Market Update – September 13th, 2022

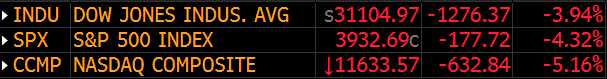

Good Evening. Quick check-in on today’s market action. In a word, it was nasty. Catalyzed by a stronger-than-expected print in the August Consumer Price Index (CPI) both stocks prices and bond yields moved in unfavorable directions. All 3 major stock indices had difficult days as depicted below:

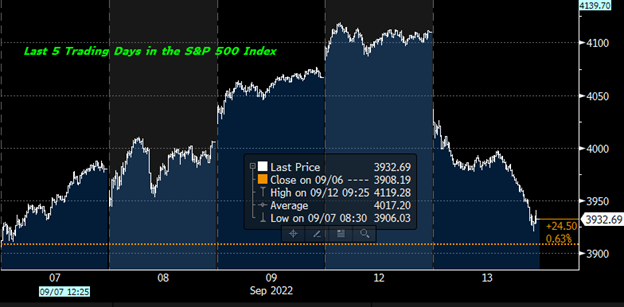

Perhaps the only saving grace was that this sharp drop followed 4 solid advances, resulting cumulatively in a small gain since last Tuesday (see below):

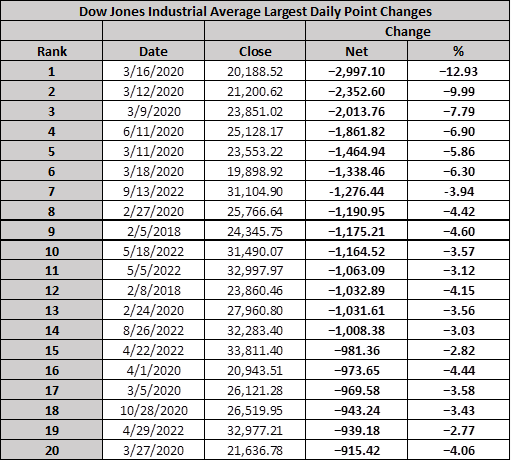

Despite that, a move of today’s magnitude is still a bit breathtaking, and in many ways historically outlying, so I think it deserved some perspective.

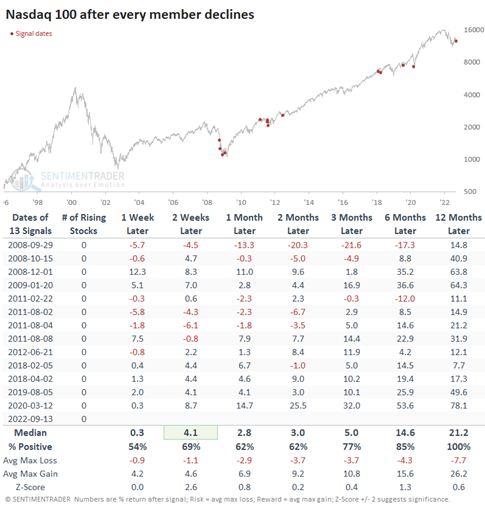

Every member of the Nasdaq 100 Index fell today. This is only the 13th time in history that this has happened. The chart and table below indicates that in the prior 12 instances, this same index has been higher 77% of the time in the following 3 months, 85% of the time in the following 6 months and 100% of the time in the following 1 year. In the following 1 year, the average rate of gain exceeds 26%. This is not a prediction. Again, just perspective.

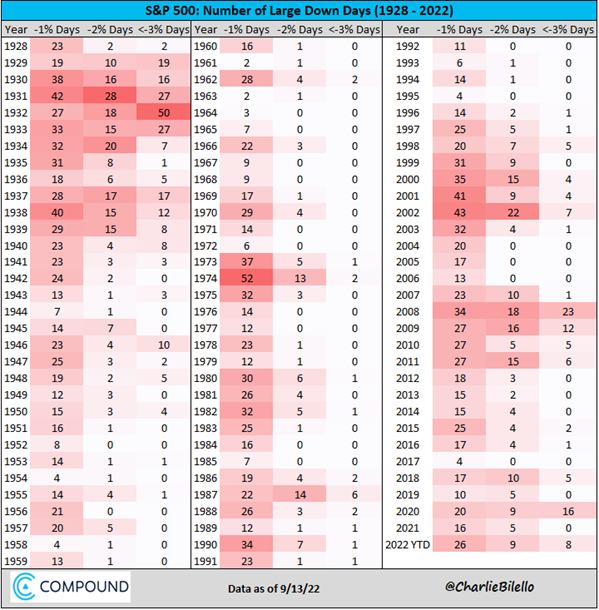

And while today represented the 7th largest point drop in a day for the Dow Jones Industrial Average, it was but the 121st largest percentage drop in the S&P 500 since 1928:

Lastly, another interesting viewpoint: already in 2022, we have had 43 days of down days exceeding 1, 2 & 3%…..that is only 2 fewer days of aggregated declines as took place through all of 2020….the pandemic year…..and we still have 3.5 months to go! To say the intra-day price fluctuation has been extreme is no exaggeration (see below):

