Market Update – March 13th, 2023

Good evening,

The last 3 trading days in the market has been characterized by a sharp increase in volatility led by falling share prices of banks – a few of which have seen all-out collapses in value. In spite of government action announced last night to protect depositors, investors continued to flee bank stocks in mass today with the S&P Regional Banking Index falling another -11.2%, bringing it’s 3-day decline to -22% and S&P Bank Index falling -9.96%, down -20% over the past 3 days.1 It has become a “sell first, ask questions later” environment as there seemed to be little rhyme or reason as to which banks saw the largest declines and the whole sector was indiscriminately targeted.

The volatility was sparked by the shuttering of a large commercial bank at the end of last week: Silicon Valley Bank (SVB). SVB, at the time was the 16th largest US bank by deposits, representing the 2nd largest bank failure in history.2 Silicon Valley Bank was a pillar in the Venture Capital industry – the preferred lender to start-ups, their founders and the private equity firms whom held interest in these early stage companies. It was seen as a badge of honor to bank with SVB.

However, as cash burn intensified for the industry, deposits began to dwindle and after becoming a forced seller of a portion of their securities portfolio to meet withdrawals and then failing to raise capital, confidence in the bank quickly eroded. Members of the Venture Capital community stoked the panic and urged clients to remove deposits from the bank – in total over $42 billion (>20% of total deposits) was removed by the close of business on Thursday, March 9th.3 The bank was essentially insolvent and closed by regulators the next day.

Over the course of Friday, March 10th, trepidation grew around the status of deposits over the $250,000 FDIC limit for insurance held at SVB. Over the weekend, concerns of 1) depositors being forced to take haircuts on their withdrawals continued along with 2) the general stability of the banking system, prompted an attempt to stem a potential panic the following Monday, the government stepped in on Sunday evening to shore up confidence, guaranteeing all uninsured deposits of Silicon Valley Bank, as well as Signature Bank (a bank with significant exposure to the cryptocurrency industry that was also closed on Sunday). This was accomplished through a lending facility whereby the Federal Reserve would lend funds to these banks pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. This facility came with this important distinction: These assets will be valued at par.4

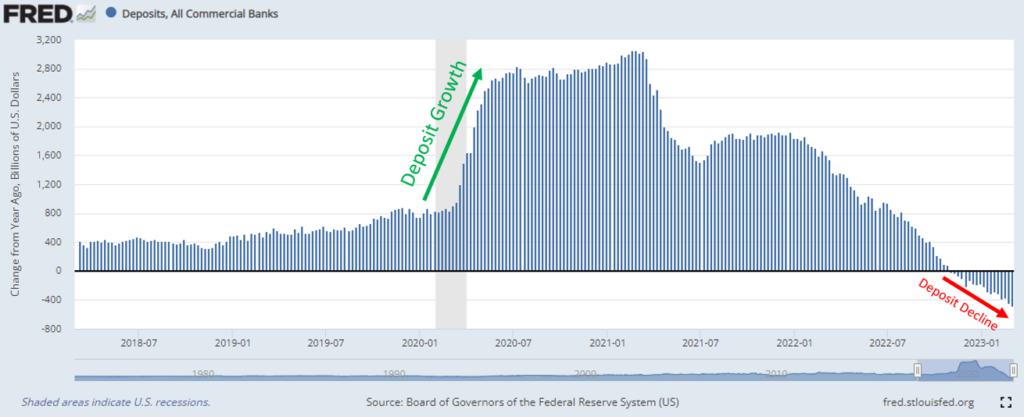

That distinction highlights the solution to the problem that banks are currently facing. Banks took in massive amounts of deposits during the pandemic, mainly from stimulus measures. Banks largely invested these deposits into high-quality fixed income instruments (like US Treasuries) that are now underwater due to rising interest rates.

This is not a problem if banks hold the bonds to maturity as there is no or very little credit risk with the vast majority of these holdings; however, if banks are forced to sell these bonds at market prices before maturity, they would have to take a loss (like SVB was forced to do). As withdrawals have ramped up due to either new alternatives for cash (US Treasuries or Money Market funds) or the need to fuse additional operating capital into a business (exacerbated by a slowing economy) these bonds may have to be sold.

Suffice to say, and without getting into the weeds of bank balance sheet management, a few banks did an extremely poor job of managing this risk, and when deposits rushed to the exits, they were left insolvent.

It wasn’t a question of the credit quality of the asset, which is a key important difference from prior bank crises, it was a mismatch with the timing of the liability.

