Years of Experimentation

By: Douglas G. Ciocca

It is always interesting to compare headlines from prior periods. Often, they are ominous framers of the future. Alternatively, they magnify matters of the moment. Regardless, they are a time stamp, offering insights to the psyche prevailing at print.

A headline can be a noun or a verb – depending on whether the intent is to report news or to make news. Headlines lines can warn, wax, wane or weaponize.

Looking back just one year is fascinating. Though only 12 months have passed, it seems like a lifetime, given the range of economic and emotional upheaval that has transpired and the corresponding roller-coaster ride in the stock market.

Here are a few of my favorites from the 4th quarter of 2018:

Rates are surging with 10-year, 30-year Treasury yields touching multiyear highs; CNBC October 3, 20181

Fed Minutes Point to Continued, Gradual Interest-Rate Increases; Wall Street Journal Oct. 17, 20182

Despite Trump criticism, Fed sees need for more rate hikes; Reuters Oct. 17, 20183

Many U.S. firms in China eyeing relocation as trade war bites: survey; Reuters October 29, 20184

US stocks sink again amid shutdown fears, Fed angst; Associated Press December 20, 20185

‘Down, down, down’: Stocks sink as rate fears, shutdown gloom push Nasdaq into bear market; USA Today December 21, 20186

It is almost eerie to reconsider these captions as it refuels the fear felt across Wall Street in the 4th quarter of 2018.

Such consternation was catalyzed by three distinct concerns and their anticipated echo across all classes of assets:

- The Fed was raising interest rates. In fact, they had begun raising interest rates in December of 2015….slowly removing stimulus from an economy that had steadily recovered from the financial crisis. Higher rates tend to be bad for the bond market as newly issued obligations offer a yield premium to the more seasoned stuff. And bad for stocks as additional dollars of revenue must be allocated to interest payments, which punishes profits.

- The Trade War rhetoric between the US and China was stout and steady. Well into their second year, the tit-for-tat tariff talk dented the determination of investors to ride things out to a resolution;

- An impending government shut-down due to budgetary bickering underscored the antipathy across political party lines. More threats, these of a domestic making, further eroded confidence and prompted pessimism.

This combination conspired to clobber the markets. In the 4th quarter of 2018, the S&P 500 Index dropped 13.9%7, and the damage would have been much worse but for the Boxing Day boomerang! From December 26th to 31st, the market was higher by over 6.5%7.

Let’s flash forward 12-ish months and inspect the bold print:

The Fed will cut rates five more times before April, analysts predict; CNBC August 20, 20198

U.S. Long-Bond Yield Nears All-Time Low as Global Anxiety Grows; Bloomberg August 12, 20199

Optimism is rising that some sort of US-China trade deal is coming — here’s what we know; CNBC October 11, 201910

Trump leaves door open to shutting down government before Thanksgiving; Washington Post November 3, 201911

The Dow Rises 31 Points as the Stock Market’s Record-Setting Continues; Barron’s November 5, 201912

Wow! While it is often said that the only constant is change, it seems the only thing that has changed is the Fed…..everything else has been constant. So why would the market go from free fall to all-time highs amidst so much nagging negativity?

It would be convenient, and not incorrect, to surmise that the level of interest rates, (a.k.a. the cost of money) is the predominant driver of market value. When you consider that:

- Lower borrowing costs can incentivize loan demand for both consumers and companies, unleashing a multiplier effect in the form of investing and/or consuming;

- Lower rates against which cash flows are being discounted raises the present value (a.k.a. price) of an investment such as a common stock or a piece of real estate and;

- Statistically speaking (and if you took a Stats class in college, I am very sorry – both for that experience and for this explanation) the Fed Funds Rate is the “manipulated variable” in an ongoing market experiment.

To elaborate on that last point, an experiment generally has 3 variables:

- The manipulated variable is the one that can be controlled: the actions of the Fed;

- The controlled variable is the one that is held constant: political infighting, geopolitical one-upmanship, etc.;

- The responding variable is what happens as a result of the experiment: financial market volatility and direction.

And in addition to the specific level of interest rates, the communication and expectation about their future direction is visibly and vitally important. It harkens a hint of perhaps the greatest of all parenting saws: “It’s not what you say, it’s how you say it!”

Keeping with the headline flashback fun, let’s focus on the head of the Fed, Jerome Powell, and his vacillating vicissitudes:

HARD LINE, TIGHTENING TONES…….

