles/treasuries-real-yield-stocks-inflation-51650404673

5Source: Bloomberg Market Data

The views expressed herein are those of Doug Ciocca on April 24, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.