As a bank, other parties’ assets (deposits) are your liabilities and other parties’ liabilities (loans/bonds) are your assets, so when those other parties demand their assets back you tap your balance sheet to fulfill these requests. In the case of Silicon Valley and Signature Banks they were unable to match up their assets and liabilities in light of the run on their banks.

As markets digested these developments, the fallout in the year’s main macro story has flown somewhat under the radar. The Fed’s fight against inflation has taken a back seat to what some call the Fed’s unofficial third mandate: preventing financial instability.

It was hypothesized many times last year that the Fed would not stop tightening until they “broke something,” and that appears to have happened with the 2nd and 3rd largest bank failures in US history. The long and variable lags of monetary policy are beginning to show their teeth and so the market has significantly changed their view of future Fed policy:

- On March 8th, the market was pricing in a step back up to a 0.50% hike at the March 22nd Fed meeting, followed by 2 more hikes in May and June before pausing with a terminal rate above 5.5% without any rate cuts for the balance of the year.5

- As of today, March 13th, the market is pricing in 0.25% with major discussion of a pause (no hike) at the March 22nd Fed meeting, followed by 4 rate cuts starting in June 2023 through the end of the year.6

In just 5 days the market has completely priced in a pause and pivot for the Fed. This significant shift in market expectations for Fed policy will be tested as early as tomorrow morning with the release of February CPI inflation data. The next time we hear officially from the Fed will be at the March 22nd meeting when the FOMC will announce its policy decision, will release a new set of economic projections and Jay Powell will address the media.

We will keep in close contact on the market developments as we get closer but to conclude, we wanted to address a reasonable question we have fielded a number of times regarding the safety of deposits and portfolios at institutions and wanted to address the main one: Is my money safe?

By and large, money is safe on deposit in regulated US banks. Deposits up to $250,000 are insured by the government through the FDIC and deposits over $250,000 are arguably now implicitly guaranteed for the time being by the new Fed facility. These insurance limits apply in the case of a bank failure, and we view the recent failures as more isolated situations as opposed to systemic risks to the whole system and household banking institutions.

This does not preclude one from being diligent regarding which bank your funds are held – there are still characteristics of banks that make us more comfortable than others and spreading out deposits to maintain FDIC coverage remains a prudent strategy. Please reach out to our team if you have any concerns regarding deposit coverage or questions about an institution’s safety.

As far as investment portfolios, Kavar Capital clients’ assets are held at qualified custodians, (ex: Charles Schwab), and always in the name of the investor. Client assets always belong to the client, they do not reside on the balance sheet of a custodian and they can be easily moved if we lost confidence in that custodian’s financial condition.

Our largest custodial relationship is Charles Schwab. Schwab custodies $7.05 trillion in total client assets as of 12/31/22 and is the largest custodian for Registered Investment Advisors (RIAs) in the US by a wide margin.7,8

Client assets at Schwab are protected by the Securities Investor Protection Corporation (SIPC). SIPC provides up to $500,000 of protection for brokerage accounts held in each separate capacity (e.g., joint tenant or sole owner), with a limit of $250,000 for claims of uninvested cash balances. And importantly for values over $500,000, Schwab holds supplemental coverage under a policy secured with Lloyd’s of London underwriters, the additional protection of securities and cash extended to Schwab is up to an aggregate of $600 million for all Schwab customers. This additional protection becomes available in the event that SIPC limits are exhausted.9

Schwab released a statement this morning to re-assure investors of its capital position in light of its stock price decline that is linked here: https://www.aboutschwab.com/perspective-on-recent-industry-events There is detail in the statement highlighting Schwab’s sound financial position.

Please reach out to any of our team members directly with questions or concerns specific to your personal portfolios and circumstances. We will keep in close contact as market developments evolve over the next few weeks.

The views expressed herein are those of John Nagle on March 13th, 2023 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.

Footnotes:

- Morningstar Direct Data

- CNBC https://www.cnbc.com/2023/03/10/silicon-valley-bank-collapse-how-it-happened.html

- CNBC https://www.cnbc.com/2023/03/10/silicon-valley-bank-collapse-how-it-happened.html

- Federal Reserve https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312a.htm

- CME Group FedWatch Tool https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- CME Group FedWatch Tool https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- Charles Schwab https://content.schwab.com/web/retail/public/about-schwab/schw_feb2023_press_release.pdf

- WealthManagement.com https://www.wealthmanagement.com/ria-news/quarter-rias-may-add-new-custodian-next-year