Market Update – August 5, 2019

The stock market has begun this week in similar fashion to how it ended the last: poorly.

Last week saw declines of 2.6% for the Dow Jones Industrial Average and almost 4% for the Nasdaq.

Today, both of those indices fell by around 3% and struggled all day to find firm footing.

After so recently hitting all-time highs (7/16 for the Dow and 7/26 for the Nasdaq) with optimism awash on all shores, it is natural to want a revelation on the reversal. Here is my take:

Wednesday, 7/31

The Federal Reserve Bank’s Open Market Committee decided to lower overnight lending rates by 0.25%. This move was completely expected as the Fed’s comments in the weeks leading up to the decision were well telegraphed. There was no surprise…..

…..except that Fed Chair, Jay Powell, was a little less gracious in guiding expectations for continued cuts in the cost of money than the market had been hoping. This pressured prices for the rest of the day as the recalibration was reflected.

Also, the second night of the second round of the Democratic Primary Debates concluded with no clear front-runner to challenge President Trump and no clear consensus on the party’s platform or priorities.

Thursday, 8/1

The market’s mood had modified significantly, with the Dow up around 300 points by midday. The characterization of the Fed as a curmudgeon had calmed and comparisons were cast to prior-periods of mid-cycle pausings and their propensity to positivity.

And then President Trump dropped a doozy: he threatened to impose 10% tariffs on $300 billion of imported Chinese goods that had previously been spared. He indicated dissatisfaction with the pace of progress in the negotiations and stepped outside of an agreed upon moratorium on tariffs while trade talks were ongoing.

Quickly all 300 points of gain vanished and roughly 300 points of decline were tagged on.

I believe that President Trump felt emboldened by 2 things: the Fed cutting rates (and expressing an openness in continuing to do so incrementally which can elongate the economic expansion) and a heightened sense of his success prospects in the 2020 election.

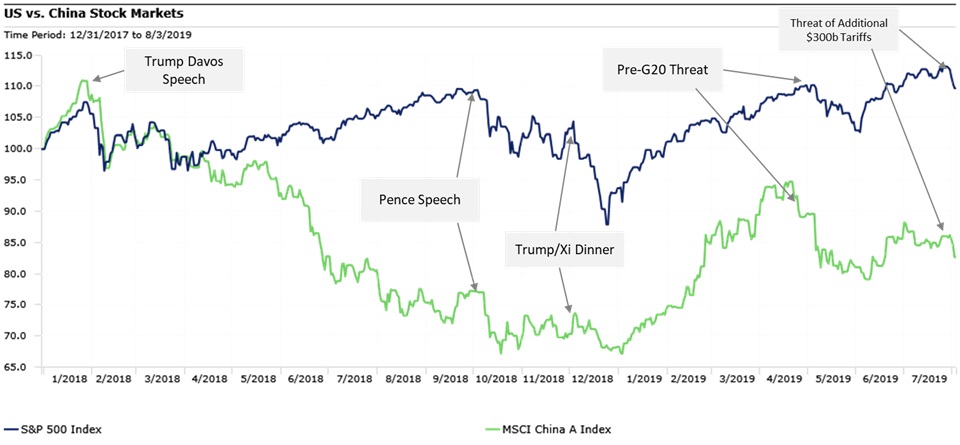

And when he feels emboldened, he tends to play a heavy hand in the trade negotiations. Indeed, there is significant precedent that supports this point as trade tensions have tended to escalate around recent all-time highs for stocks:

Source: Strategas, Morningstar Direct

Friday, 8/2

Chinese President Xi Jinping announced the high likelihood of retaliatory tariffs on US goods coming into China, signaling displeasure with Trump truncating the tax truce and indicating no interest in backing down.

The Dow fell almost 100 points while the Nasdaq dropped by over 1.3%.

Monday, 8/5

The Chinese kept the spotlight on the trade war’s intensification by lowering their currency peg to the US dollar, allowing it to trade below 7 for the first time since 2008. This makes comparable products cheaper in China than the US and ultimately shifts demand.

In addition, the Chinese state-run media service Xinhua reported: “The Customs Tariff Commission of the State Council has not ruled out import tariffs on newly purchased US agricultural products after August 3, and Chinese related companies have suspended purchasing US agricultural products.1”

Suffice it to say, the trade war does not appear to be mellowing, and any price appreciation that embedded such simmering has strayed.

Also, the societal and emotional impact of 2 mass shooting over the weekend weighs heavily on the hearts of investors and such tragedy does nothing but sour sentiment.

It is quite possible that the geopolitics which orbit the capital market’s universe will be in focus for a while. I think that the Chinese feel little urgency to get a resolution in the trade negotiations. Should Trump lose the election in 2020, the Chinese may come across a counterpart more capable of compromise. They have time to bide in assessing the likelihood of that outcome.

I don’t think that Trump feels that he can be quite so patient – hence the hammering of the Fed to keep rates low……and then go lower. Hence, the haste in hinting at additional tariffs in the absence of a done deal. What the president does not want to do is have his bread-and-butter backfire. Should negotiations designed to improve our domestic economy actually adversely impact us, then the sound and fury will sadly signify nothing.

I think that Trump will lean on all identifiable levers to keep the economically vibrant, job-creating engine of the US at full-throttle but that may involve periodic stalling. I am hopeful that these past couple weeks are just that and that the economy and markets do not veer off course for long.

Please reach out to our team at Kavar with any questions relating to your specific accounts/objectives/etc and we will keep in close touch! dc

The views expressed herein are those of Doug Ciocca on August 5th, 2019 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This information is provided as a service to clients and friends of Kavar Capital Partners, LLC solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Past performance does not ensure future results. Kavar Capital Partners, LLC makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that Kavar Capital Partners, LLC considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and we are not obligated to update any information or opinions contained herein. Articles may not necessarily reflect the investment position or the strategies of our firm.

This market commentary is a publication of Kavar Capital Partners, LLC. It should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author on the date of publication and are subject to change. Content should not be viewed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs do not represent the performance of Kavar Capital Partners, LLC or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. Projections and opinions are based on assumptions that may not come to pass. Data is derived from sources deemed to be reliable. Kavar Capital Partners, LLC is registered as an investment adviser and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.