Market Update – August 30th, 2022

Good evening,

Following Jerome Powell’s highly anticipated speech at the KC Fed’s annual Jackson Hole Symposium last Friday, capital markets have been in a tailspin. Bonds and stocks (even the lone hold-out, commodities, capitulated today) have had little defense against souring sentiment. Its source: 1) additional anticipated interest rate hikes and subsequently, 2) fear of an imminent recession.

Additional anticipated interest rate hikes

Chairman Powell spoke for only 8 minutes but managed to convey a heavily hawkish message. (As an aside, I have no idea who adapted terminology otherwise reserved for military maneuvering to interest rate policy….presumably a very wonky ornithologist!) He emphasized 3 potentially unpleasant offshoots of his initiative:

- “….higher interest rates will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation.”1

- “Restoring price stability will likely require maintaining a restrictive policy stance for some time.”2

- “…We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply..”3

That trifecta of terms: Pain, Restrictive and Forceful catalyzed volatility, as measured by a 27% pop in the VIX Index from Friday’s low to today’s high (see below from Bloomberg Market Data).

And pressured stock prices, as measured by a 5.66% drop in the S&P 500 Index from Friday’s high to today’s low (see below from Bloomberg Market Data).

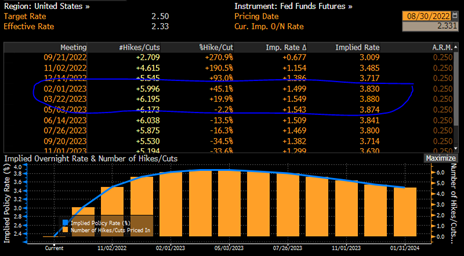

Additionally, what is known as the “terminal rate” was pushed out to 3.88 from 3.77 after Friday’s speech. The terminal rate is the estimated end point for the Fed’s tightening intentions (see the blue outline in the Bloomberg table below).

Since the current Fed Fund’s Rate is 2.5%, the expectation is for the overnight cost of money to go up to 3.88% by March of 2023.

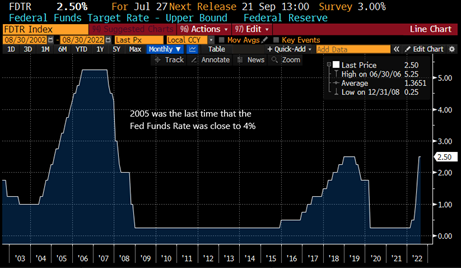

And since it has been 17 years since we’ve experienced rates at the level (see below), the anticipation of such has created considerable anxiety.

Fear of an imminent recession

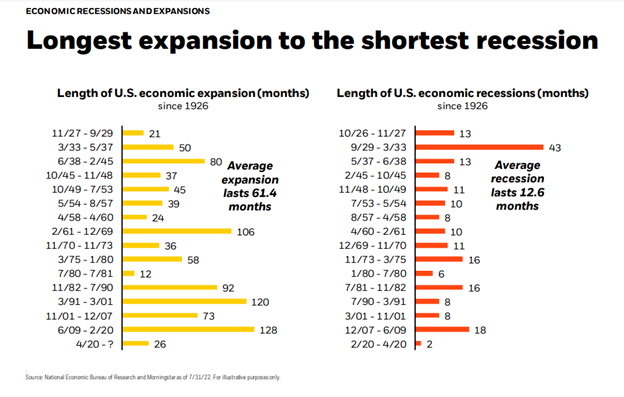

I think it is important to suggest that at some point, there will be another recession. It is an inevitability of the business cycle. In fact, as the chart illustrates below, there have been 12 recessions in the US since 1950.

Perhaps interestingly, but certainly confusingly, the definition of a recession is poorly defined. For generations, a recession was characterized as 2 consecutive quarters of negative GDP growth.

However, that has changed. The National Bureau of Economic Researchers, NBER, (the data dogs charged with marking the cyclical inflection points) now defines a recession as: “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”4

So you can understand why it is inconclusive as to where we stand, adding ambiguity to capital allocation decisions that may “pivot” (more on that in a minute) on the underlying economic state of affairs.

Fears of being in, or going into, a recession are elevated given the tough talk and concerted efforts of the Fed to slow the economy by increasing the cost of money and shrinking their balance sheet (extracting liquidity from the financial system by redeeming debt for dollars). The theory goes that should the Fed overdo their efforts, cooling could lead to contraction and the ills associated with recessions will overtake investors. Always up for fear-fueled front-running, markets are making the necessary alterations ahead of actuality.

