Market Update – May 25th, 2023

The Debt Ceiling crisis has intensified to a boiling point as government officials have failed to make meaningful progress towards an agreement in the latest display of dysfunction in the Nation’s Capital. In multiple ways, this “crisis” is completely self-inflicted and something that shouldn’t be a crisis to begin with — the Debt Ceiling has been raised 78 times since 19601, usually without fanfare, under both Democrat and Republican leadership. But with a split congress, the political brinkmanship has returned with little regard to the implications of toying with the United States creditworthiness.

We have fielded a lot of questions on the topic and while the stock market has remained somewhat calm, the bond market is forecasting some near-term nervousness.

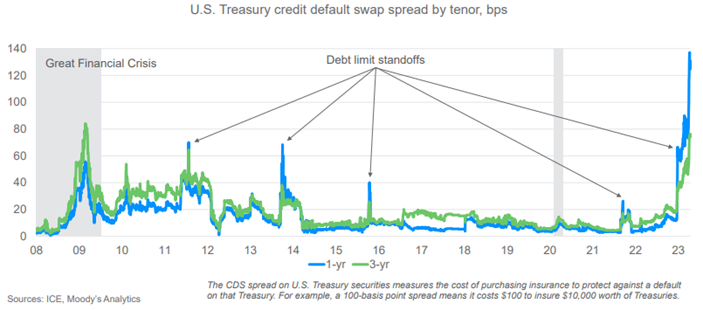

Credit Default Swap (CDS) spreads, a measure of the cost of insurance against a default by a borrower, for United States government bonds have risen from 15.23 basis points at the end of 2022 to 159.77 basis points as of 5/23/23 – a substantial move and significantly higher than prior debt ceiling debates2.

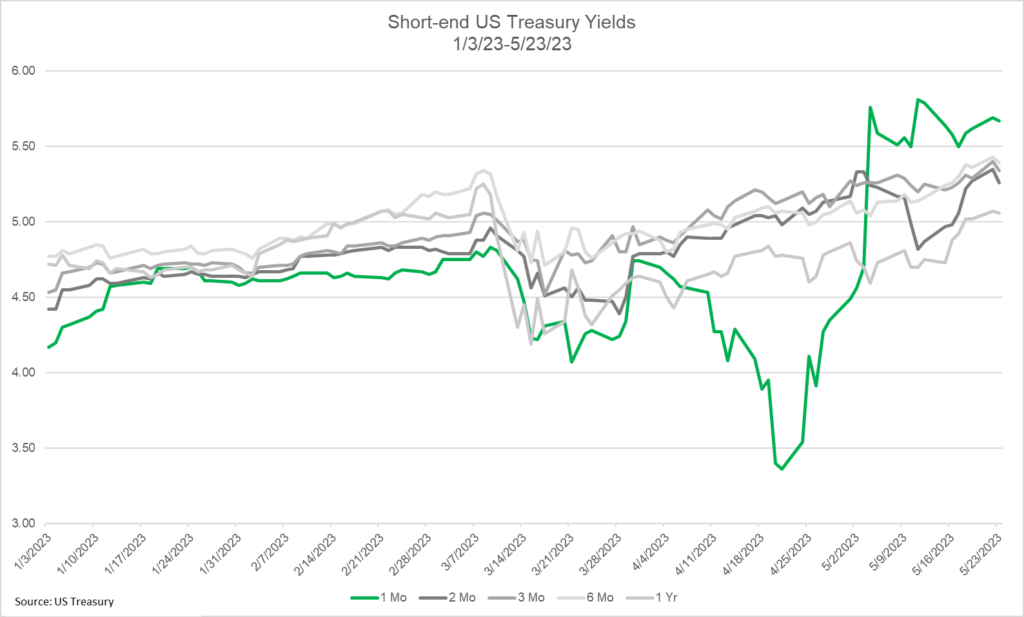

In addition, the very short-end of the US Treasury curve has exhibited skittishness over the looming deadlines. The 1-month US Treasury yield spiked, decoupling from its relationship with other short maturity Treasuries3. Looking deeper into the T-bill market we see apprehension towards holding maturities around the presumed X-date (when the Treasury would run out of funds to pay current obligations). T-bills maturing on June 1st and June 6th are yielding close to 7% while T-bills maturing on May 31st are yielding less than 3%; a clear line of demarcation4.

