Market Update – May 4th, 2022

Good afternoon,

Today the Federal Reserve moved forward with its highly anticipated and thoroughly telegraphed rate hike, increasing the Fed Funds Rate Target Range by 50 bps (0.50%) as it continues to tighten monetary policy in order to rein in inflation.

The 50 bps hike is a departure from the recent rate hike procedure for the Fed; as they raised by more than 25 bps for the first time since May 20001; exemplifying how much the economic landscape, and particularly inflation, has changed in the view of the committee and how far behind the curve the Fed was.

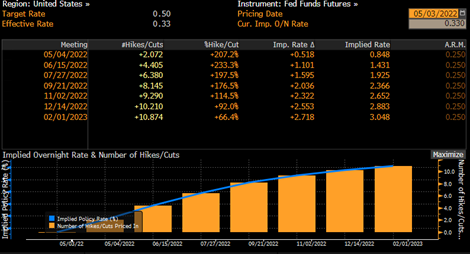

This meeting was highly anticipated given the intensification of hawkish communication since the prior meeting resulting in increasing market expectations for rate hikes this year. Going into the meeting, markets were expecting an extraordinary 10 total rate hikes (defined as a 25 bps hike) by the end of 20222:

As the 50 bps rate hike was fully expected by the market the immediate reaction was jumpy but in a tight range as the statement provided little in the way of market moving revelations.

Of course, the main event was Chairman Jay Powell’s press conference after. Powell’s prepared remarks were distinctly hawkish – noting on several occasions that inflation was “much too high” and seemingly willing to throw the kitchen sink at it. However, during the Q&A session the markets found the answer they were looking for and turned sharply positive after Powell stated that an even more aggressive hike of 75 bps was not something the committee was actively considering. Stocks rallied for the best day since May 20203:

And Treasury yields dropped, with the 10-year Treasury yield falling from above 3% to end the day at 2.91%4:

By taking 75 bps off the table, Powell removed an apparent risk that investors were discounting as a policy mistake. The market was clearly defensively positioned heading into this meeting fearing the rate hike path could be even more aggressive; but with that simple clarification risk was back on (at least for the last hour of trading today).

Powell further communicated that the current plan, as of now, looks to be 50 bps hikes at the next two meetings in June and July, which followed by a break in August, gives the committee clearance to be data dependent to determine the appropriate actions in September through the end of the year. The reduction in uncertainty soothed markets as Fed commentary has been anything but clear over the past month. Even though, the committee views are always changing as data comes in and there is much out of their control — as Powell remarked they can only really impact excess demand (consumers) but can’t do much for supply issues (energy costs, supply chain disruptions, etc.) – markets can be comforted for now that the Fed’s rate hike path doesn’t have to so drastic as to move 75 bps.

The meeting came at a tumultuous time for financial markets as US stocks made new lows for the year on Monday of this week after intense selling characterized the end of the week before. A mixed bag of economic data and corporate earnings contributed to the decline, but the driving force remains the policy shift from accommodation to neutral and potentially restrictive. Today was a step in the direction of neutral, policy remains accommodative, but markets are tightening on behalf of the Fed; the data has begun reflecting these tighter financial conditions.

We’ll stay in close touch as market developments continue to impact portfolios. Please reach out to our team with questions/comments on how the information presented in this update is impacting your portfolio specifically.

Footnotes:

- https://www.cnbc.com/2022/05/04/fed-raises-rates-by-half-a-percentage-point-the-biggest-hike-in-two-decades-to-fight-inflation.html

- Bloomberg Market Data

- Bloomberg Market Data

- Bloomberg Market Data

The views expressed herein are those of John Nagle on May 4th, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.