This is in direct opposition to the type of trading activity that was at work in the 6 weeks prior to Powell’s pronouncements as, for some unexplainable reason to me, the market began anticipating (and pricing into the Fed Funds Futures (the chart above that displayed the terminal rate) a “pivot” as opposed to a “pause” – essentially a bet that rates would begin to drop just as quickly as they rose as opposed to holding steady for a while. Again, I don’t get it. But what we have seen come out of the stock markets since Friday has been the realignment of that perspective.

So, a quick recommendation and then an observation.

I think investors need to resist the temptation to consider monetary policy in a binary fashion – it is not just tightening or loosening but vigilant monitoring and tweaking with open market operations to sustain an appropriate amount of ongoing liquidity that will satisfy the Fed’s dual mandate.

Lost in all their efforts to crack-the-back of inflation is their additional decree to maximize sustainable employment.5 It is due to the resiliency of the job market that they feel emboldened to so vigorously pursue price stability.

It is very interesting that the market now feels that the Fed means business – due to Powell’s pugnacious speech on Friday. This has been the seemingly uniform sentiment over the weekend – that for some reason now is the one time we should tune into what the Fed says and not what they do? Since that has never been proven prescient, I guess I’m skeptical as to why this time would be different.

Keep in mind that this is the same Fed head who claimed in 2020 that he was, “…not even thinking about thinking about raising rates until 2023 at the earliest.” Err…..Jay…you’ve now raised them 4 times 1 year ahead of schedule.

Or in April of 2021, when Chairman Powell first and famously ascribed the influences of inflation as, “transitory” and due to temporary factors.6 A very far cry from his characterization on Friday as: “…the current high inflation in the United States is the product of strong demand and constrained supply”7

So here is the thing: we know Jay Powell is not perfect and that he is dependent on fluid data with which to make his decisions, making it suboptimal to take the totality of his commentary as gospel. As the saying goes, the only constant is change.

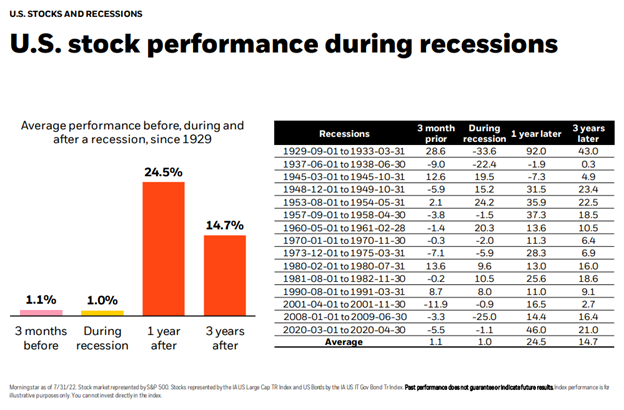

For the sake of argument, let’s say we go into a recession. Is that necessarily an elongated multi-year malaise? By no means. Is it the death knell for the stock market? By no means.

See below for a couple instructive charts and one table from BlackRock that illustrate the historical timelines and market impacts of a recession:

While these preceding graphics are by no means intended to be predictive, they do offer comforting perspective.

And while most of my comments thus far have dealt with the impact monetary policy is having on stocks, it is important to point out the bond market has been severely dislocated this year as well.

Keep in mind that bond prices move inversely to their yields and that thru the of the day today, the Bloomberg Barclays US Aggregate Bond Index (the fixed income equivalent to the S&P 500 stock index) is lower by -10.2%, qualifying as one of the worst first 8 months of a year in history.

With this high level of cross-asset class correlation, the opportunity set to deploy capital has expanded appreciably in our mind.

Externalities persist and catalyze doomsday theories that, while percolating, are being addressed by innovation, modification and general ingenuity. A hallmark of capitalism has always been its flexibility.

So for now, in managing client portfolios in this challenging environment, we are undertaking a 4-prong strategy:

- Consolidating to quality in equity investments – more concentration in our portfolios in higher caliber names;

- Disciplined dollar-cost averaging with the infusion of new cash;

- Tax-loss harvesting to optimize portfolio management decisions in the out-years, and;

- Moving more plain-vanilla options into our fixed income portfolios as bonds are offering comparable yields (w/ less risk) than bond-surrogates.

We’ll keep in touch as we move through this market cycle and will emphasize optimism and opportunism where appropriate as we believe that the economy and markets will emerge from their current challenges in stronger fashion than when they went in.

Have a great evening. dc

1,2,3 https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

5 https://www.chicagofed.org/research/dual-mandate/dual-mandate

7 https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

8 Source: Bloomberg Market Data

The views expressed herein are those of Doug Ciocca on August 30, 2022 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.