What is the Debt Ceiling?

The Debt Ceiling is a legislative mechanism that limits the absolute amount of debt that can be issued by the US Treasury. It theoretically maintains some restraint on Congressional spending. However, its contributions to fiscal discipline in Congress are often outweighed by its potential to be a highly disruptive fiscal hazard from time to time.

Since the Federal budget operates in a deficit it must regularly borrow to meet its obligations. When they get close to the ceiling, there becomes uncertainty around the government’s ability to meet those obligations as they are precluded from selling more bonds.

The Debt Ceiling as it is currently constructed was enacted in 1917 to allow for the Treasury to issue debt more easily during World War I without Congressional approval each time. The US is 1 of only 2 countries to even have a Debt Ceiling tied to an absolute amount of debt (Denmark being the other). The current debt ceiling is $31.4 Trillion as of January 19th, 2023 and it was last raised by $2.5 trillion in 2021.5

The US technically hit the Debt Ceiling on January 19th, 2023 and the Treasury Department began using ‘extraordinary measures’ to meet its obligations. Treasury Secretary Janet Yellen has most recently stated that the US may exhaust these measures to satisfy its obligations as early as June 1st, 2023 a.k.a. the “X-date.”6 Estimates vary on the X-date where Treasury runs out of cash. Moody’s estimates a June 8th, 2023 X-date, as an example7. And there are arguments that Treasury can make it well into summer with some maneuvering – it’s a moving target with a lot of variables. Regardless of the specific, drop-dead X-date is, it’s coming.

Nearly everybody agrees that fiscal discipline is important for the government but the Debt Ceiling itself is mostly a pointless method of enforcing that discipline. The reason is simple: the spending is already approved and at a later date the debt ceiling blocks the actual paying for the spending. It’s like going out to dinner, eating your meal and then refusing to pay for it even though you have a wallet full of cash and credit cards – it doesn’t make sense – and everybody in the restaurant would think you’re a deadbeat.

Prior Debt Ceiling Episodes

Similar episodes have happened many times before with each time resulting in the debt ceiling being raised. Recent examples that are being frequently revisited are 2011 and 2013.

In 2011 the debt ceiling debate went right up until days before the X-date and markets declined around it. The S&P 500 dropped -18.6% from 4/30/11 to 10/3/11.8 However, it’s important to recall the challenging investment environment within which this debate occurred. 2011 included a full-blown European debt crisis, double dip recession fears, sticky high unemployment, the Arab Spring, etc. The economy, markets and investor psyche were all very fragile at that point in history coming out of the Global Financial Crisis. The market bottomed after the Debt Ceiling crisis was resolved, largely led down by Greece default fears and the rest of the European Debt Crisis. That’s not to say we are in calm waters today in the market; this market presents it own unique set of global risks (and that is an argument for Government officials to take the situation that much more seriously).

The biggest direct impact for US markets in 2011 was the downgrade of Treasuries by Standard and Poors, which came a week after the raising of the debt ceiling. The downgrade came out on Friday evening, August 5th and the market lost -6.7% the following Monday. Ironically, Treasury bonds rose in value following the downgrade, and the US dollar strengthened.9

In 2013 there was also a Debt Ceiling crisis and US markets showed little reaction because there was a lot of positive fundamentals supporting it; the S&P 500 was positive during a government shutdown and a similar Debt Ceiling debate period.10

Debt Ceiling Options

The first and only legitimate option is to come to an agreement and raise the debt ceiling. Democrats and Republicans will each have to make concessions to get it done.

If Congress cannot come to a deal on new legislation, there are several theoretical workarounds that can be taken to avoid a default temporarily:

- Prioritization of payments

The Treasury could choose which bills to pay and which to not pay. Logically they would choose to make any interest and principal payments on Treasuries first to avoid a default that would rattle the capital markets. Then other programs and obligations would be paid in some priority and some would be delayed.

While this may technically avoid a default, and is already kind of happening, purposefully delaying other timely payments would damage the credibility of the US. Rating agencies may also consider this a default anyways and take negative action.

- 14th Amendment

The 14th Amendment of the Constitution states that “The validity of the public debt, authorized by law … shall not be questioned.” Some legal scholars believe the clause forbids the government from defaulting on its debt and would allow for the President to authorize a higher debt limit or allow Treasury to borrow beyond the debt limit, thereby circumventing Congress. The legality of this is complex and certain to be challenged in courts so it is an unlikely solution.

