Market Update – October 1st, 2023

The last couple months in the financial markets had a Deja Vu to ’22 feel to them. Cross-asset class correlations were running high, pretty colors on pie charts were just running and every interviewee, analyst and commentator seemed to tilt negative. The market’s muscle memory is strong, especially when resolve is weak, and rising interest rates and energy prices tripped selling triggers much as they did this time last year.

As illustrated below, the S&P 500, Nasdaq Composite and Russell 2000 stock indices were deeply red for the last 2 months. The green on the screen was reserved for the dollar and oil prices.

Perhaps after such a heady start to the year, a bit of a breather should come as no surprise. Particularly considering the somewhat self-fulfilling statistic of seasonality:

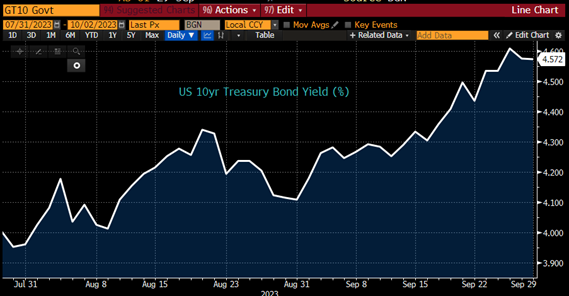

Throw in the most recent rip up in interest rates, to levels not seen on the 10yr bond since 2007, and sentiment is defensibly dour.

Pessimists have been spewing a well-worn narrative: expect persistently higher interest rates to 1) decelerate the economy, 2) undermine consumer confidence, 3) re-rate market multiples and 4) shift capital to more conservative corners.

Even as an optimist, I have a hard time arguing with any of those points.

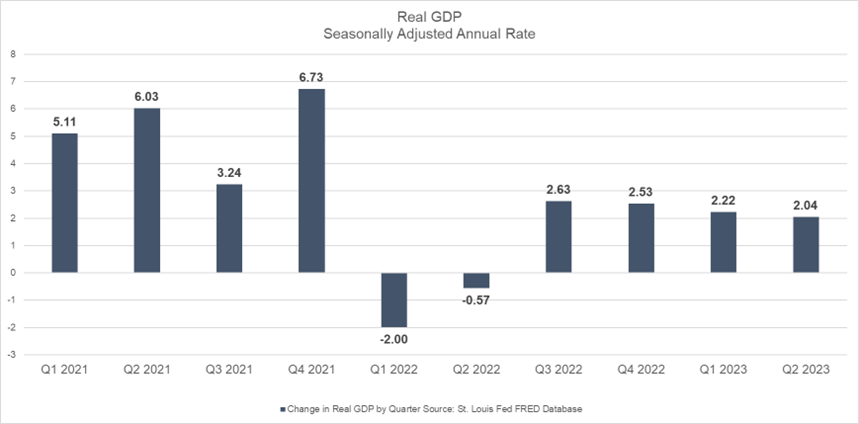

(1) The objective of the Fed’s tightening initiative that began 18 months ago was to “destroy demand.” What in that characterization doesn’t denote deceleration?

(2) To quote from The Conference Board charged with monitoring the temperament of the consumer: “Consumer confidence fell again in September 2023, marking two consecutive months of decline,” said Dana Peterson, Chief Economist at The Conference Board. “September’s disappointing headline number reflected another decline in the Expectations Index, as the Present Situation Index was little changed. Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for groceries and gasoline in particular. Consumers also expressed concerns about the political situation and higher interest rates. The decline in consumer confidence was evident across all age groups, and notably among consumers with household incomes of $50,000 or more.1”

(3) The Price/Earnings Multiple (P/E) on the S&P 500 has dropped to 17.8x from more than 20.0x (see below). While still above its long-term average of 16.76x, most of the revisions have occurred in the technology sector. Tech companies are known as “long-duration equities” due to their aspirational sales cycles which creates an outsized negative impact of a higher discount rate on their future cash flows (yep, the old present value calculation). When you consider that tech comprises over 27% of the weighting of the S&P 500, its multiple “sneeze” has caught the market a “cold.”

