Market Update – July 1st, 2022

Good afternoon and I hope you have a fun July 4th weekend ahead of you!

Our customary quarterly update will hit your e-mailboxes next week, but I wanted to check in quickly ahead of the holiday.

The second quarter was one we were happy to push past. It was notable for many reasons related to the capital markets: persistently high intraday price fluctuations, interest rate elevations, ongoing adverse economic impacts of “externalities” (Eastern European conflict and China’s COVID lock-in) and ad nauseum negotiations as to whether the economy is/has/will/may/could enter a recession.

There are many aspects to this argument, and they literally start with the actual definition of a recession. Forever, a recession was defined as 2 consecutive quarters of negative GDP (Gross Domestic Product). Well, that has changed. Currently, the data dogs from the National Bureau of Economic Research (NBER) who are tasked with pinpointing the inflection points of an economic cycle define a recession as: “…..a significant decline in activity spread across the economy, lasting more than a few months, visible in industrial production, employment, real income, and wholesale-retail trade1.”

So in the words of many a US toddler are careening across our country in the next couple days: “Are we there yet?”

And in the response of many a perplexed parent navigating without a reliable GPS: “I’m not sure.”

Certainly, there are signs of the US economy slowing. We received several data points to that affect just this week. Keep in mind, that is the goal of the Federal Reserve Bank (the Fed) – to slow the pace of price appreciation (inflation) so that the economy does not overheat. They are directly intending to destroy demand by injecting impediments to consumption.

Inflation needs slowing. Validation of that statement is everywhere: home prices, gas prices, food prices, healthcare cost, etc., etc., etc.

The big fear manifested in the capital markets however is that they do their job “so well” that the economy does not just slow, but it shrinks. It is a fine line between cooling and contracting the economy and investors are expressing nervousness in the Fed’s ability to stick the proverbial landing.

So going into this celebratory weekend of our incredible country, I am offering some points of optimism (by no means an exhaustive list) that the efforts of the Fed have shown initial efficacy…that prices in certain areas have come in a bit and that expectations (often fulfilled) are lining up with a less inflationary future. I’ll do so by excerpting some charts and data from Charlie Bilello, a reliable research partner2.

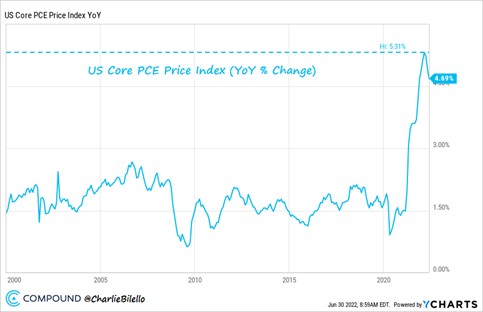

“The Fed’s “preferred measure of inflation” (Core PCE Price Index, which excludes Food & Energy) has now shown a decline in the year-over-year inflation rate for 3 consecutive months, moving from a high of 5.3% down to 4.7%.

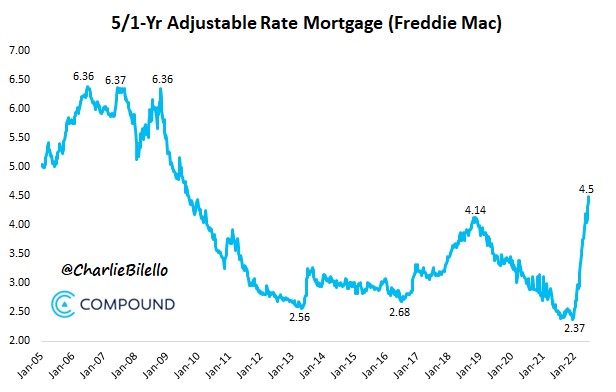

“The end of the easy money era has led to a rapid repricing of risk across all markets but is perhaps most notable in the mortgage market. After hitting an all-time low of 2.37% just 6 months ago, Adjustable-Rate Mortgages in the US are now at 4.50%, their highest level since 2009.”

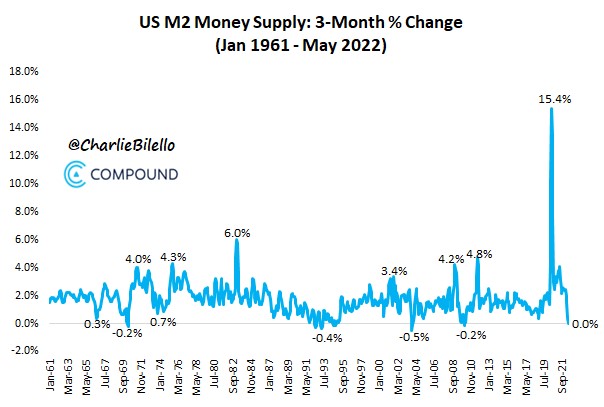

“The money supply growth has flatlined over the last 3 months, the first time we’ve seen that happen in over a decade. With the Fed just starting its balance sheet reduction, this trend should continue in the coming months.”

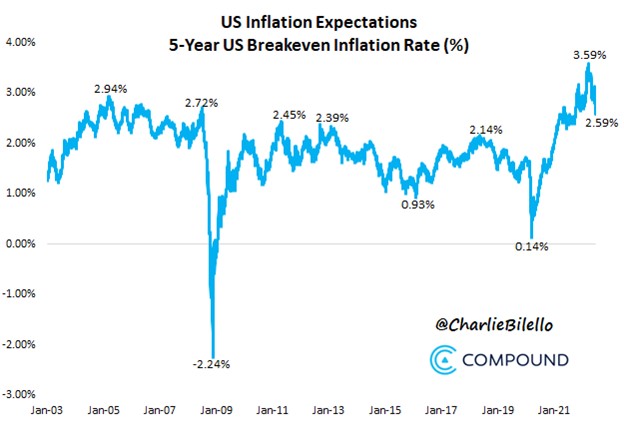

“Another positive development has been the downward trend in market-based inflation expectations. 5-year breakevens are now at 2.59%, their lowest levels of the year and down a full percentage point from the peak in March (3.59%).”

All of us @ Kavar Capital Partners wish you and your families a wonderful Independence Day Weekend! God Bless America! dc

The views expressed herein are those of Doug Ciocca on July 1st, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.

1 https://www.nber.org/business-cycle-dating-procedure-frequently-asked-questions

2 https://compoundadvisors.com/2022/7-chart-thursday-6-30-22