- Issuing Perpetual or Premium bonds

The Debt Ceiling only applies to face value of bonds. Perpetual bonds have no face value but instead pay interest forever. Premium bonds would be issued with above-market interest rates to drive up the selling price well above the face value.

This would disrupt the world’s most liquid and transparent market by introducing unique structures. It is also an unlikely (and gimmicky) solution that doesn’t fix the actual problem while causing new ones.

- “Minting the coin”

This idea would entail Treasury Secretary Janet Yellen using her authority to instruct the US Mint to produce a platinum coin valued at $1 trillion and deposit at the Federal Reserve in the Treasury General Account or buy back Treasury debt held by the Federal Reserve. The Coinage Act grants the Treasury Secretary broad coin seigniorage authority (the authority to mint the coin) in any denomination.

A crazy idea for sure, that was actually borne out of an internet comment section, but it fits in well with the absurdity that is the Debt Ceiling debate. However, although interesting to think about, it is unlikely to happen.

The only feasible option that sticks for the long-run is to raise the Debt Ceiling with a bipartisan agreement.

What happens if the US defaults?

The scenario where the Debt Ceiling isn’t raised prior to the X-date remains extremely unlikely given historical precedent and what’s at stake, but the possibility is not 0% as evidenced by the aforementioned moves in the fixed income and credit market so it should be addressed.

If the debt ceiling is not raised, the US government will run out of cash to make payments and will have to delay payment for its obligations – domestically these could include programs like Medicare, Medicaid, Social Security and unemployment benefits. This would heavily disrupt consumers but would only be a short-term disruption until a resolution is reached.

More importantly to financial markets, choosing to miss an interest and/or principal payment on the global risk-free security, US Treasuries, would be a massive and unprecedented mistake. Markets would undoubtedly be rattled –almost assuredly in the form of weakness in risk assets like stocks. It would be interesting though to see how interest rates react – US Treasuries would likely still be the preferred safety trade but a technical default could be a problem for some institutions so there’s arguments to made that rates could move in either direction and potentially different directions based on maturity.

It really is an unimagined situation from an economic and markets perspective. The only confident estimate of what would happen is a lot of volatility.

The short-term impacts would likely be just that: short. Any adverse market reaction would force lawmakers hands to drum up the political will to make a deal. Bondholders as well as other owed parties would be made whole once the Treasury has access to cash again.

The long-term impacts are more open-ended. Rating agencies may consider downgrading the US from it’s pristine AAA credit rating as Standard & Poor’s did in 2011 due to the political dysfunction. The credibility of the US would be damaged and a new risk premium in the form of higher financing costs would likely be applied to US Treasuries – the magnitude of which is unknown as is how long creditors would demand it until confidence is restored. This higher base rate negatively affects all financial assets and there would most likely be residual damage to global markets and economies at a time when recessionary risks are already elevated.

But again, defaulting is a choice that lawmakers would be making by not raising the limit and one that can be easily avoided. The US won’t default unless the government chooses to do so.

Investor Actions

From a portfolio perspective, we reiterate a common theme we’ve used frequently in our investment approach:

Manage for the short-term, Investment for the long-term.

The current environment is a conducive one for this approach to play out. We expect heightened volatility as we move closer to the deadlines. And, if in the extremely unlikely event that a financial accident occurs within the Treasury market, there will surely be additional volatility and weakness in the markets. Therefore, maintain sufficient reserve capital for the short-term so that long-term assets can stay the course and/or be used opportunistically.

Please let us know if you have any questions regarding the Debt Ceiling and the implications for financial markets and/or your personal portfolios at Kavar Capital. If there is enough interest, we are happy to follow up with a Q&A update on specific questions we receive.

- https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/debt-limit

- https://www.cnbc.com/2023/05/24/the-us-isnt-the-only-country-with-a-debt-ceiling-heres-how-denmark-avoids-the-drama.html

- https://www.reuters.com/world/us/yellen-says-june-1-is-hard-deadline-raising-debt-ceiling-2023-05-21/

- https://www.moodysanalytics.com/-/media/article/2023/debt-limit-scenario-update.pdf

The views expressed herein are those of John Nagle on May 25th, 2023 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.