October 2018: “Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral,” he added. “We may go past neutral, but we’re a long way from neutral at this point, probably.”12

EXHIBITING SOME FLEXIBILITY, MORE DATA DEPENDENCE VS. PREDETERMINED…….

January 2019: “If we came to the view that the balance sheet normalization or any other aspect of the normalization was part of the problem, we wouldn’t hesitate to make a change,” he said.13

LIGHTENING UP A BIT, RETHINKING THE STANCE…….

July 2019: “In additional to that, we are learning that the neutral interest rate is lower than we had thought and … the natural rate of unemployment rate is lower than we thought. So monetary policy hasn’t been as accommodative as we had thought,” Powell said.14

SHOULD BE GOOD FOR A WHILE…..GONE BUT NOT FORGOTTEN…….

October 2019: “So I think we would need to see a really significant move up in inflation that’s persistent before we would consider raising rates to address inflation concerns.”15

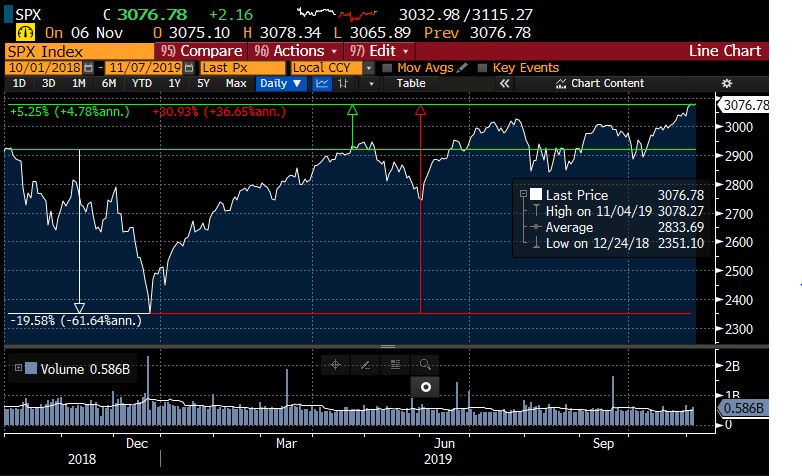

The chart below of the S&P 500 from Bloomberg below offers corresponding responsivity of the market (the responding variable) to the articulation of the policy outlook, leaving little to the imagination or for further investigation.

So here the market sits, at or near all-time highs, and a Fed likely to be lethargic for a while. This by no means implies that only upside remains for financial markets. All variables possess qualities of direction as well as speed and the velocity of the Fed’s tailwind has been reduced.

Should the complexion of the “controlled variable” improve, then it is possible that the response of the “responding variable” is positive, or vice versa. But ultimately, as we’ve seen over the last 12 months, the Fed is the predominant input in this perpetual market experiment.

The Fed has a dual mandate: to promote maximum employment and maintain price stability. Directing this decree requires great deft and determination and certainly as we’ve seen: articulation as to their basis and bias.

1 https://www.cnbc.com/2018/10/03/us-bonds-and-fixed-income-fed-remarks-in-focus.html

6 https://www.usatoday.com/story/money/2018/12/21/stock-market-dow-falls-bear/2379114002/

7 Source: Bloomberg Market Data

8 https://www.cnbc.com/2019/08/20/the-fed-will-cut-rates-five-more-times-before-april.html

12https://www.cnbc.com/2018/10/03/powell-says-were-a-long-way-from-neutral-on-interest-rates.html

Important

Disclosures:

The views expressed herein are those of Douglas

Ciocca on November 7, 2019 and are subject to change at any time based on

market or other conditions, as are statements of financial market trends, which

are based on current market conditions. This information is provided as a

service to clients and friends of Kavar Capital Partners, LLC solely for their

own use and information. The information provided is for general informational

purposes only and should not be considered an individualized recommendation of

any particular security, strategy or investment product, and should not be

construed as, investment, legal or tax advice. Past performance does not ensure

future results. Kavar Capital Partners, LLC makes no warranties with regard to

the information or results obtained by its use and disclaims any liability

arising out of your use of, or reliance on, the information. The information is

subject to change and, although based on information that Kavar Capital

Partners, LLC considers reliable, it is not guaranteed as to accuracy or

completeness. This information may become outdated and we are not obligated to

update any information or opinions contained herein. Articles may not

necessarily reflect the investment position or the strategies of our firm.