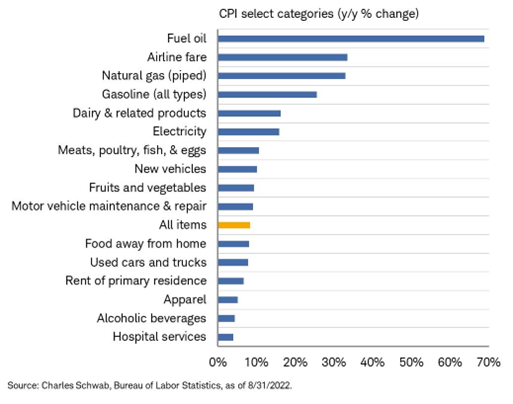

In the 4 trading days before today, the stock market had been rallying on the prospects of disinflation. Disinflation is the reduction in the rate of change of higher prices, or the slowing of inflation. We all know that we are paying more for essential goods and services and have been hopeful for the cresting in that ascendency. Thankfully, it has been evident in things like gasoline prices, but evasive in things like healthcare and food.

Each month, a CPI number is released that represents the percentage change over the prior year (YoY) and the prior month (MoM). And while “Headline” CPI has moderated YoY (from a June peak of 9.1% to today’s read of 8.3%1) and came in at only +0.1% MoM, the inconsistency of the stickier “Core” CPI (CPI excluding volatile components like food and energy) read is meddlesome, moving up 0.6% vs. last month’s 0.3%.2 See below for an interesting depiction of select YoY components of CPI:

The implications of higher inflation are 2-fold: 1) The persistency of high inflation is addressed by increasing interest rates – a mechanism controlled by the Federal Reserve Board of Governors (Fed) – designed to dampen demand and depress prices. 2) Higher costs for basic items reduce capital available for discretionary items, thereby impacting the profitability and hiring appetite for the companies that offer them.

Regarding the work of the Fed, they have been clamoring for a while now that they are going to break the back of inflation by raising interest rates until they extract the desired outcome – price stability. They worry as much about the actual level as they do about the perceived adverse influences of inflation. This was a pointed excerpt from an article I read online last month to that effect:

Low, stable inflation helps keep consumer expectations in check. If consumers anticipate persistently high inflation — even if those expectations are unhinged from reality — those whims can become a self-fulfilling prophecy.3

Despite being data dependent, the Fed is attempting to preemptively engineer an economic moderation without inadvertently causing a recession.

They have continued to ratchet up their expectations on how high they must raise rates to obtain that desired outcome. Each additional “tightening” that takes place, instigates investor angst as the consequences of a contraction (not just a slowing) are recalibrated.

Think of Fed policy as if you were a mountain climber. Each foot higher that you climb, the more damaging the effects of a fall. Now, you may not fall. Ideally you would summit and head down the other side to a cozy base camp! But what if you fall?? That is what the market is trying to price into its levels daily.

If you did fall, OK, OK no more imagery……if the Fed did fail in landing softly, then jobs could be lost, a recession could ensue and a general period of economic malaise may set it. As you’d suspect, these are not good undercurrents for solid stock market performance.

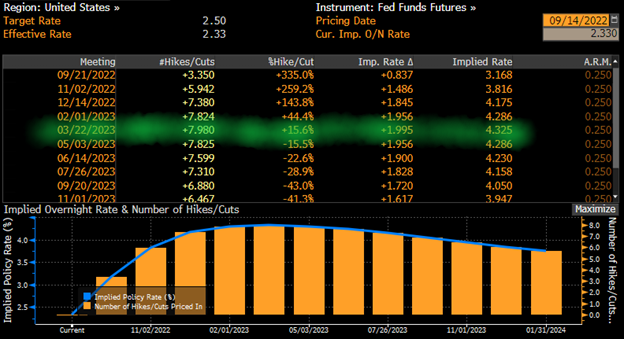

And with each adjustment higher in interest rates, the margin of error for the Fed falls. The table below illustrates when and at what level the market is estimating the Fed to find its stopping point, or what they refer to as the “terminal rate”:

That terminal rate is approximately 2% higher than the current Fed Funds rate, indicating an intent to appreciably alter financial conditions thru raising the cost of money between now and March of next year. This adjusted considerably higher today in light of the hot CPI number and the nervousness of the investment community was reflected in the sell-off.

There is an important economic number that comes out tomorrow as well: the Producer Price Index (PPI), or the corporate counterpart to the CPI. As well, there is a Fed meeting next week, where they will be raising interest rates (@ least 0.75% based on the top line of the table above) and commenting on their outlook for future policy implementations and implications.

We’ll keep in close touch as we move through the next couple weeks and please reach out @ any time to our team @ Kavar as to how any of this information impacts you and your financial plan directly.

1 Source: Bloomberg Market Data

2 Source: Bloomberg Market Data

3 https://www.cnbc.com/2022/07/14/how-inflation-can-hurt-and-help-consumers.html

The views expressed herein are those of Doug Ciocca on September 13, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.