Market Update – March 17th, 2024

As Q1 of 2024 heads into its last couple weeks, the financial market’s themes for the year have begun taking shape. Strength in stocks has carried over from 2023 but bonds have struggled. Interest rate indecision endures as front-running the Fed has faltered. On Wednesday, we’ll hear from Jay Powell but it’s doubtful he’ll say much. Economic strength has done the talking and his committee’s data-dependency has curtailed any coming cuts. Cash yields have hovered near highs and kept loads of capital uncommitted from more historically attractive asset classes. And while cryptocurrency threatens conventional components for a share of the conversation, to us it still belongs at the kid’s table.

So here are 4 themes that have evolved in the year’s first few months.

Enduring economic strength

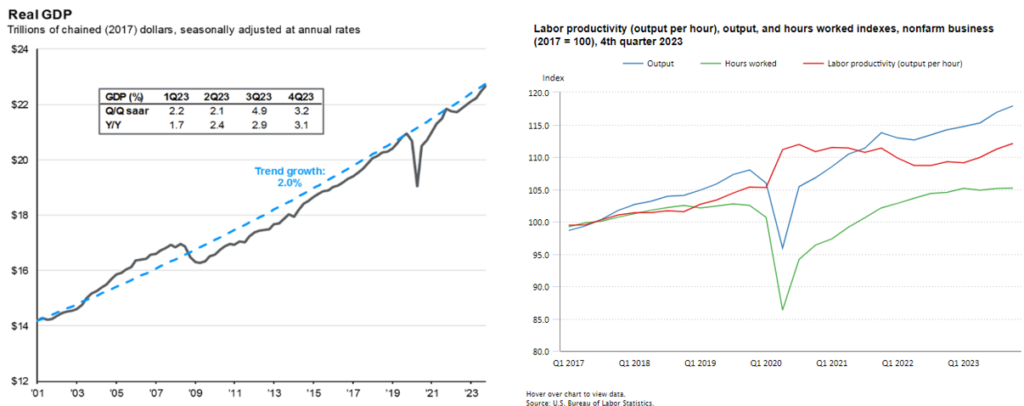

It was hard to find a highfalutin strategist that wasn’t calling for a recession in 2023. Something about the perpetuation of tight financial conditions, courtesy of aggressive interest rate hiking in 2022, seemed to lengthen the shelf-life of pessimistic predictions. The resiliency of the US economy has altered that outlook in 2024 and the cadre of town criers has turned more constructive. GDP has grown at a rate above trend which due in large part to the strength of the consumer (almost 70% of the measure)1 which is due in large part to the strength of the job market…more on that in a minute. Add to that the stimulant of productivity and you get persistency through efficiency. Productivity had been strangely evasive for a country as tech-centric as the US and its reemergence has the power to preserve this progression.

Labor Market Back in Balance

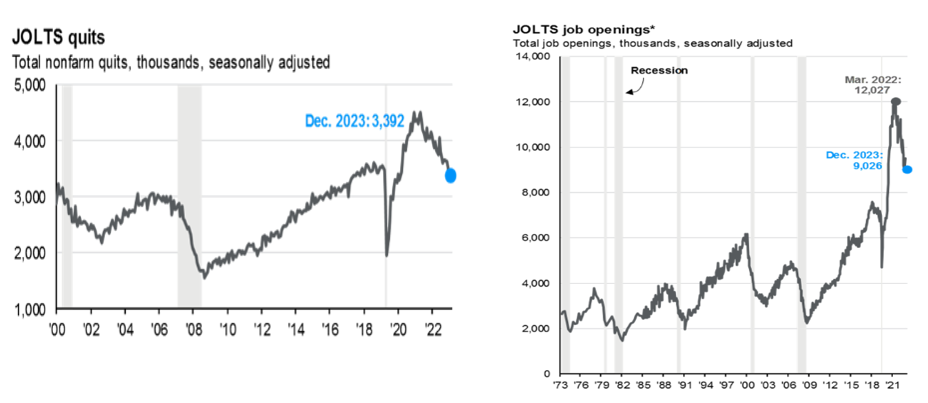

Coming out of pandemic, the job market was horribly skewed. Stories ran with regularity about the absence of available employees. NPR even produced a 9-part series in 2021 entitled, “Where are the Workers?” (Check it out – very well done! https://www.npr.org/series/1017985033/help-wanted-where-are-the-workers). We follow a bunch of important labor statistics, including the “Quits Rate,” (which is essentially the number of workers leaving current jobs for the same or similar jobs at higher rates of pay), the “JOLTS” Survey (Job Openings and Labor Turnover, which offers insight as to how many available jobs exist for every available worker) and the real (after inflation) average hourly earnings for American workers. All these measures have come dramatically into better balance and here is why that is important: it allows for more bilateral negotiations between companies and employees and helps to sidestep a wage-price spiral that can accelerate inflation through higher employment costs that reduce corporate profitability and ultimately slow the economy.

