Market Update – February 8, 2018

I had hoped that Monday’s note would be the sole piece of general communication from our offices this week, but the market reminded me that: #1 Hope is not a strategy and; #2 It is always in charge!

All of the domestic and foreign stock indices experienced pretty steep declines today, bringing the drop from the top to almost exactly 10% for the both the S&P 500 and the Dow Jones Industrial Average.

A 10% pull-back from a prior period high in an index is known as a “correction”. This is a technical reference for when a market “corrects an overshoot and returns prices to their long-term trend.”1

Recently, the term “correction” has been (somewhat oxymoronically) connected in the financial press with the term, “healthy”…..see below for a sampling:

Fed’s Kaplan says market correction healthy, sees no economic impact – Rueters

Ex-ECB President Trichet Says Stocks Needed ‘Healthy Correction’ – Bloomberg

Stock Market Slump Looking More Like a Healthy Correction – Nasdaq

I believe that is a sensible characterization. Insomuch as stocks, like any asset, need to periodically offer entry points with attractive expected rates of return or they would price themselves out of affordability….ultimately reducing demand and causing violent price adjustments. So, sure, a pullback of some materiality may actually be healthy. It just doesn’t feel like it at the time.

Therefore, the search for attribution is ongoing.

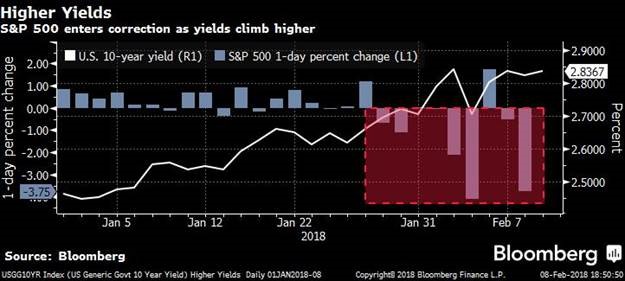

Much of the correction is being blamed on the lift in bond yields as a proxy for interest rates (see below from Bloomberg Market Data). Undoubtedly, they have seen a decent move from their lows of early this year.

This did not really sneak up on anyone though, considering that the Federal Reserve Bank has raised interest rates 5 times in 15 months and is telegraphing that @ least 3 or 4 more are likely this year.

The prospect of higher interest rates can alter the cash flow generating prospects for public companies if more of their revenue is used to repay debt vs. kicking out dividends or reinvesting in their businesses, so some concern is valid as to the sustainability of current valuations.

Thankfully, in general, public companies are seeing elevations in their profitability that exceed any increase in their cost of capital.

In addition to better-than-expected growth in 2017, company guidance and analyst estimates for 2018, 2019 and beyond were ratcheted up throughout last year and the forecasted growth rate for 2018 stands at a staggering 21.4% which would be near the best year-over-year growth since 2011.2

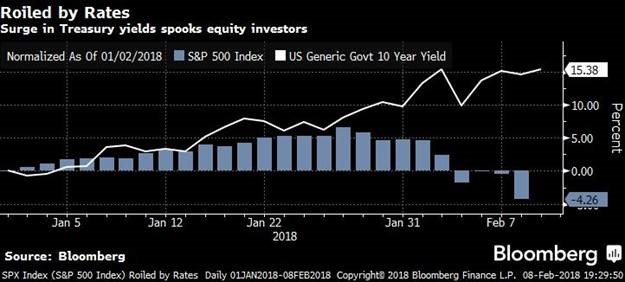

I also think investors have been spooked by the recent correlations of asset classes (namely stocks and bonds) and the lack of a perceived safe-haven in markets. As the chart below (from Bloomberg Market Data) indicates, the idea that there is no place to hide, has incented to people to exit the market altogether.

In fact, just this afternoon, Lipper reported outflows $23.9 Billion dollars of mutual funds and exchange-traded-funds (ETFs) over the last week, ending yesterday. That is a record redemption for 1 week.

It is very clear that fear is today’s predominant market emotion!

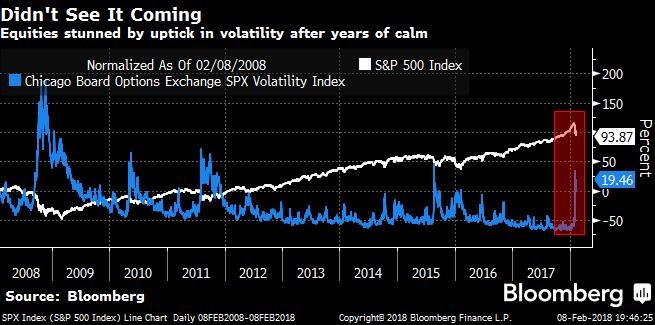

And fear, and fear of fear itself, decidedly influences market behavior – it is the embodiment of volatility.

Such volatility has been absent for quite some time, so its reemergence could not help but be a little destabilizing (as depicted below from Bloomberg Market Data):

By no means should this be considered an exhaustive list of “issues” with the market that have conspired to bring us this correction. You may go online tonight and read about the unwinding of risk-parity program trades or poorly sponsored Treasury auctions, among other things, and they likely deserve some of the credit (or is it blame?) as well.

The market had an incredibly strong start to the year and has unfortunately given that back. Undoubtedly the performance pendulum will swing sporadically throughout the year, as I find it likely that volatility will stay with us for a while.

The key to navigating any market environment successfully is staying committed to the long-term goals and objectives of your portfolio and also, I think, staying optimistic.

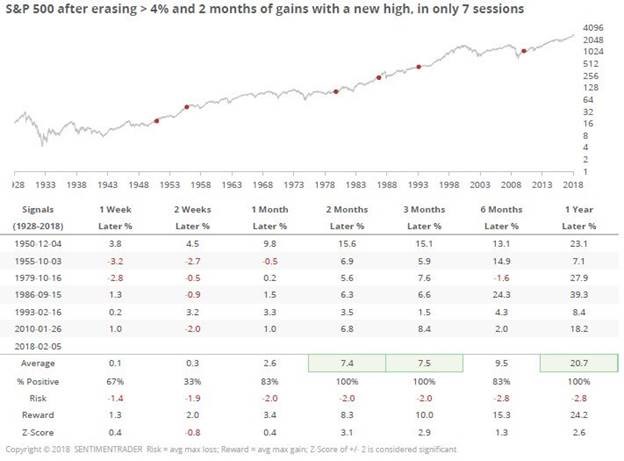

On that note, while the chart below is in no way making a prediction, it is an interesting one with which to close this update.

In each of the 6 prior periods when the S&P 500 erased gains of greater than 4% (spanning 2 months and hitting a new high) in only 7 trading sessions, (basically where we now stand), it recovered and grew over the next 2 months, 3 months, 12 months (and in 5 of 6 6-month periods).

We’ll keep in touch.

1https://twitter.com/michaelsantoli/status/961654490557566978

2 Source: S&P Capital IQ

The views expressed herein are those of Doug Ciocca on February 8, 2018 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.