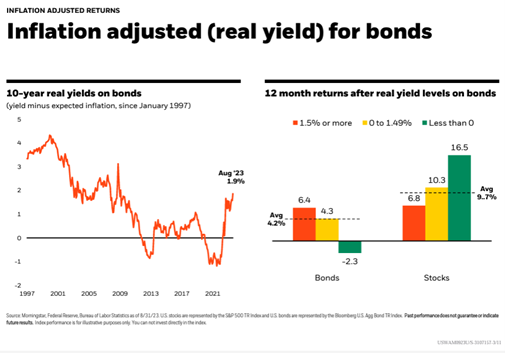

(4) An obvious direct result of higher interest rates is….higher interest rates! Forever, there was an adherence to an acronym in the market: T.I.N.A.: There Is No Alternative (to stocks)! But now there is a very viable one: bonds! And another one: cash! If you are lending and not borrowing money, this is an environment that you may have been waiting almost 20 years for: establishing a positive “real yield” (rate of interest minus inflation) with your conservative capital. So it may be only natural to redirect a certain amount of your investment dollars out of stocks and more in this direction.

As I said, I’ll stipulate to all of those “pessimistic” positions. But I’ll also offer a quick counterpoint as to why each adds to our positivity going into the year’s final quarter.

(1) The growth of the US Economy has undeniably slowed, and that offers the opportunity for more sustainable growth in the future. It also, in our opinion, heightens the likelihood that the Fed is done, or nearly done raising interest rates. The single largest component of Gross Domestic Product (GDP) is the US Consumer….whose confidence we learned has been dented. With a sufficient suppression of their purchasing power, we think it is time to consider the mission accomplished as the Fed is loath to see “slowing” become “shrinking.” When you add in the enduring strength of the job market, the prospects of finding level ground, or what the Fed calls its “neutral rate,” have heightened.

