Market Update – March 10th, 2023

Good Morning,

The stock market had a very challenging session yesterday, well, at least the second half of the trading day was challenging. We’ve fielded questions from several clients and most were oriented around the following couple questions:

What drove the market lower yesterday and why did most all of the headlines deal w/ Silicon Valley Bank (symbol: SIVB)?

Second question first: SIVB is a regional bank, based in Santa Clara, CA. It is a decent sized bank, with $212 billion in assets. To put that in perspective, it is approximately 10% the size of JP Morgan, the country’s largest bank.

Located near the epicenter of many high-tech start-up companies, SIVB counts as its clients venture-capital and private-equity backed organizations that endeavor to provide us all with the next big/great thing.

Start-up companies access debt and equity markets to raise capital to fund their aspirations and SIVB assists in that process. As a result, many of these firms retain their proceeds with SIVB in the form of deposits.

Capital is the life-blood of lending institutions as well as fledging companies and if there are fears of its impairment, it can have adverse consequences. Such a fear hit SIVB today and its impact spread across the banking sector and the broad market.

The fear had less to do with SIVB (in my opinion) than it did with the struggle of economic participants (borrowers and lenders) to navigate a lightning fast interest rate reversal implemented by the Federal Reserve Bank (a.k.a. the Fed).

It is no secret that the Fed has undertaken a massive tightening initiative – raising rates 8 times in 12 months for a total of 4.50%. It is also no secret, mostly because they won’t stop talking about it, that the Fed intends to keep on hiking rates. They meet on March 22nd and seemingly the only thing left for debate is by just how much (as opposed to “if”) they will adjust rates higher.

Hiking rates, known academically as: restrictive monetary policy, is expressly designed to slow the economy. It is typically pursued when: underlying economic conditions are vibrant, inflation is rising and employment is strong. It is the primary tool of the Fed and they invoke policy modifications to attempt to stabilize prices and achieve a balanced job market. In many respects, it is how they attempt to soften the peaks and valleys of an economic cycle.

The speed with which the Fed has raised rates in the past 12 months is unprecedented. Full stop. The rhetoric accompanying their actions is equally an outlier. Full stop. And these actions have impacts. Despite the well-known and often uttered expectation that: “monetary policy has long and variable lags,” the Fed has pushed forward without allowing the implementation of their efforts to be analyzed. There simply has not been enough time to do so.

Which takes us to yesterday.

SIVB disclosed on Wednesday night that they sold a large portion of their investment portfolio, and in doing so took a significant loss…to the tune of approximately $1.8 billion. The investment portfolio is funded by customer deposits.

The reason SIVB was selling was two-fold: depositors were withdrawing funds to invest in higher yielding fixed income securities (largely Treasury bills that have seen a parabolic rise in yield as the Fed has been raising rates). And secondly, their tech start-up companies were needing greater amounts of cash to fund their operations in the midst of a slowing economy.

Coming out of the worst year for the bond market since 1926 (the Bloomberg Barclay’s Aggregate Index fell by 13% in 2022), the positions they were selling priced below what they paid, resulting in the loss. In conjunction with the sales, they undertook a 3-prong approach to shore up capital – the details of which are not relevant to this writing – which the market viewed as an act of desperation.

Despite being 15 years in the rear-view mirror, the market tends to associate any whiff of the capital constriction with the Global Financial Crisis. It seems to assume that all banks are painted with the same brush and that, as each other’s counterparties, no issues are contained.

The entire banking sector sold off hard, with the S&P Bank Index down 7.28% and the S&P Regional Bank Index off by 8.2%.

The market is also is very sensitive, and reactive, to the repricing of credit in a slowing economy and is attempting to front-run future actions of the Fed by de-emphasizing risk assets. We don’t blame investors for wanting to avoid a “Lehman” moment, but the landscape of the banking system simply does indicate that one is approaching.

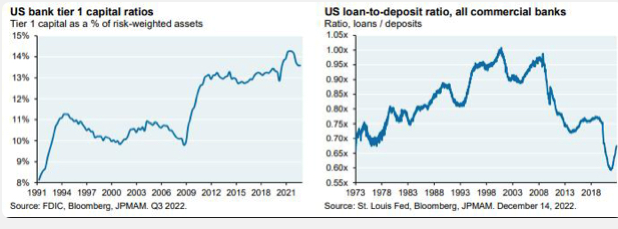

As the charts below indicate, US banks are capitalized much stronger today vs. 2008 – 2009.

There is little doubt that the fear of contagion may continue today, especially with the world anxiously awaiting a critical piece of economic information that will influence the outcome of the Fed meeting later this month – the Non-Farm Payroll/Jobs report for February which comes out later this morning at 7:30am CST.

In addition, there are already many media machinations exacerbating the issues at SIVB.

We’ll look for opportunities from this dislocation – in both the financial services industry as well as the broader market – and will keep in touch as more information on its influence is ascertained.

Please reach out to any member of our team if you have questions on how this impacts your portfolio specifically. dc

The views expressed herein are those of Doug Ciocca on March 10th, 2023 and are subject to change at any time based on market or other conditions, as are statements of financial market trends, which are based on current market conditions. This market commentary is a publication of Kavar Capital Partners (KCP) and is provided as a service to clients and friends of KCP solely for their own use and information. The information provided is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy or investment product, and should not be construed as, investment, legal or tax advice. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio. All investment strategies have the potential for profit or loss and past performance does not ensure future results. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses. Charts and graphs presented do not represent the performance of KCP or any of its advisory clients. Historical performance results for investment indexes and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a client’s portfolio will match or outperform any particular benchmark. KCP makes no warranties with regard to the information or results obtained by its use and disclaims any liability arising out of your use of, or reliance on, the information. The information is subject to change and, although based on information that KCP considers reliable, it is not guaranteed as to accuracy or completeness. This information may become outdated and KCP is not obligated to update any information or opinions contained herein. Articles herein may not necessarily reflect the investment position or the strategies of KCP. KCP is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability.