Market Update – July 9th, 2023

The first half of 2023 for the financial markets was defined more by questions than answers:

- When will the Fed be done raising interest rates?

- Are we going into a recession?

- Is the stock market’s strength sustainable on the backs of so few companies?

- What is the best way to play A.I. (artificial intelligence)?

- Should I move cash out of my bank?

These are all excellent points for consideration and are all, in some form or fashion, interconnected. They underscore the intellectual curiosity critical to making informed decisions on the meanderings of markets.

We’ve written for years that markets are nothing more than an abstraction (something nonspecific, a concept that is not concrete) that reflect the current collective will of the participants and pivot on 2 axes: economic growth (or shrinkage) and access to capital. When either is too abundant, prices rise, valuations expand, and greed becomes the predominant emotion. When either is scarce, prices fall, valuations contract and fear replaces greed. Mean reversion lurks at the inflection points and contrarian behavior tends to be rewarded.

In that regard, an asset allocator will look to tactically rebalance portfolios in areas offering the best opportunities….effectively employing anticipatory behavior to capture cycle turns in the belief that the steepest part of any market move occurs @ its onset.

Market cycles historically tend to “follow the Fed.” As the interest rate setting body in the US (and some would say the world) our Federal Reserve Bank modifies the cost and availability of capital to heavily influence the growing or slowing of the economy.

Having raised interest rates 10 times in 15 months (the sharpest bunching of hikes in over 40 years) one would think that its impact would have been immense, if not immediate, in cooling the economy. Yet it has been neither furious nor fast!

Most gauges of economic growth have sustained. Most indicators of high employment have endured. Most statistics on inflation have been sticky.

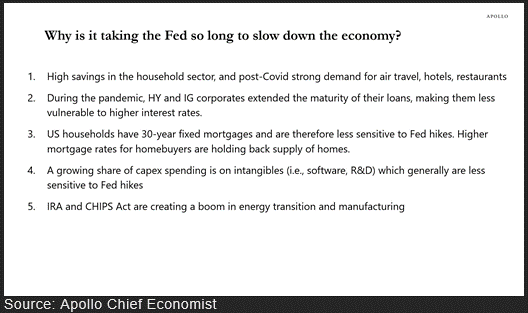

Which, for us, begs the ultimate question of 2023: Why is it taking the Fed so long to slow down the economy?

Ok, so a shout-out to Apollo Global Management and their economics team, as they also asked, and answered, the question for us in a Twitter post last week!

Anecdotally it is difficult to refute the first bullet point. Having spent time in Las Vegas, Los Angeles, and Boston in the last 2 months, I have been stunned by the packed planes, full restaurants and overall expense of lodging. Whether this is pent-up pandemic pressure or a benefit of remote employment, demand is undeniable.

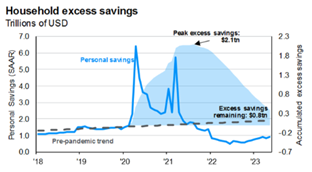

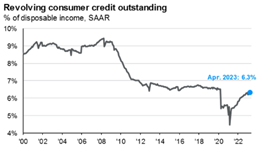

Its perpetuation is what we question as excess savings are now below pre-pandemic trends and consumer credit levels have begun to creep higher. See below:

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

#2 is an important point but one that will eventually approach the end of its shelf-life. Similar to a homeowner who refinanced their mortgage (referenced in the first sentence of point #3), the finance heads of corporations took advantage of low interest rates, courtesy of Covid, to lock in financing costs @ historically low levels. That helped to control expenses and allowed more of each dollar of sales to hit the bottom line…enhancing profitablity.

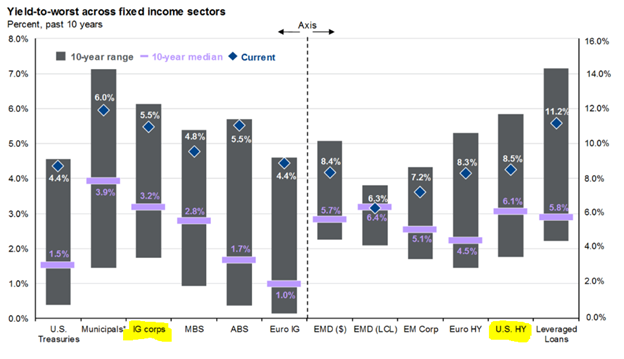

As indicated in the accompanying chart, yields on HY (high yield) and IG (investment grade) bonds have moved off their lows and should the need for refinancing exist to replace called or maturing issues, the prevailing terms will be much less favorable.

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Keep in mind, importantly, that for a balanced portfolio that includes an allocation to fixed income (bonds), the higher rates equate to greater levels of cash flow for the investors as a lender….a welcome modification after years of anemic yields.

Point 4 &5 are compelling but also a smidge contradictory. Undeniably as more of the global economy continues to be service, technology and finance based, the need for an incremental unit of capital to generate an equal unit of output declines. In essence, the scale-benefits of economic growth are greatly enhanced by productivity. Productivity is fundamentally infinite and therefore not subject to the supply and demand dynamics for scarce tangible items like plant, property and equipment.

However, when the fiscal stars align and create cool acronyms like: IRA (Inflation Reduction Act) and even cooler initiatives like the CHIPS and Science Act (informally the CHIPS Act) then the volume of committed capital can offset the marginal cost elevation and promote economic growth at a pace that exceeds the monetary policy drags of the Fed.

(The Inflation Reduction Act of 2022 (IRA), signed into law on August 16, 2022, directs new federal spending toward reducing carbon emissions, lowering healthcare costs, funding the Internal Revenue Service, and improving taxpayer compliance.1

The CHIPS Act’s $52.7 billion investment in domestic semiconductor manufacturing (see table 1) aims to fulfill three main objectives: 1) reduce the likelihood that shocks abroad might disrupt the supply of chips, 2) boost American international economic competitiveness and create domestic jobs, and 3) protect semiconductors from being sabotaged in the manufacturing process.2)

So yes, these 5 bullet points answer our question. And yes, the Fed’s steadfast determination to slow the economy may result in another rate hike or 2 this year. Because yes, our multi-faceted economy simultaneously exhibits resiliency and susceptibility as it approaches its flex point.

There will be many more questions in the second half of 2023, of that I am certain. I am also certain that we will consider them closely as we reflect the answers in our client portfolios.

Have a great night and thank you for your confidence in Kavar Capital.

The views expressed herein are those of Doug Ciocca on July 9th, 2023 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.