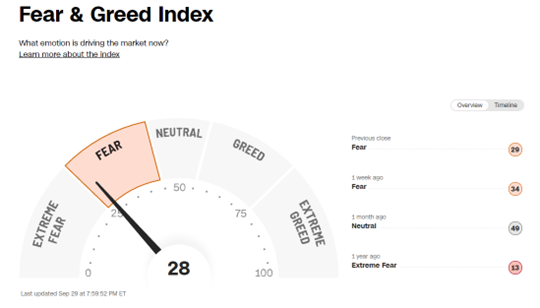

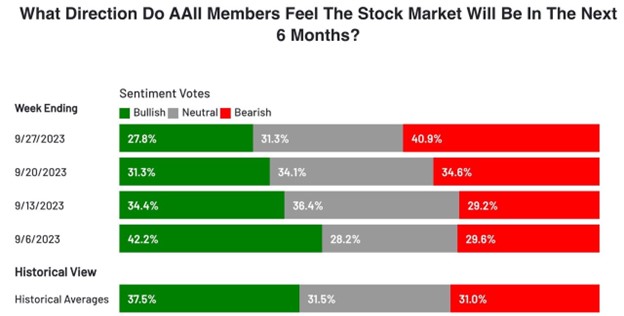

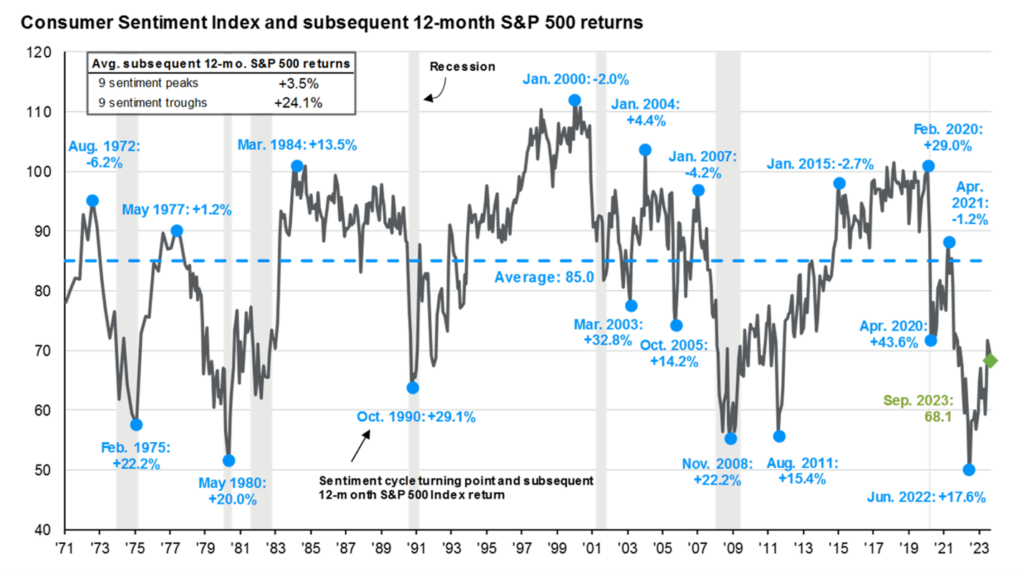

(2) Try as I might, it’s difficult to get through a market note without some small homage to Warren Buffett. When The Oracle spoke of being, “fearful when others are greedy and greedy when others are fearful,” he likely had charts like the ones below at his disposal:

Suffice it to say, the forward returns for the market tend to be strongest when sentiment is weakest. We are not at a low point right now, but we are sufficiently below average enough that we think the risk/reward set-up for equities leans positively.

(3) Much has been made of the lack of breadth in the stock market thus far in 2023. 7 tech stocks have been coronated the “Magnificent Seven” for their outsized contributions to the S&P 500’s performance. Most of those stocks are in the technology sector. There are, therefore, 493 other stocks and 9 other industry groups that have effectively been performance laggards this year. That is exciting to us as we consider the fundamentals of companies and sectors that are poised to participate in an environment characterized far differently than it was 9 months ago. This chart below is staggering in the disproportionality of the current domestic equity return stream.

(4) If ever we’ve been in an environment that beckons for balance, we believe it is now. As I mentioned, on an inflation-adjusted basis, bonds look attractive to us. Within the universe of bonds (and it is a big one!) we are still maintaining a reasonably short duration (or average time to maturity of the bonds in the portfolio). This is out of respect to what seems likely to be an environment that holds rates at, or a bit above, current levels for longer than had initially been surmised.

As the chart below illustrates, the undercurrent of positive real yields has constructive implications across asset-classes but no single area jumps out as an obvious overweight.

This should allow a client’s asset allocation to be driven more strategically than tactically and invokes the benefits of rebalancing and active management.

Bear in mind that the real yields have 2 levers: inflation and interest rates. Inflation has come down considerably from its peak in June of 2022 when it touched 9.1% to the current rate of 3.7%, while the Fed Funds Rate has gone up 5.25% since March of last year.2 And interestingly, I read in the Wall Street Journal this morning that, “…since 1945, the S&P 500 has risen 21% on average in the two years after the release of data showing a peak in consumer-price inflation, according to Brett Nelson, head of tactical asset allocation for the investment strategy group at Goldman Sachs Group. When episodes with a recession are excluded, the index’s average gain was 28%”3

This is not intended to be a prediction, just some perspective. That was the essential point of this piece: there is so much negativity swirling around right now (and we didn’t even get into the UAW strike or the narrowly averted government shutdown!) but that is frequently the gateway to opportunity in investing.

The myopic clouds of conventional wisdom often obstruct the horizon of long-term goal attainment.

We are finding reasons to be optimistic and look forward to kick-starting the new quarter.

1 https://www.conference-board.org/topics/consumer-confidence

2 Source: Bloomberg Market Data

The views expressed herein are those of Doug Ciocca on October 1, 2023 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. The charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.