Domestic Politics

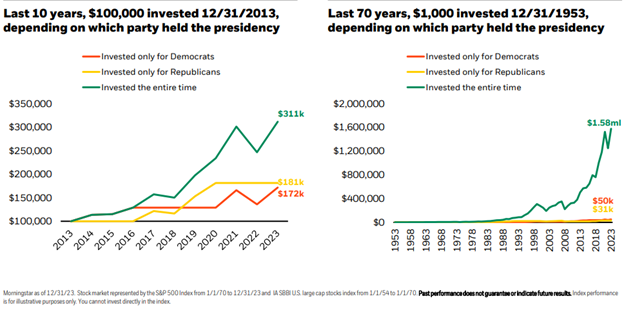

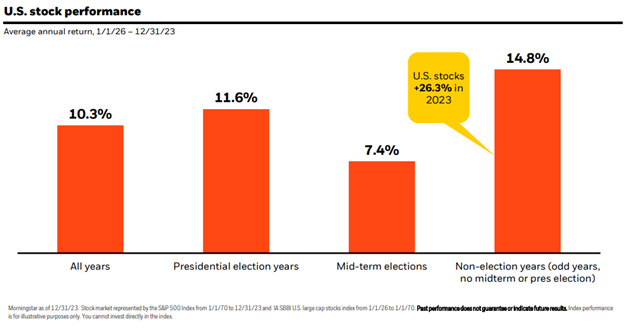

Domestics politics tend to invoke heavy language. Statements including the words, “consequential” and “transformative” are common leading up to Presidential elections. Our country certainly has seen better days along the lines of bipartisanship and decorum, and it is hard to believe we’re likely to have a rematch between 2020’s combatants for the White House. However, with the timeline for owning equities being much longer than for fixed income or cash investments, we always lean on perspective to navigate the policies of either party and their estimated influence on stock markets. The charts below from BlackRock illustrate the benefits of widening that frame and of patience as a big part of the process:

Pickup in M&A Activity

In what we consider to be phase 1 of the consolidation comeback, we are seeing a big pick-up in intra-industry deal activity in 2024: acquisitions representing strategic tie-ups, with stock as the primary consideration given the strength of certain sectors and the lack of a sufficient enough drop in financing costs to throw a lot of debt on a deal.

Also from Barron’s this weekend: “….Last year was a dead zone for M&A activity. Just $1.37 trillion of U.S. deals were consummated, as interest rates rose and the outlook for corporate profits weakened. Together, that meant the cost to finance a deal became more expensive, while the potential return from an acquisition fell.

This year, though, rates have stabilized and profits have continued to grow. Management teams are now more confident that buying new assets will produce strong returns. Companies in the U.S. have announced $388.2 billion of M&A this year, 63% higher than at this point last year, according to London Stock Exchange Group. That puts deals on pace to hit close to $1.9 trillion for 2024.”

The prospect of a pick-up in M&A tends to add levity to valuations for both counterparties to a transaction: the acquiror for their scale-driven earnings accretion and the acquired for their presumed latent identification of symbiotic benefits to their new partners once given the bandwidth to be unbridled.

Phase 2 we would anticipate appearing sometime in 2025, when the fuel will be lower costs of capital once/if the Fed begins cutting rates in earnest and the buyer pool may broaden to incorporate private equity and public aggregators. These types of suitors pride themselves on financial engineering and scale vs. the more strategic buyers that define the earlier phase.

John will check in after the end of the quarter but our outlook is broadly positive across equity and fixed income asset classes. There are plenty of tactical opportunities in market with so many moving parts, but suffice it to say, there is a benefit to striking a balance in portfolios in 2024 given a growing economy with persistently highish interest rates, a balanced labor market and companies at an accelerating point in their profit cycle.

Happy St. Patrick’s Day!

-Doug Ciocca

1 https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/