Market Update – February 4, 2018

Happy Super Bowl Sunday! Particularly to those clients of ours in Philly and New England!

I wanted to offer a quick check-in as we wrap up an action-packed week. Amid the State of the Union address, Janet Yellen’s final Fed meeting and an onslaught of earnings and economic reports, the Dow Jones Industrial Average fell 4.14%1 – the bulk of which was accounted for in Friday’s 665-point decline – and the S&P 500 dropped 3.85%1.

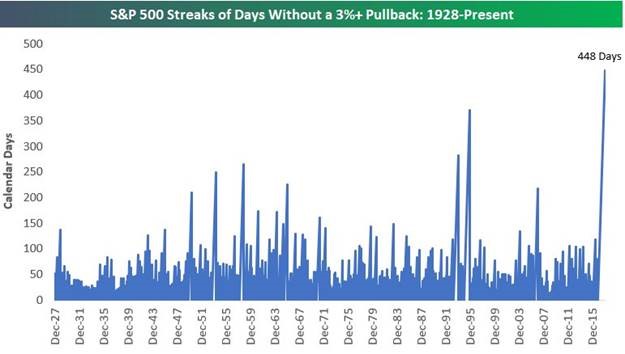

In doing so, a notable streak was broken: Friday ended the longest period in modern market history without an S&P 500 Index price decline of at least 3% (see below from Bespoke Investment Group https://twitter.com/bespokeinvest?lang=en).

Not surprisingly, investor angst, as measured by the VIX Index (know colloquially as the “Fear Index”) jumped to levels not seen in a couple years, closing above 17. (see below from Bloomberg Market Data).

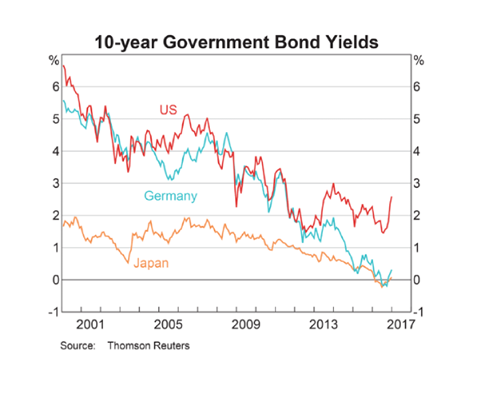

The identifiable culprit for the high volatility and weak price performance was none other than the otherwise boring old bond market. As indicated in the chart below (from Bloomberg Market Data), rates on the 10-year US Treasury bond pushed up to their highest levels in almost 4 years.

Strong US economic data, corporate profit growth and Fed governor commentary all conspired to push rates above 2.80%.

Bond prices and yields are inversely related, so the spike in yields saw a corresponding drop in prices. It was safe to say that this past week, aside from cash, there was really no place to hide in the financial markets.

Tweets, blog posts, analysts and talking heads have been flooding the media and mediums with the implications of last week’s price actions – most of which that I’ve read are mongering fear and some of apocalyptic proportions.

Yes, higher bond yields, all else being equal, offer a more formidable alternative to stocks than lower bond yields. Yes, when the future profit-stream of stocks are discounted at higher rates than in the past, the net present value of those profits is lower – challenging a company to grow faster just to maintain its valuation. Yes, it is more expensive to service debt when interest rates move higher should a company possess debt in it capital structure. We get all of that.

However, I think some perspective is proper at this point. Here are 3 important items to consider:

- The average yield on the 10-year US Treasury bond going back to 1970 is 6.45%2, over 3.60% more than the current yield;

- In addition to moving higher in yield, the 10-year bond widened its spread over the 2-year bond – something called the term premium between those maturities. I discussed this in last month’s Kavar Canvas as we ruminated on the absence of spread and interest in a “steepening” influence. (https://kavarcapital.com/questions-and-quandaries-in-the-new-year/).

The reestablishment of this steepening is a relatively positive influence on capital markets. As the charts from Bloomberg Market Data indicate below, a flat-to-inverted condition in the bond market presages weakness in the economy and the stock market:

3. The relative value of the US bond market vs. the rest of the developed world. The disparity in yields that exist across the globe may offer opportunities for cross-border investment flows to the US after its latest lift:

I saw an interesting interview over the weekend with Tony Dwyer from Canaccord Genuity that I would encourage you watch (https://www.bloomberg.com/news/articles/2018-02-02/stocks-in-rate-wringer-with-rout-raising-existential-questions). In it, Mr. Dwyer states, “corrections are only considered natural, normal and healthy until you actually get one. And then once you get one, by definition its gotta feel different or nobody would sell it.”

He goes to characterize the recent price action as within the realm of expectations and augurs for perhaps a little more volatility before things settle down a bit. We would agree.

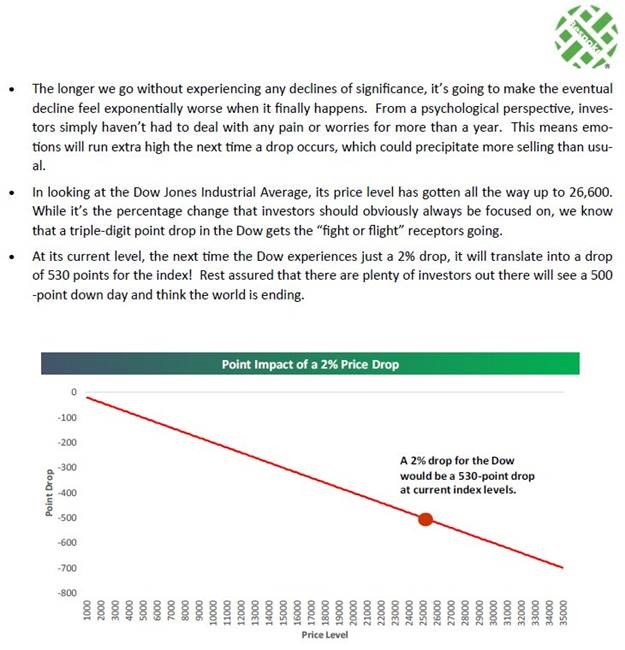

I’ll wrap up with 2 more points of perspective as it relates to the stock market (one quick, the other a little longer but also very interesting! Both are courtesy of Bespoke Investment Group)

Friday represented 9th-largest point decline in the Dow Jones Industrial Average on record. It is also the 697th-largest percentage decline. That’ll tell how far we’ve come.

Enjoy the game and the rest of the weekend and we’ll keep in close touch as the markets keep meandering!

- Source: Bloomberg Market Data

- Source: Bloomberg Market Data

The views expressed herein are those of Doug Ciocca on February 4, 2018 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.