Market Update – September 14th, 2022

A deeper dive into the CPI numbers

As a follow-up to our market update last night, we wanted to provide more detail on the inflation report that rattled investors and why it caught the market so offsides.

Consumer Price Index: All Items (aka “Headline” inflation)

- The headline inflation number surprised modestly to the upside, increasing +0.1% from month-over-month vs. -0.1% expectations1.

- While the upside surprise disappointed markets, the trend is a positive, we have now had two consecutive months of barely any inflation overall, therefore year-over-year CPI decreased from +8.5% in July to +8.3% in August2. Making progress.

Consumer Price Index: All Items Excluding Food and Energy (aka “Core” inflation)

- Core CPI is a measure of inflation that excludes Food and Energy prices. These goods are excluded because of their volatile nature and their susceptibility to supply side shocks. Food and energy prices often experience wild swings that ultimately self-correct as the market balances.

- Core CPI allows economists to see broader underlying changes in the trend in consumer prices without the undue influence of food and energy price volatility.

- Core inflation surprised more significantly to the upside, increasing +0.6% from month-over-month vs. +0.3% expectations3.

- This upside surprise resulted in an increase of year-over-year Core CPI from +5.9% in July to +6.3% in August4.

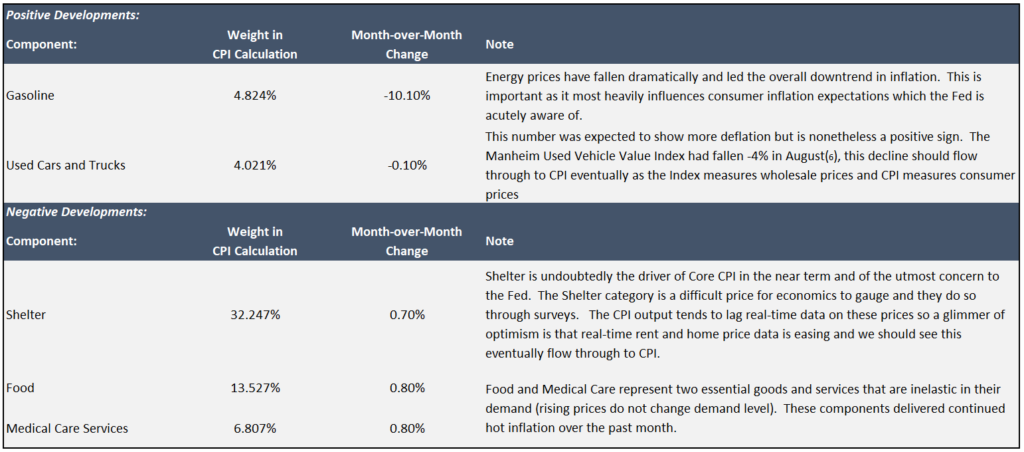

Looking deeper into the components provides insight into the ultimate drivers of the overall index5:

And lastly, its important to note that although CPI gains most of the mainstream attention, the Fed’s preferred measure of inflation is PCE (Personal Consumption Expenditures) which measures inflation under a different methodology. The differences include7:

- Sources of data: The CPI uses data from household surveys; the PCE uses data from the gross domestic product report and from suppliers. In addition, the PCE measures goods and services bought by all U.S. households and nonprofits. The CPI only accounts for all urban households.

- Coverage: The CPI only covers out-of-pocket expenditures on goods and services purchased. It excludes other expenditures that are not paid for directly (e.g., medical care paid for by employer-provided insurance, Medicare, or Medicaid). These are included in the PCE.

- Formulas: The CPI formula is more likely to be affected by categories with wide price swings such as computers and gasoline. The PCE calculations smooth out these price swings, which makes the PCE less volatile than the CPI.

PCE is preferred by the Fed for these reasons8:

- The expenditure weights in the PCE can change as people substitute away from some goods and services toward others. Thus, if the price of bread goes up, people buy less bread, and the PCE uses a new basket of goods that accounts for people buying less bread. The CPI, however, is less fluid in response to changing consumer preferences.

- The PCE includes more comprehensive coverage of goods and services.

- PCE data can be revised more extensively than the CPI, which can only be adjusted for seasonal factors and only for the previous five years.

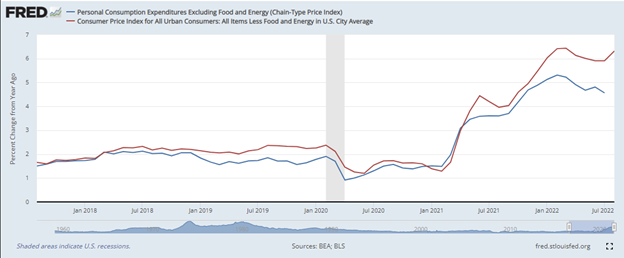

And the good news is that PCE is the Fed’s primary measure of inflation and it is closer to the Fed’s 2% target than CPI. PCE has also run cooler than CPI through this cycle; so while CPI generates headlines, PCE should be of more importance to investors:

Footnotes:

- Bureau of Labor Statistics https://www.bls.gov/news.release/pdf/cpi.pdf

- Bureau of Labor Statistics https://www.bls.gov/news.release/pdf/cpi.pdf

- Bureau of Labor Statistics https://www.bls.gov/news.release/pdf/cpi.pdf

- Bureau of Labor Statistics https://www.bls.gov/news.release/pdf/cpi.pdf

- Bureau of Labor Statistics https://www.bls.gov/news.release/pdf/cpi.pdf

- Manheim https://publish.manheim.com/en/services/consulting/used-vehicle-value-index.htmlcallan

- Callan https://www.callan.com/blog-archive/cpi-vs-pce/

- Callan https://www.callan.com/blog-archive/cpi-vs-pce/

The views expressed herein are those of John Nagle on September 14, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.